Despite the challenges, Vietnam’s GDP in 2023 still achieved a growth rate of 5.05%, slightly higher than UOB’s previous expectation of 5%. The resistance came from the first six months, which limited the effectiveness of the whole year’s activities. In the first half of 2023, Vietnam’s economy only grew by 3.72% compared to the same period, significantly lower than the 6.46% rate in the first half of 2022. The aggregated data from January-February 2024 indicates that the recovery is heading in the right direction.

According to the latest statistics from the General Statistics Office, Vietnam’s exports and industrial production both experienced steep declines in February. In February, exports decreased by 5% compared to the same period, and industrial production decreased by 6.8%, compared to the respective increases of 42% and 18.3% in January. The sharp decline was largely due to the Lunar New Year falling in February this year, while it occurred in January last year. To provide a more accurate comparison, the aggregated data from January-February 2024 shows that exports increased by 17.6% compared to the same period, while industrial production increased by 5.7% compared to the average rate of -2.2% in the period from January-February 2023.

Vietnam’s Purchasing Managers’ Index (PMI) for both January and February 2024 remained above 50, compared to the average of 49.3 in January and February 2023.

These data indicate positive momentum in the manufacturing and external trade sectors, which UOB expects to sustain, particularly in the second half of 2024 as the semiconductor sector makes a more solid recovery and global central banks begin to implement more appropriate interest rate policies.

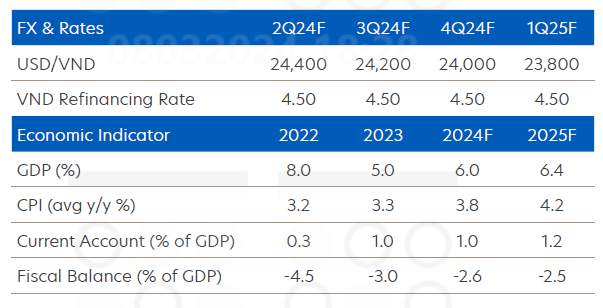

While risks from external events continue to weigh on the global economic outlook (including conflicts in Eastern Europe and the Middle East), Vietnam’s prospects are strengthened by the recovery of the semiconductor industry, stable growth in China and the region, as well as beneficial supply chain shifts for Vietnam and ASEAN. UOB maintains a growth forecast of 6% for Vietnam in 2024, within the official target range of 6-6.5%. In the first quarter of 2024, UOB expects GDP growth rate to decrease to 5.5% compared to the same period, due to the impact of the Lunar New Year holidays (compared to 3.3% in the first quarter of 2023). UOB predicts that inflationary pressures will continue to rise, with a forecasted full-year CPI of 3.8% in 2024, up from 3.25% in 2023.

SBV to maintain stable monetary policy in 2024

The State Bank of Vietnam (SBV) swiftly responded to the economic downturn at the beginning of last year by quickly lowering interest rates. The last policy rate cut took place in June 2023, when the refinancing rate was cut by a total of 150 basis points to 4.5%. With the pace of economic recovery, the potential for further interest rate cuts has diminished. Therefore, UOB believes that the SBV will maintain the refinancing rate at the current level of 4.5%.

Instead of continuing to lower interest rates with limitations in calculating the lower bound, the Government shifted its focus to non-interest rate measures to support the economy. One of them is bringing credit to borrowers (i.e., quantitative easing measures). In 2023, the credit growth rate reached about 13.5% compared to the same period, slightly below the target range of 14-15%, as regulators required banks to simplify lending procedures and improve businesses’ access to bank loans. In 2024, the SBV sets a credit growth target of about 15% with flexible adjustments based on the economic developments throughout the year.

VND’s potential for slight recovery

The USD/VND exchange rate reached a new high of 24,700 dong/USD at the end of February, along with the significant strength of the USD against Asian currencies. Despite the short-term weakness of the VND, expectations of stronger GDP growth in Vietnam (forecasted at 6% in 2024 compared to 5.05% in 2023) and the recovery in manufacturing and external trade sectors are positive factors that can stabilize the VND. The subsequent recovery of the CNY – to which the VND often has a similar trend – along with the weakening of the USD prior to the Fed’s interest rate cut in June, will bring a slight recovery to the VND. UOB updates its forecast for the USD/VND exchange rate to be 24,400 in Q2/2024, 24,200 in Q3/2024, 24,000 in Q4/2024, and 23,800 in Q1/2025.