According to the information from United Overseas Bank Vietnam (UOB), despite a challenging year, Vietnam’s GDP in 2023 is still expected to grow at a rate of 5.05%, slightly higher than UOB’s expectation of 5%. The drag comes from the first six months of 2023, which has limited the effectiveness of the year’s activities.

In the first half of 2023, Vietnam’s economy only grew by 3.72% compared to the same period, significantly lower than the 6.46% pace in the first half of 2022. Consolidated data from January to February 2024 shows that the recovery momentum is heading in the right direction.

According to the latest data released by the General Statistics Office (GSO), Vietnam’s exports and industrial production in February declined sharply. In February, exports decreased by 5% compared to the same period and industrial production decreased by 6.8% compared to the same period, compared to respective increases of 42% and 18.3% in January.

The sharp decline is mainly due to the Lunar New Year falling in February this year instead of January last year. To make a more accurate comparison, consolidated data from January to February shows that exports increased by 17.6% compared to the same period in 2023, while industrial production increased by 5.7% compared to an average of -2.2% during the same period from January to February 2023.

Industrial production increased by 5.7% compared to an average of -2.2% during the same period from January to February 2023.

The Purchasing Managers’ Index (PMI) of Vietnam shows that both the January and February indexes in 2024 are above 50, compared to the average of 49.3 in January and February 2023.

“These data indicate positive signs of recovery in manufacturing and foreign trade, and we expect this pace to be maintained, especially in the second half of 2024 when the semiconductor industry is more solidly recovering and global central banks start to implement more appropriate interest rate policies,” said a UOB representative.

While risks from external events continue to weigh on global economic prospects (including conflicts in Eastern Europe and the Middle East), Vietnam’s prospects are reinforced by the recovery of the semiconductor industry, stable growth in China and the region, as well as supply chain shifts that benefit Vietnam and ASEAN.

According to UOB representatives, the bank maintains its forecast of Vietnam’s growth at 6.0% for 2024, within the official target range of 6.0-6.5%.

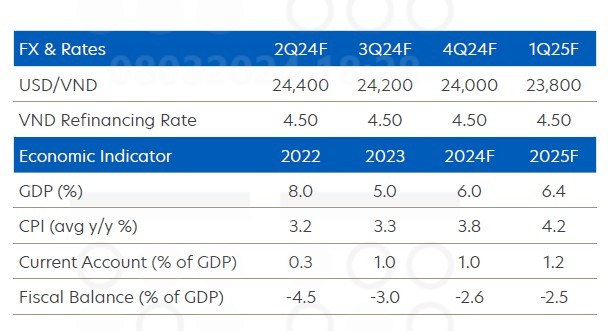

“In the first quarter of 2024, we expect the GDP growth rate to decrease to 5.5% compared to the same period due to the impact of the Lunar New Year holiday. We predict that inflationary pressures will continue to increase, with the full year CPI forecast to rise to 3.8% in 2024 from 3.25% in 2023,” shared a representative from UOB.

The State Bank continues to maintain stable interest rates, and the Vietnamese dong is likely to have a slight recovery

The State Bank of Vietnam quickly responded to the economic downturn at the beginning of last year by promptly cutting interest rates. The last policy rate cut took place in June 2023 when the refinancing rate was cut by a total of 150 basis points to 4.50%. “With the pace of economic activity recovering, the possibility of further interest rate cuts has diminished. Therefore, we believe that the State Bank will maintain the refinancing rate at the current level of 4.50%,” UOB representative expected.

Instead of continuing to lower interest rates with limitations in calculating lower thresholds, the Government has shifted the focus to non-interest rate measures to support the economy. One of these is to bring credit to borrowers (i.e., quantitative easing measures).

In 2023, bank credit growth reached about 13.5% compared to the same period, slightly lower than the target of 14-15% set for the year, as regulatory agencies requested banks to simplify lending procedures and improve the access of businesses to bank loans. For 2024, the State Bank set a target to promote credit growth to about 15% with flexible adjustments based on economic developments during the year.

The Vietnamese dong is likely to have a slight recovery.

In addition, it can be seen that USD/VND traded at a new high of 24,700 at the end of February along with a significant strengthening of the USD against Asian currencies. Despite the short-term weakness of the Vietnamese dong, expectations of stronger GDP growth in Vietnam (forecasted at 6.0% in 2024 compared to 5.05% in 2023) and the recovery momentum in manufacturing and foreign trade are positive factors that could help stabilize the Vietnamese dong.

“The further recovery of the CNY – which the VND typically follows – together with the weakness of the USD ahead of the Fed rate cuts in June will bring a slight recovery to the VND. Our updated USD/VND forecast is 24,400 in Q2 2024, 24,200 in Q3 2024, 24,000 in Q4 2024, and 23,800 in Q1 2025,” informed a UOB representative.