The market could no longer sustain the fragile balance of the morning session as new loss-making stocks accepted a sharp price cut to exit. The matched trading volume on both exchanges this afternoon increased by 50% compared to the morning session, causing the VN-Index to plummet to its lowest point of the day with the number of red stocks being 3.7 times higher than the green ones.

The sharp decline at the end of last week pushed a large volume of newly-traded stocks into a sudden short-term risk of loss. Efforts to increase leverage sharply while the money flow was not ready to buy higher caused the price level to quickly drop.

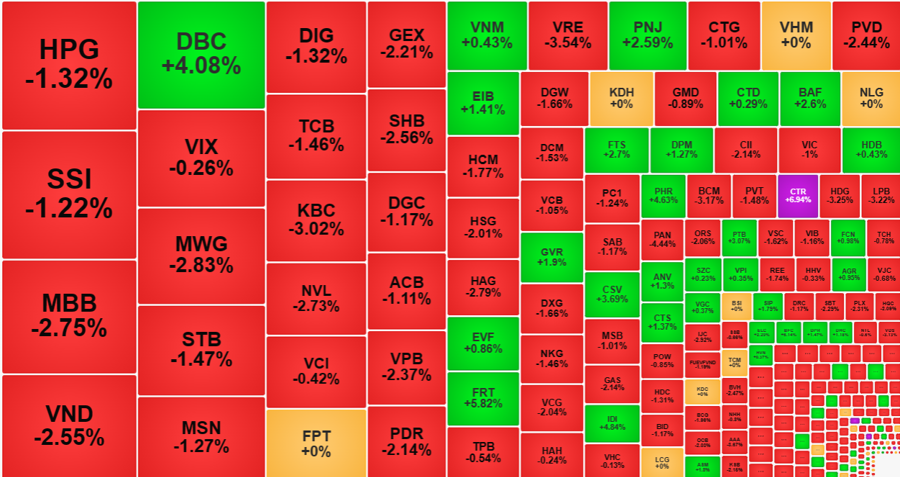

In the morning session, VN-Index saw 44 stocks decrease by over 1%, while at the end of the session, this number increased to nearly 150. The breadth also worsened with 106 gainers/392 losers. A signal indicating a particularly large selling pressure is: Although HoSE only had 68 stocks decrease by more than 2%, this group accounted for nearly 31% of the total value of the floor. The top 10 stocks with the largest decrease and trading volume in this group were MBB, VND, MWG, KBC, NVL, GEX, SHB, VPB, PDR, all of which were traded with a volume over 300 billion dong. MBB even matched nearly 811 billion dong with a decrease of 2.75%.

The leading group, of course, is the main target of the pressure. All 10 stocks that caused VN-Index to decrease the most are stocks in the VN30. VCB decreased by 1.05%, GAS decreased by 2.14%, VPB decreased by 2.37%, BID decreased by 1.17%, MBB decreased by 2.75%… are the most noticeable ones. In fact, this is still due to the capitalization factor, while in terms of fluctuation, VRE, BCM, MWG, SHB, BVH, PLX, GAS even fell further. VN30-Index closed down 1.21%, stronger than the main index’s decrease of 0.95%, and the basket still had only 3 stocks that increased, namely GVR increased by 1.9%, HDB increased by 0.43%, and VNM increased by 0.43%.

The large stocks plummeted heavily this afternoon, with MSN decreasing by 3.13% compared to the morning session’s closing price, and closing down 1.27% compared to the reference price. MWG decreased by 2.52% in the afternoon alone, extending the loss to -2.83% compared to the reference price. VRE decreased by an additional 3.35%, VPB decreased by an additional 2.11%, BVH decreased by an additional 2.47%…

Especially for the afternoon session, HoSE matched 13,461 billion dong, an increase of 48% compared to the morning session. This liquidity, together with a significantly lower price level, shows that the sellers took control. VN-Index lost 11.86 points, and within just two days, it lost nearly 30 points and fell back below the peak level of September last year. Thus, this breakthrough week has confirmed to be a “bull-trap” that trapped billions of shares. Sooner or later, this will increase selling pressure even more.

In the midst of the selling frenzy, the market still had some standout stocks that went against the trend. This group also saw considerable selling pressure, but the money flow supported it well, thus keeping it in the green with high liquidity. Among the 106 stocks that closed above the reference price of VN-Index, 46 stocks increased by more than 1%. The noteworthy stocks in terms of liquidity were DBC with 728.1 billion dong, with an increase of 4.08%; PNJ with 289.7 billion dong, with an increase of 2.59%; EIB with 247.4 billion dong, with an increase of 1.41%; FRT with 210.4 billion dong, with an increase of 4.82%; BAF with 108.4 billion dong, with an increase of 2.6%; GVR with 172.2 billion dong, with an increase of 1.9%; FTS with 160 billion dong, with an increase of 2.7%…

However, this is just a few individual stocks. In the context of the general market adjustment, there will still be high risks in going against the trend because the demand for “catching falling knives” will only increase. Moreover, the higher liquidity in these stocks shows that investors want to withdraw, and sooner or later, the money flow will narrow down again.