The market liquidity decreased compared to the previous trading session, with the trading volume of VN-Index reaching over 923 million shares, equivalent to a value of over VND 22.5 trillion; HNX-Index reached nearly 93 million shares, equivalent to a value of nearly VND 2 trillion.

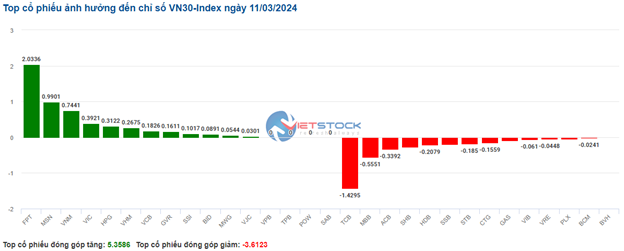

VN-Index opened the afternoon session quite negatively as selling pressure appeared right from the start, causing the index to plummet and close near the day’s lowest level. In terms of impact, VCB, GAS, VPB, and BID were the most negative contributing stocks, taking away more than 4 points from the index. On the other hand, GVR, FRT, and CTR were the most positive contributing stocks to VN-Index, with an increase of over 1 point.

| Top 10 stocks with the most significant impact on VN-Index on 11/03/2023 session (measured in points) |

HNX-Index had a similar trend, in which the index was negatively affected by stocks like DXP (-4.7%), PVC (-2.74%), SHS (-2.7%), TNG (-2.68%),…

|

Source: VietstockFinance

|

The finance sector experienced the most significant decline in the market with a decrease of 2.18%, mainly due to stocks like IPA (-2.34%), OGC (-1.82%), and TVC (-2.35%). Following were the mining sector and the wholesale sector with a decline of 1.99% and 1.95%, respectively. On the other hand, the auxiliary manufacturing sector was the most resilient sector with a strong recovery of 1.55%, mainly driven by stocks like PTB (+3.07%), DHC (+1.18%), and CAP (+8.64%).

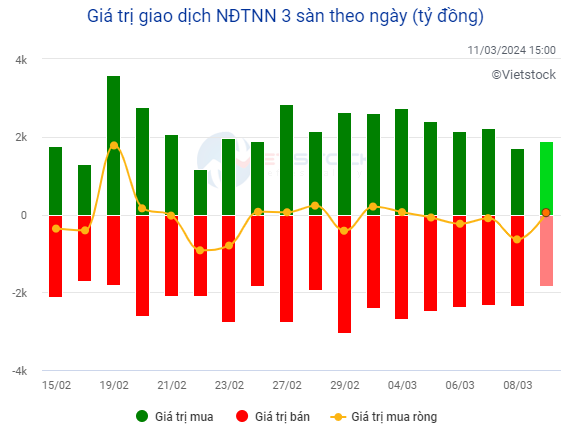

In terms of foreign trading, this group returned with a net buying of nearly VND 229 billion on HOSE, focusing on stocks like FRT (VND 96.8 billion), EIB (VND 66.43 billion), FTS (VND 62.7 billion), and HPG (VND 62.35 billion). On HNX, foreign investors had a net selling of nearly VND 152 billion, focusing on stocks like PVS (VND 98.08 billion), CEO (VND 24.55 billion), and SHS (VND 16.84 billion).

Source: Vietstock Finance

|

Morning session: Tug of war around the reference level

At the end of the morning session, VN-Index slightly increased after a sharp decrease in the previous week, while continuous tug of war around the reference level indicated cautious investor sentiment. VN-Index increased by 4.58 points to reach 1,251.93 points; HNX-Index increased by 0.22 points to reach 236.54 points. The number of temporary declining stocks had the advantage with 291 increasing stocks and 309 declining stocks.

The trading volume of VN-Index recorded nearly 362 million units in the morning session, with a value of over VND 9 trillion. HNX-Index recorded a trading volume of nearly 33 million units, with a trading value of over VND 720 billion.

Source: VietstockFinance

|

Halting the morning session, stocks like TCB, GAS, and BCM were the most negative contributing stocks, taking away more than 1 point from the index. On the other hand, stocks like BID, GVR, and FPT were the most positive contributing stocks, contributing over 2.6 points to the index.

