A major shareholder persistently divested its capital in Nagakawa Group

On March 7th, 2024, An Vu International Economic Development Company – a major shareholder of Nagakawa Group (HNX: NAG) – registered to sell over 3.2 million shares of NAG (10.17% ownership) from March 7th to April 7th, 2024, shortly after failing to sell these shares from January 26th to February 26th, 2024.

The new transaction is still conducted through matched orders and agreements, aimed at restructuring the investment portfolio. Based on the closing price of the latest session (March 6th), which is VND 10,800/share, it is estimated that An Vu Company can earn over VND 34.7 billion from the deal, while reducing its ownership to 0%.

In terms of relationship, Ms. Nguyen Thi Huyen Thuong – CEO of NAG – is the daughter of Mr. Nguyen Duc Kha, Chairman of the Board of Directors of An Vu Company. Currently, Mr. Kha and Ms. Thuong respectively own 37.74% and 4.45% of the capital at NAG.

Hoa Phat’s management wants to sell 1 million shares via matched orders

Mr. Nguyen Ngoc Quang, a member of the Board of Directors of Hoa Phat Group (HOSE: HPG), registered to sell 1 million shares of HPG with the reason of personal financial needs. The transaction is expected to take place from March 11th to April 9th via matched orders.

If the transaction is successful, Mr. Quang will still hold nearly 102.8 million shares of HPG, equivalent to 1.77% ownership.

This information emerged after the business activities of the “steel king” rebounded and HPG shares also recovered. At the end of the session on March 8th, the HPG share price was at VND 30,300/share, up nearly 32% compared to the beginning of November 2023.

Hoa Sen’s leadership is determined to sell 1.5 million HSG shares after 3 failed attempts

After 3 unsuccessful sales, Mr. Tran Ngoc Chu, the Standing Vice Chairman of Hoa Sen Group (HOSE: HSG), continued to register to sell 1.5 million HSG shares from March 7th to April 5th, via matched orders or agreements.

If the sale is successful, Mr. Chu’s ownership in HSG will decrease from 1.78 million shares (0.29% ownership) to 281,147 shares (0.04% ownership).

This information was announced when HSG shares were at almost a 2-year high. At the end of the session on March 8th, the share price reached VND 22,400/share, up 32% compared to the beginning of November 2023.

Chairman MWG’s younger sister wants to sell some shares

Ms. Nguyen Thi Thu Tam, the younger sister of Mr. Nguyen Duc Tai – Chairman of the Board of Directors of Mobile World Investment Corporation (HOSE: MWG), has just registered to sell 200,000 MWG shares from March 14th to April 12th, 2024, for personal financial needs.

Currently, Ms. Tam owns 0.036% of the shares, equivalent to nearly 530,000 MWG shares. If the transaction is successful, her ownership will decrease to 0.023%, equivalent to nearly 330,000 shares.

The transaction is expected to be carried out through agreements or matched orders on the exchange. Based on the MWG closing price on March 8th, which was VND 47,750/share, it is estimated that Ms. Tam can earn about VND 9.6 billion.

SCIC plans to spend nearly VND 480 billion to acquire 30 million MBB shares

State Capital Investment Corporation (SCIC) announced that it will exercise the right to purchase 30 million shares in a separate private placement of 73 million shares approved by the Board of Directors of Military Commercial Joint Stock Bank (HOSE: MBB) on January 27th, 2024.

Currently, SCIC holds over 491.4 million MBB shares, accounting for a 9.42% ownership in the bank. After completing the transaction, SCIC will increase its ownership to over 521 million shares, equivalent to a 9.86% charter capital of MBB. SCIC stated that the transaction is expected to take place from March 8th to April 6th.

At the end of January this year, MBB’s Board of Directors approved a private placement plan for 73 million shares to 2 investors: Military Industry-Telecommunications Group (Viettel) and SCIC.

The expected offering price is VND 15,959/share, nearly 35% lower than MBB’s closing price on March 6th, which was VND 24,400/share.

Among which, Viettel has the right to purchase 43 million MBB shares and SCIC has the right to purchase 30 million MBB shares. There is a transfer restriction period of 5 years from the completion of the private placement.

|

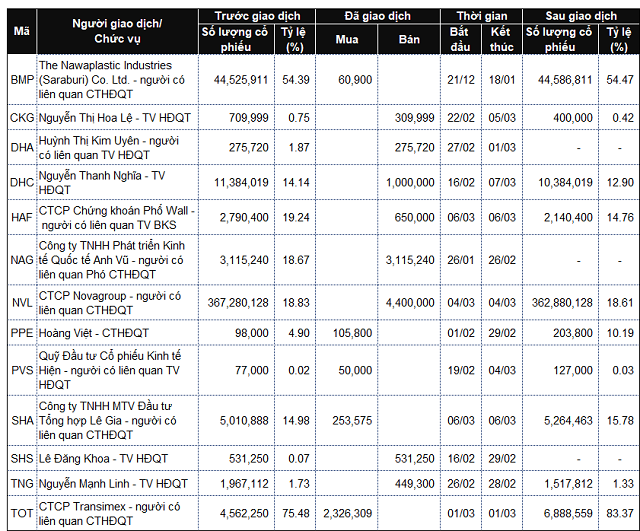

List of company leaders and relatives who traded from March 4th to March 8th, 2024

Source: VietstockFinance

|

|

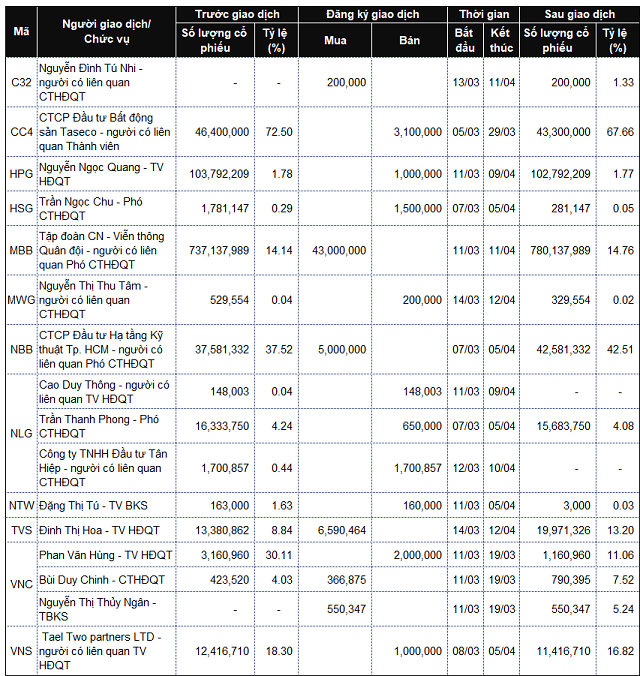

List of company leaders and relatives who registered to trade from March 4th to March 8th, 2024

Source: VietstockFinance

|

Thanh Tu