According to the February activity report, Pyn Elite Fund points out that the VN-Index increased by 7.6% thanks to the leadership of banking stocks. Meanwhile, the investment performance of foreign funds only reached 5.2% due to the stagnant growth of Sacombank’s STB shares and a 1% devaluation of the VND against the USD. Thus, after dominating the market in the first month of the year, the fund was unable to maintain its winning streak.

However, overall for the first two months of the year, the investment performance of Pyn Elite Fund reached 12.44%, higher than the 10.9% increase of the VN-Index during the same period. This is a commendable achievement for the foreign fund from Finland after a challenging year in 2023.

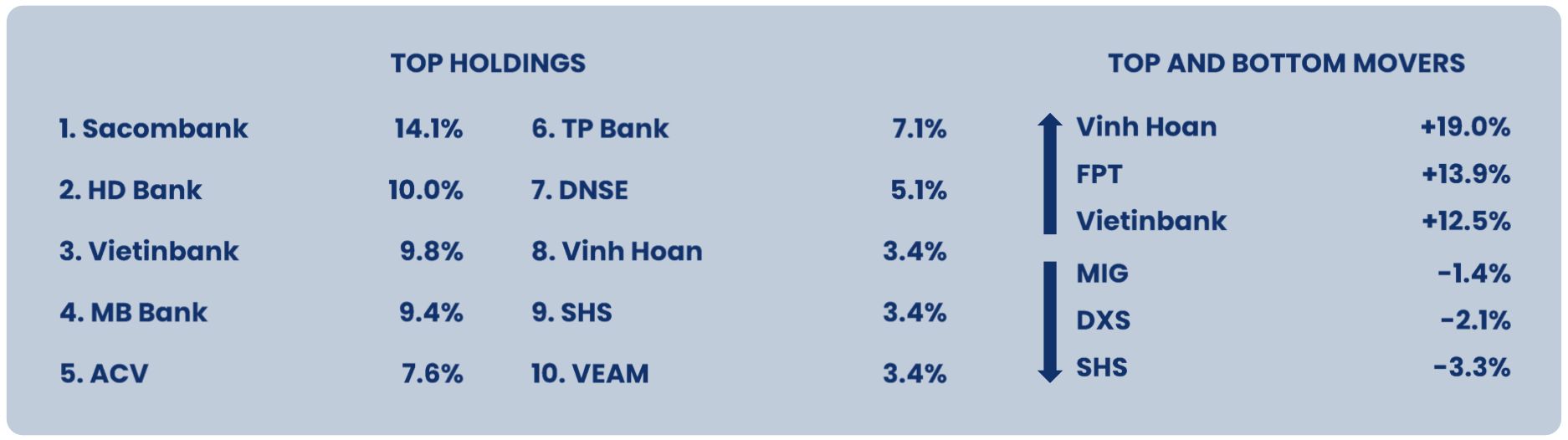

Pyn Elite Fund is one of the largest foreign funds investing in the Vietnamese stock market with a portfolio size of 785.4 million EUR (~21.2 trillion VND) at the end of February. Banking stocks still dominate, but the proportions of STB, HDB, MBB, and TPB have all decreased slightly compared to the end of January.

In February, the strongest performing stocks in Pyn Elite Fund’s portfolio were VHC (19%), FPT (13.9%), and CTG (12.5%). On the other hand, the stocks with the largest decrease were MIG, DXS, and SHS, but the decline was not significant, ranging from 1% to 3%. DNSE was emphasized as a notable investment of the fund, however, this securities company has only recently conducted an IPO and has not yet been listed on the stock exchange.

In terms of macroeconomic conditions, Pyn Elite Fund forecasts that production activities will strengthen as order volumes increase and inventory levels decrease. In the first two months of the year, exports increased by 19.2% compared to the same period last year. Industrial production increased by 5.9% compared to the same period, but it is still lower than exports. The PMI increased from 50.3 in January to 50.4 in February due to higher output and order volumes.

Retail sales growth slightly increased to 8.5% in February (up from 8.1% in January). Pyn Elite predicts that consumer spending will grow stronger in the second half of 2024 as the labor market improves along with the recovery of exports.

In the stock market, at the end of February, Prime Minister Pham Minh Chinh chaired a conference with key agencies and organizations including the State Bank, the Ministry of Finance, the State Securities Commission, the World Bank, securities companies, and investment funds. In this event, the Prime Minister emphasized the pursuit of upgrading the emerging market status by 2025 and set deadlines for important milestones such as the new KRX trading system and solutions for non-capital raising.

In a letter to investors at the end of February, Petri Deryng, Director of Pyn Elite Fund, commented on the stable currency market, bank liquidity, and interest rates returning to attractive levels. Therefore, Vietnam’s listed companies will record profit growth of over 20% in 2024.

Particularly, the head of Pyn Elite Fund has great confidence in the banking sector, expecting significant profit growth. “In general, stocks, including banking stocks, have been undervalued for several years. There is great potential for price appreciation as Vietnam’s economy continues to thrive with favorable monetary market cycles.“, emphasized Petri Deryng.