Today, the market has found a reason to decrease, confirming the rumors of the past few days. Perhaps many sensitive investors have reacted since yesterday, or even from last week, but the fundamental issue is still a market that is heavily speculated, so sooner or later it will have to be shaken off.

This afternoon, the State Bank “absorbs” 15 trillion VND with a 28-day term. Last time, near the end of September 2023, there were 3 “hinting” sessions that absorbed 10 trillion VND, then increased to 20 trillion VND/day. The market has reason to worry because the 2023 absorption period from September 21st to November 9th saw a 30-day decrease before hitting the bottom and losing more than 16%.

This time’s money absorption may not create as much shock as the first time, but what matters is still the effectiveness. Last time, the exchange rate hit bottom from late October 2023 and the initial signal was a gradual decrease in the scale of absorption sessions in early November 2023, the market hit bottom before the absorption period ended. This time, we also have to wait for the scale and frequency in the coming days.

However, when the market decreases, it will still decrease, without necessarily being caused by money absorption. Additional unfavorable information will accelerate short-term reactions. This is good when looking at relieving leverage pressure and is beneficial for cash holders. When the price falls quickly, greed also arrives early.

Today’s liquidity remains at a relatively high level, with the two exchanges trading about 24.5 trillion VND, equivalent to an average level of 16 sessions since after the Lunar New Year. In the coming sessions, liquidity may start to decrease because investors who can exit will hold cash to observe. If there are no debt issuance events to absorb money, the demand for bottom fishing may be stronger, but now there is a reason to wait. Moreover, the market’s past in the previous money absorption period will be used as a reference, and the final T+ rebound phases will still only trap more money. Two signals that will be paid more attention to in the market’s progress are the scale of money absorption sessions and the exchange rate developments.

It is still advisable to rest and be patient at the moment. Stocks are still there and won’t disappear, if someone buys then others will “release,” even cut losses in a loop. The opportunity to buy always exists and what should be concerned is not buying at what price, but buying at a low risk area.

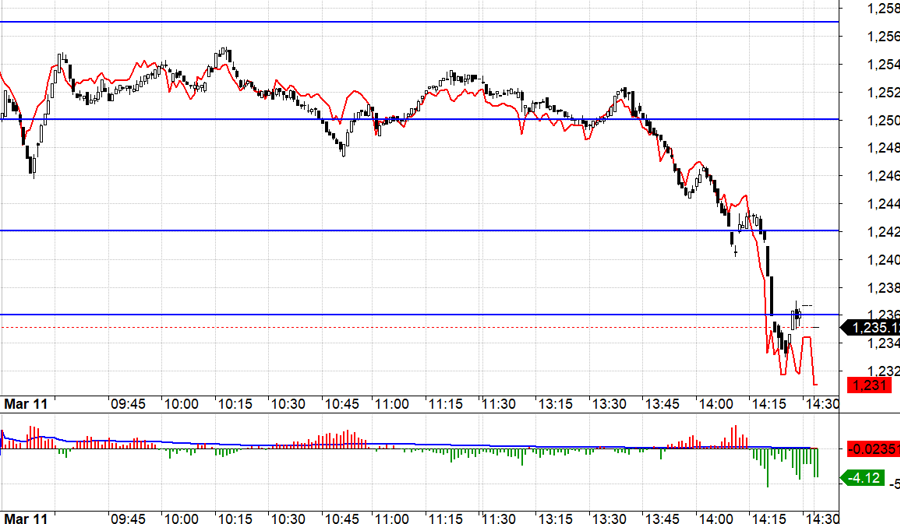

The derivatives market today is still favorable for Short. Yesterday, it was expected that the market could rebound a bit because after a day of sell-offs, the price rebounds are normal and opportunities for short-term Long can be taken advantage of. However, the opportunities are not clear, VN30 moves with a small range and has no support. The first resistance level is 1257.xx and cannot reach it, while the important level of 1250.xx is a prolonged wrestling index. Therefore, if this level is broken, it will open up border to 1242.xx or deeper.

VN30 in the morning has twice briefly dropped below 1250.xx to about 1248. Therefore, the Short setup needs to change a bit, breaking 1250.xx is a signal for Short exploration with a stop loss being VN30 returning above this level. A strong Short signal is VN30 breaking the morning lows. The cover points are 1242 and 1236, even 1229.

The underlying market tonight will reflect on the “money absorption” information. The two-day decrease in amplitude is very fast, meaning pushing a series of stock positions into short-term loss. The minimal reaction is to reduce leverage, while demand will pause and wait. The “door” for further decreases is high. The strategy is flexible Long/Short.

VN30 closed today at 1235.12. The nearest resistance levels tomorrow are 1236; 1242; 1250; 1257; 1261. Support levels are 1230; 1220; 1213; 1202; 1197; 1192.

“Stock blog” is a personal opinion and does not represent the views of VnEconomy. The opinions and assessments are those of individual investors and VnEconomy respects the opinions and writing style of the author. VnEconomy and the author are not responsible for any issues related to the published evaluations and investment opinions.