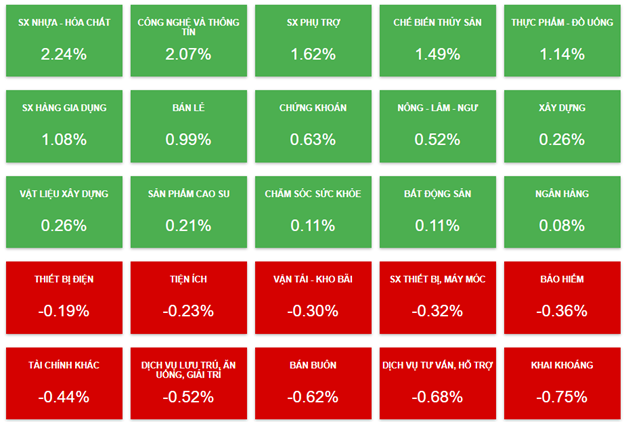

The plastics and chemicals industry contributed the most to the index’s growth at the end of the morning session. Most stocks in this industry recorded significant growth, such as GVR (+3.28%), DGC (+1.09%), DPM (+1.97%), BMP (+1.33%), PHR (+5.87%), CSV (+3.34%), BFC (+7%),…

In addition, the technology and information industry also showed positive signs, but not all stocks in the industry. The presence of two big players in the sector, FPT and CTR, recorded increases of 1.82% and 6.94%, respectively.

Furthermore, stocks in the seafood industry also saw strong growth in the morning session. Specifically, ANV increased by 3.62%, ASM by 4.05%, FMC by 1.35%, and IDI almost hit the ceiling with an increase of 6.05%.

Sector performance at the end of the morning session on 11/03. Source: VietstockFinance

|

By the end of the morning session, green colors temporarily dominated when looking at the overall industry. In particular, the plastics and chemicals industry had the highest growth rate at 2.24%. On the other hand, mining was the most negative industry with a decrease of 0.75%.

10:30 AM: Trading with cautious sentiment

After a significant point drop in the previous week, the current cautious sentiment of investors caused the main indices to swing around the reference level. As of 10:30 AM, VN-Index decreased by 2.34 points, trading around 1,249 points. HNX-Index reached 236 points.

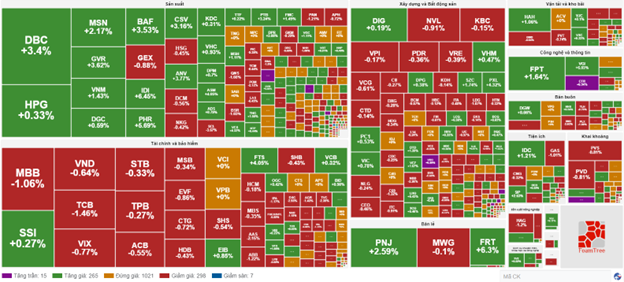

The current breadth in the VN30 basket is leaning towards the red side, but the selling pressure is not significant. In particular, the banking group is facing high selling pressure, with MBB down 1.43 points, MBB down 0.56 points, ACB down 0.34 points, and SHB down 0.28 points. On the contrary, the stocks from the FPT, MSN, VNM, and HPG group are still in the green and contribute more than 4 points to the overall index.

Source: VietstockFinance

|

Bank and insurance stocks are under heavy selling pressure, with most stocks in the red. Notable stocks include PRE (-8.08%), PVI (-1.69%), BMI (-0.85%), MBB (-1.06%), TCB (-1.46%),…

On the other hand, real estate and securities sectors have a positive trend, with stocks like VHM (+0.47%), VIC (+0.78%), DIG (+0.19%),… and FTS (+3.71%), BSI (+1.22%), TVB (+2.29%),…

Compared to the opening, the market breadth has a considerable number of stocks with unchanged prices, with over 1,000 stocks. The number of increasing stocks is 280 (15 stocks reach the upper limit) and the number of declining stocks is slightly higher with 305 stocks (7 stocks reach the lower limit). The total trading volume on all three exchanges reaches over 251 million units, corresponding to over VND 6.3 trillion.

Source: VietstockFinance

|

Market Opening: Cautious at the beginning of the session

The slight green appeared at the beginning of the trading session; however, the increase was not significant, and the indices simultaneously fluctuated around the reference level. This shows that investors’ optimism is still present in the market, along with caution.

At 9:30 AM, VN-Index increased by more than 4 points and traded around 1,252 points; HNX-Index reached 236 points.

Green colors temporarily have the advantage in the VN30 basket with 18 increasing stocks, 8 declining stocks, and 4 unchanged stocks. Among them, banking stocks like MBB, TCB, STB… are the reason for the points drop. On the contrary, stocks like FPT, GVR, and VIC are still in the green and contribute more than 2.6 points to the index.

Technology and manufacturing stocks are the highlights of the market. Stocks like VNM increased by 1%, DBC increased by 2.38%, VGI increased by 2.74%, FPT increased by 0.15%

The securities sector is in the red at the beginning of the trading session. Representative stocks like VND decreased by 0.42%, HCM decreased by 0.18%.