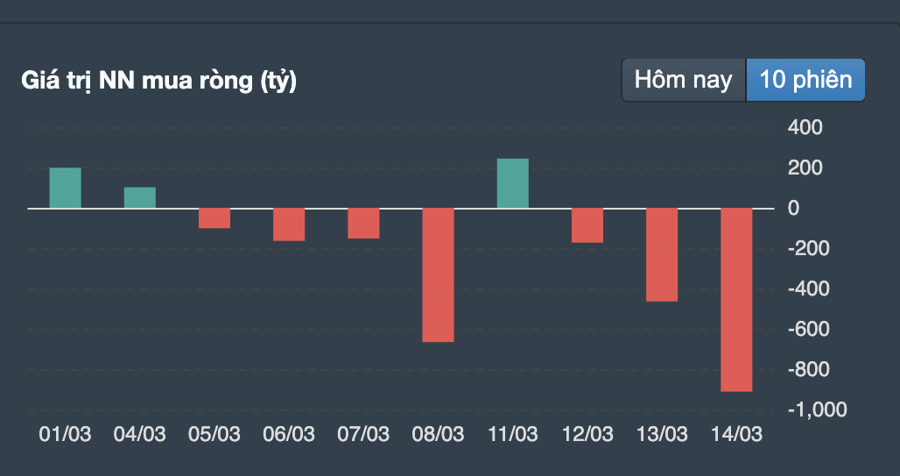

Foreign investors continued to sell off stocks with the strongest selling pressure in a month, resulting in a net selling value of 911 billion VND mainly due to the selling of VHM and VNM in today’s trading session.

In the past 10 sessions, foreign investors have net sold nearly 2.7 trillion VND on the Vietnamese stock market. Within the past half month, foreign investors have net sold nearly 3 trillion VND.

The selling pressure from foreign investors comes amid a rapid increase in exchange rates in recent times. The interbank exchange rate USD/VND returned to the peak level of late October 2023, reaching 24,648 at the end of February (+1.56% YTD). This is due to factors such as the continued strength of the DXY, the existing pressure from the interest rate differential between USD and VND, a large amount of foreign currency flowing out of the system serving the import activities of businesses in the early stages of the year, while foreign currency received from export enterprises has not yet immediately returned to the system.

The black market exchange rate has increased by 2.66% since the beginning of the year, reaching 25,430 amidst the still high price difference between domestic and global gold, reaching 18 million VND/tael. Accordingly, the black market exchange rate continues to widen the gap with the selling rate of VCB, which is 600 VND higher and is the largest gap recorded since July 2023.

Stock valuation is no longer cheap. According to Mirae Asset, the room for the current uptrend of the VN-Index has been narrowed as it gradually approaches the 10-year average P/E (corresponding to 1,309 points) and the point increase in the previous month has helped the HOSE index return to the median level at 16.2 times compared to 14.9 times in January.

Regarding foreign capital flows, according to VDSC, based on past observations, this is the preferred net selling area of foreign investors in the short term when the Vietnamese stock market lacks major stories. Therefore, it is not ruled out that this pressure will continue in the short term.

However, in the medium and long term, the net trading status of foreign investors will turn positive again and tolerate a higher PE ratio once major commercial banks begin to reduce interest rates and Vietnam improves criteria to be upgraded in the market.

“The Southeast Asian stock market, including Vietnam, with attractive profit prospects and valuations at the current time, will be the preferred destination for foreign capital when the high interest rate policy in a longer period of time is replaced by a clearer interest rate reduction roadmap expected to begin in the second half of 2024,” VDSC expects.