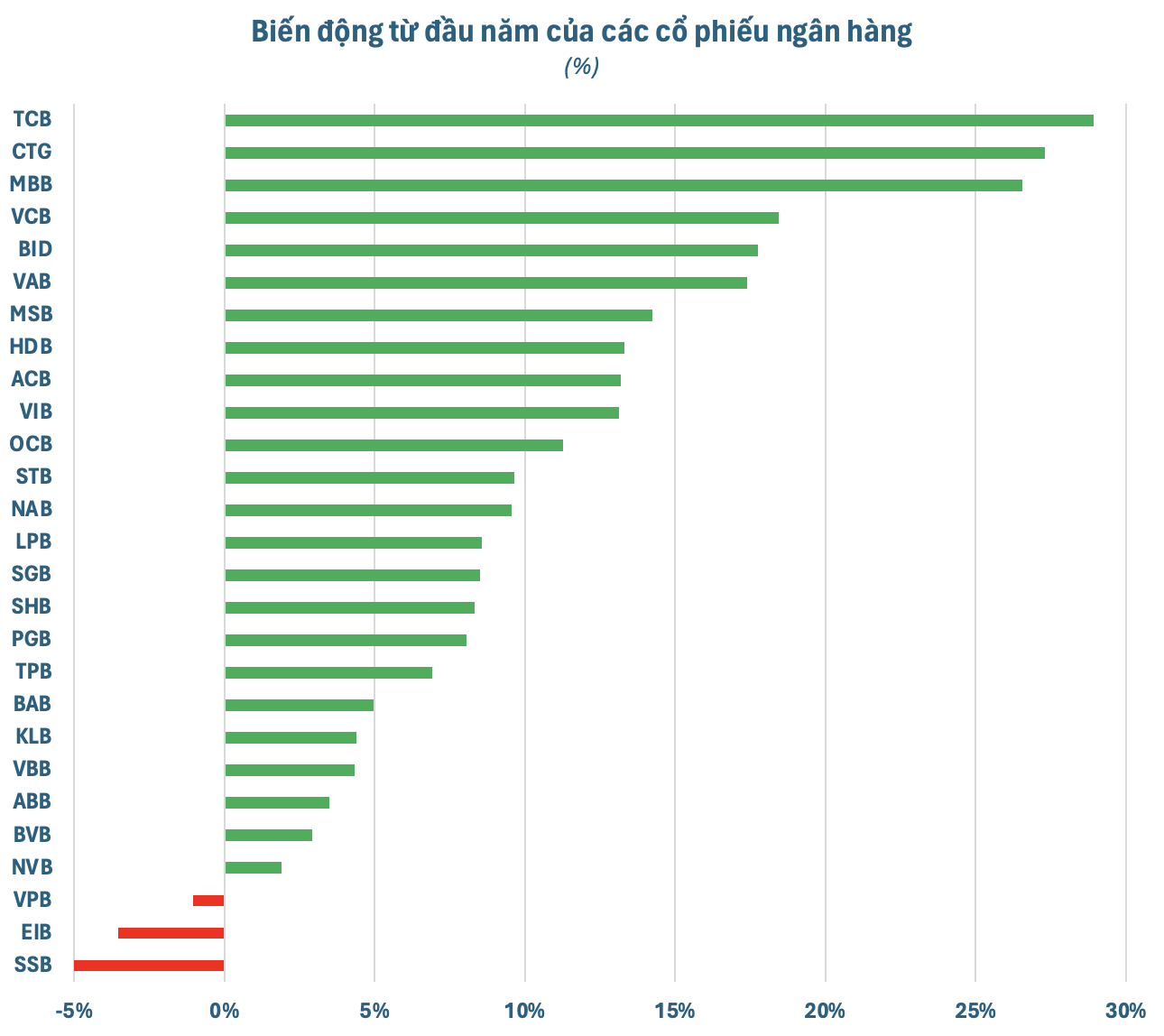

In the recent times, the focus of the stock market has been on banking stocks, which account for 40% of the total market capitalization. It is not surprising to say that the “king” stocks have been the breath of the market lately as the upward trend has been mainly led by this group. On the contrary, when the banking group takes a break, the market also adjusts.

