The primary corporate bond market experienced a decline in February with a total issuance value of only 1,165 billion VND, a decrease of 45.8% compared to the previous month, with an average maturity of 2.87 years. Among them, there were only 3 separate bond issuances by 3 companies in the construction, port transportation, and trade and services industries.

The corporate bond market has been sluggish in the first 2 months of the year mainly due to the re-enforcement of certain provisions in Decree 65, which has made regulations on corporate bond issuance stricter, according to KBSV. The issuance volume is expected to pick up in the second half of the year as the economy warms up, the real estate market recovers, and the bottlenecks in the corporate bond market are gradually removed.

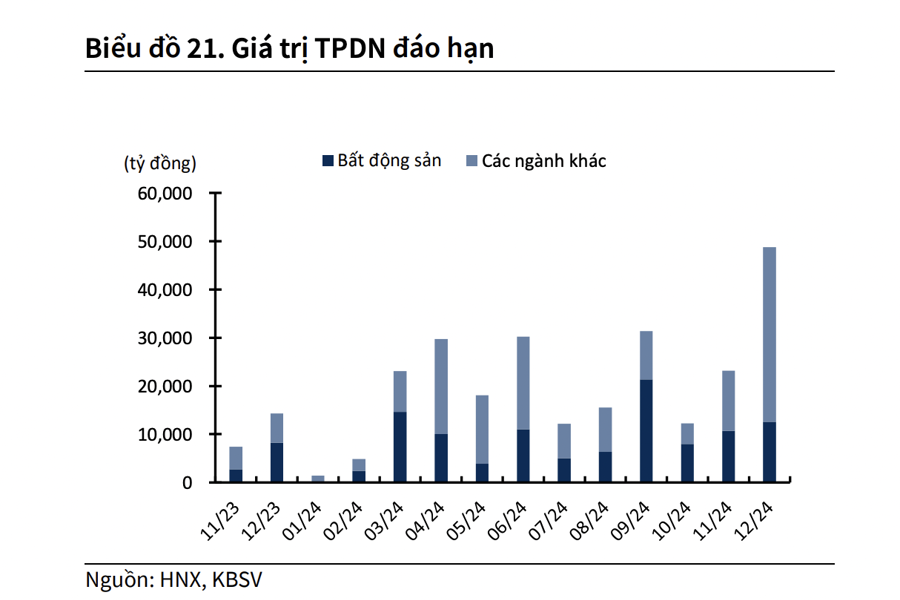

In March, it is estimated that there will be approximately 23.07 trillion VND of bonds due, an increase of 372% compared to the previous month. Among them, the Real Estate group accounts for 63%, Trade and Services group accounts for 10%, and the Construction group accounts for 9%.

For the whole year of 2024, it is estimated that there will be around 279 trillion VND of bonds due, with over 115 trillion VND being real estate corporate bonds (accounting for 41.4%), followed by the financial institutions group with over 81 trillion VND (accounting for 29%). These figures do not include the “second round” of due bonds after being extended, so the pressure of due bonds this year will actually be higher than the reflected number above.

In the secondary market, the trading volume has been decreasing in the first 2 months of the year, reaching 60 trillion VND in February, a decrease of 20% compared to the previous month. The bond repurchase activity also slowed down in February, with the volume of corporate bond repurchased reaching 2,494 billion VND, a decrease of 60% compared to the same period.

However, KBSV believes that the repurchase activity will improve in the coming months as business conditions improve, and the low interest rate environment also motivates businesses to increase repurchasing high-interest-rate bonds issued in the previous period.

Regarding exchange rates, the January PCE data of the US did not show any surprises as it decreased in line with market expectations. Specifically, the January PCE reached 2.4%, the core PCE decreased to 2.8%, and it was the lowest PCE level since April 2021. However, there have been initial signs of a possible return of inflation. ISM Services Prices, a gauge of service prices, rose sharply to 64 in January from 56.7 in December 2023.

The NFIB survey on businesses’ ability to increase selling prices shows that the probability has increased from 20% to 40% in the past 3 months. Therefore, the inflation risk of the US may continue to push up the DXY and put pressure on the exchange rate in the future.

On the contrary, the export-import activities and FDI capital inflows continue to grow positively, which are supporting factors for the exchange rate. Registered foreign investment capital as of February 20 reached 4.29 billion USD, an increase of 38.6%. Meanwhile, foreign direct investment realized in the first 2 months of the year is estimated to reach 2.8 billion USD, an increase of 9.8% compared to the previous year and the highest level in the past 5 years.

The total import-export turnover in the first 2 months of the year reached 113.96 billion USD, of which exports reached 59.34 billion USD (up 19.2%) and imports reached 54.62 billion USD (up 18%). Overall, in the first 2 months of the year, Vietnam achieved a trade surplus of 4.2 billion USD. However, domestic businesses (despite improvements) still experienced a trade deficit of 3.53 billion USD.

Therefore, KBSV maintains its exchange rate forecast, expecting a 1.5% increase this year, reaching 24,600 USD/VND.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)