From the beginning of the year, the State Bank of Vietnam (SBV) has set a credit growth target of 14.5% in one go. Based on what happened in 2023, it can be seen that the SBV has assessed that this year’s economy may continue to face difficulties, therefore, credit support from the banking system plays an important role in supporting the economy.

However, statistics on credit growth in the first months of the year show that difficulties still lie ahead for the economy. In terms of groups, state-owned banks saw the largest decrease, down 3.2% compared to December last year. It can be imagined that, with a debt scale of about VND 8 million trillion of the four state-owned banks, the above-mentioned decline is equivalent to a decrease of VND 240,000 trillion.

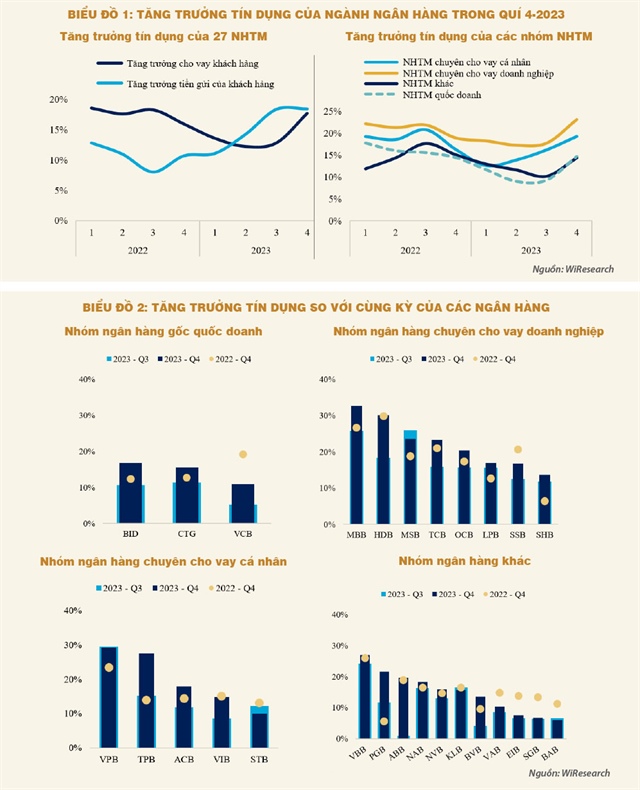

Examining the detailed credit growth of banks in the fourth quarter of 2023 will somewhat show us the prospects of the upcoming credit growth picture.

Credit growth of 27 listed commercial banks

Credit of listed banks has soared in the fourth quarter of 2023, in the context of deposit growth of banks showing signs of slowing down compared to the beginning of the year. In addition to deposits, in the fourth quarter of 2023, many banks had to increase their bond issuance activities to meet the rapidly increasing loan demand in the year-end period, as well as increasing Tier 2 capital to maintain CAR.

OCB maintains growth in the core business activities of the bank.

The highest credit growth rate in the previous year belonged to the group of banks specializing in business loans such as Techcombank or MB Bank. In the context of weak market demand, boosting disbursement for businesses, especially real estate businesses, is the main driver for credit growth. This is also a common characteristic of credit growth motivation in 2023. According to statistics from financial reports, only one bank had a higher credit growth rate for individual customers than for business customers, which is contrary to the general trend in the past decade when individual credit growth always played a dominant role in overall annual growth.

Banks specializing in individual loans such as ACB, Sacombank, or VIB… after a slow growth period in the early quarters of the year, accelerated disbursement in the third and fourth quarters of 2023, mainly focusing on disbursement for businesses.

Finally, state-owned banks with a more cautious lending strategy only had rapid credit growth in the fourth quarter of 2023.

Banks with outstanding credit growth in the fourth quarter of 2023

Credit growth has differentiated among banks, reflecting different growth strategies between banks in the context of extremely difficult growth in the past year.

For state-owned banks, Vietcombank has a more cautious credit policy with only a 4.9% increase in the first three quarters of last year and a significant increase to 10.6% in the fourth quarter of 2023 with many preferential loan packages deployed. However, to compensate for the credit growth, Vietcombank’s NIM has decreased significantly in the recent quarter. The remaining two banks, BIDV and VietinBank, have higher and more stable credit growth rates throughout the year, mainly focusing on large business customers. Credit concentration on the business group has helped these two banks significantly improve their CAR ratio.

For banks specialized in business lending, all banks have high credit growth rates and maintain stable growth throughout the year. MB Bank has the highest credit growth rate among the banking group and the entire banking industry, while Techcombank’s credit growth is also very good. A note is that the majority of Techcombank’s credit growth comes from large businesses, up to 74%, while the credit growth rate for individual customers has decreased by 5%.

For banks specializing in individual loans, the banks seem to be more cautious. The two banks with outstanding credit growth in this group are ACB and VIB. These are also two banks that have pursued a cautious credit growth policy since the beginning of the year but unexpectedly accelerated in the fourth quarter. With a bank with a very high personal loan ratio like VIB, the growth rate of personal loans in the year is only 8%, while the business segment reaches 72%.

Disbursing many loans to the business group also helped improve the CASA ratio of the banking system quickly in the recent period, especially for banks specializing in business loans. New loan capital when disbursed in the ecosystem of large corporations will contribute to the CASA for banks in this group, thereby contributing to improving the cost of capital mobilization.

Issues to note behind the growth picture

The rapid credit growth in the fourth quarter shows that the effectiveness of the growth has not really come into reality. In the face of weak credit demand from the market, hot credit growth can create significant pressure on the short-term credit quality. When faced with a large disbursement pressure but unable to find good customers, banks may choose to continue disbursement for existing customers in order to maintain their financial health.

Statistics from listed banks show that the estimated bad debt ratio has decreased from 2.24% to 1.93%. The reduction in the bad debt ratio of the banking system in the context of the overall economy still experiencing difficulties shows that a part of the credit growth of banks has been used to re-finance for maturing debts of businesses.

Meanwhile, in terms of efficiency, the internal technical disbursement can increase both deposits and loans, but in reality, it does not impact real economic activities and affects the bank’s business efficiency. Statistics show that the NIM of the listed banking system is estimated to have decreased to 3.44% from 3.51% in the previous quarter, although the CASA ratio of the system has improved significantly in the same period.

Le Hoai An – Nguyen Thi Ngoc An

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)