In the past 3 months, during the continuous uptrend, the corrections have been relatively short with not too large volatility. The money flow circulating within the banking group helps the market quickly recover after the breaks. Banking stocks take turns leading the way, when the group gets overheated and faces profit-taking pressure, the low-performing stocks, some that have not even had a gain, do not miss the opportunity to attract money.

Thanks to this, many “king” stocks have increased by double digits since the beginning of 2024. However, there are still quite a few names in the banking group that have yet to “heat up” like VPB, EIB, SSB. With the continuous abundant and flowing money into the market, these stocks are expected to attract money, thereby rising and leading the banking group as well as the overall market to return to the upward trend soon.

Looking at the “late-runners”, VPB is probably the most prominent name that can rise and lead with its Q4/2023 profit growth of 96% year-on-year, the highest in the industry. Earlier, the names that have surpassed the peak like VCB, BID, ACB, HDB, MBB or close to the peak like CTG, LPB all have promising profit growth compared to the industry average.

According to MBS’ recent report on VPB, the company forecasts that VPBank’s after-tax profit in 2024 is expected to reach VND 16,422 billion, an increase of 90.1% compared to 2023.

VPB is also the bank stock with the largest market capitalization among the stocks that have increased by less than 10% since the beginning of the year. In addition, this stock is also one of the most active stocks in the banking group. Its large market capitalization and ability to create spillover effects are advantages of VPB in attracting large-scale smart money.

In addition, the large capital inflows that have actually poured in since the end of last year after completing the deal with SMBC, accompanied by the addition of international experience and the ability to serve super large customer groups, are expected to boost VPBank’s business results in the near future.

Furthermore, “the golden goose” FE Credit has successfully completed restructuring and brought in pre-tax profit of VND 208 billion in Q4/2023. This is the second consecutive quarter that the financial company has recorded positive pre-tax profit after a long period of continuous losses. This positive transformation will support the profits of VPBank, thereby creating a premise for the bank to implement a cash dividend policy of 10% for 5 consecutive years.

In general, the potential cannot be denied but still needs to be put in the overall context of the industry. Therefore, the most important thing is still how the money flow is perceiving the prospects of the banking group?

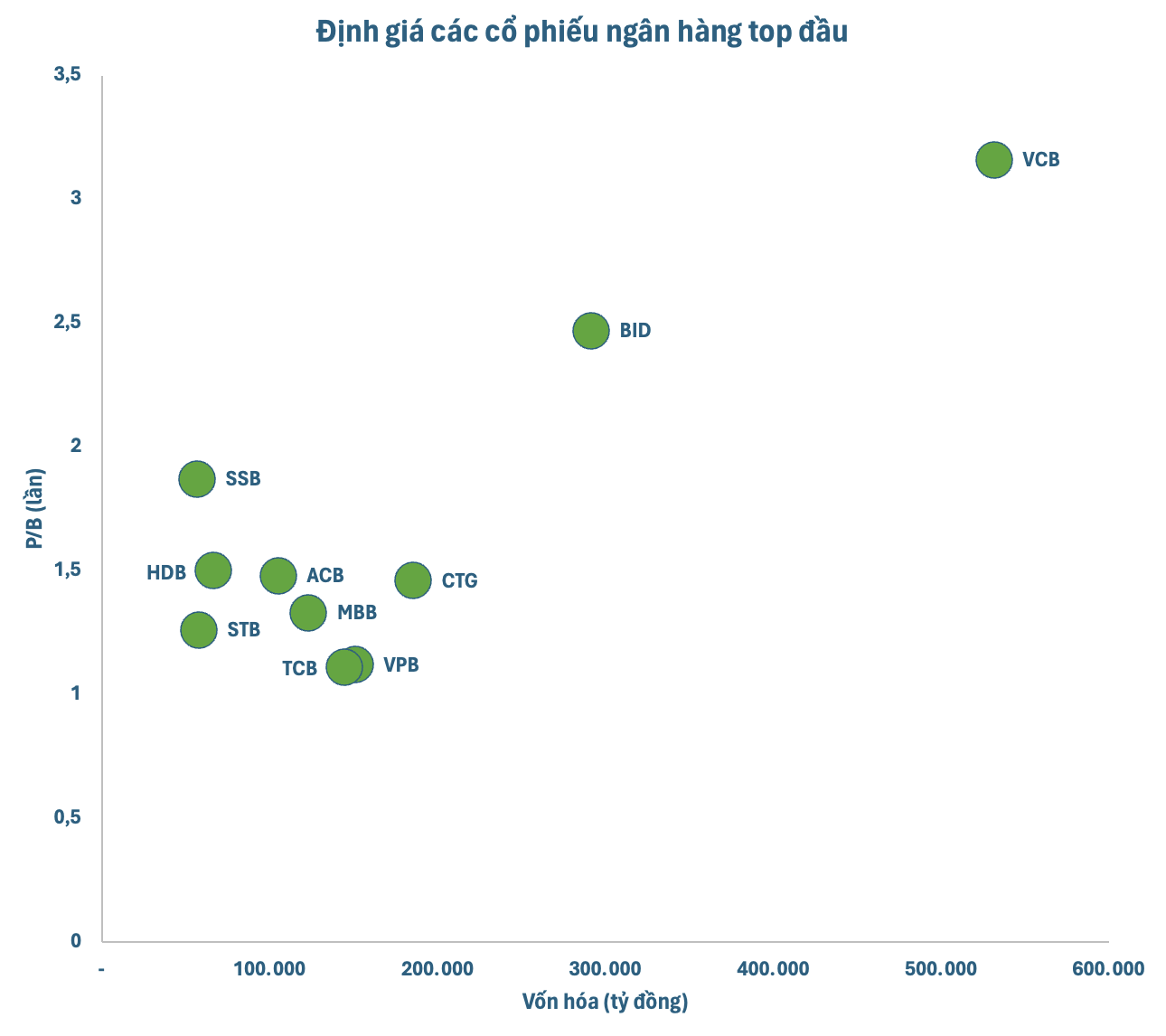

Reasonable valuation

Although experiencing a prolonged uptrend, the valuation of the banking stock group is still “quite soft”. The P/B ratio (stock price over book value) of this group of stocks is currently around 1.6 times, only slightly higher than the 5-year average level, mainly due to VCB and BID. Meanwhile, most of the “king” stocks are currently trading at a P/B ratio below 1.5 times.

Low valuation is a “buffer” that helps banking stocks reduce the severity of corrections. At the same time, this is also one of the factors that contribute to attracting new money flow. According to Vietcombank Securities Company (VCBS), the high growth rate of profit and shareholders’ equity in some banks will help the P/B ratio maintain attractive level.

Meanwhile, SSI Research evaluates that if assuming that the LGD (estimated loss) ratio for problem loans is 50% and after using the allocated provisions, the impact on shareholders’ equity will be at 11%. Therefore, this analysis department believes that the current valuation mostly reflects credit risk from overdue debts and restructured loans according to Circular 02.

According to the analysis department, the valuation hardly changes in the process of handling bad debts but will be reappraised within 6-12 months before completing the bad debt handling. In this process, banks that are able to raise capital sooner will have better conditions to accelerate the bad debt handling process, gain more market share, and achieve better results than other banks.

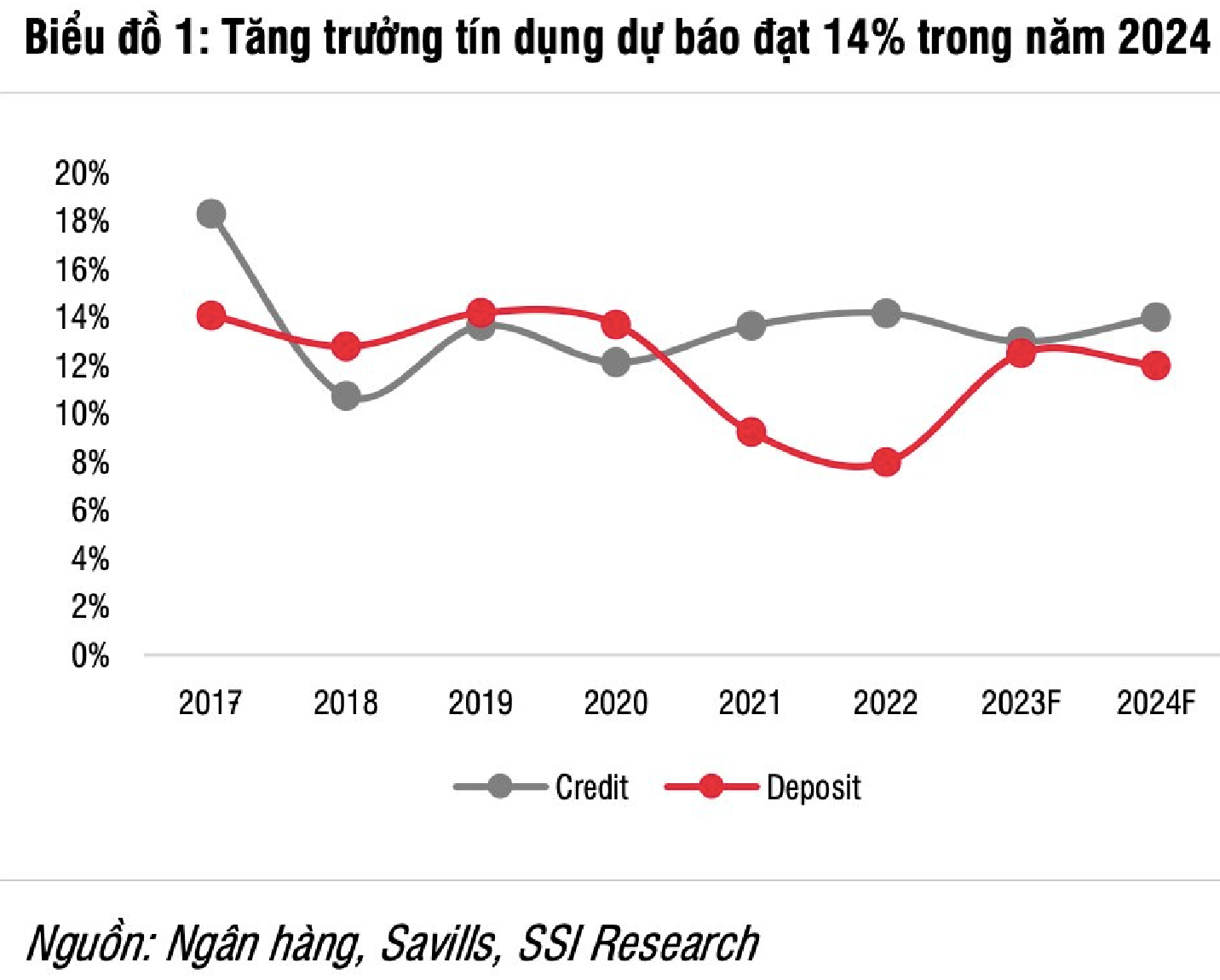

Promising profit growth

With the expected improvement in the macro economy in 2024, SSI Research expects credit growth to recover to a level of 14%. This is partly supported by the reduced lending interest rates. The growth potential may come from business sectors such as: (i) infrastructure construction sector; (ii) manufacturing and FDI enterprises; and (iii) priority sectors (agriculture, export, high technology, SMEs, and supporting industries).

According to SSI Research’s estimation, the pre-tax profit growth of banks within the research scope in 2024 is expected to reach 15.4%. This is a better growth rate than the 4.6% in 2023. NIM is forecasted to recover 9 basis points to a level of 3.75% for banks within the research scope.

The average funding interest rate in 2024 is expected to not be significantly different from the current level. Accordingly, the expected lower cost of capital (reducing 113 basis points regarding customer savings) along with the improving CASA and the longer loan terms will help reduce the pressure on NIM for credit institutions in 2024.

However, VCBS suggests that the banking sector’s profit in 2024 will continue to have a strong differentiation with a growth rate of about 10%. VCBS also notes that in case Circular 02 on debt structuring is not extended, banks with high corporate lending ratio and low NPL coverage ratio may face risks and high provisions in 2024-25. Banks with good asset quality will record bad debts and restructured debts under control at a reasonable level.