A new member, CAP stock of Yen Bai Food and Agricultural Product JSC, has just joined the club of three-digit stocks on the stock exchange. The stock recently experienced a significant increase (+8.64%), reaching a new peak at 106,900 VND/share. Compared to the beginning of the upward trend in early February, the stock has increased by 36% in value.

CAP’s market capitalization has also exceeded 1,000 billion VND for the first time, setting a record since its listing on the stock exchange in 2008. Compared to 10 years ago, the company’s market capitalization has increased by 27.5 times (a 2,650% increase), corresponding to a compound annual growth rate of 39% for the 2014-2024 period, a very impressive number.

CAP, formerly known as Yen Bai Paper Factory, was established in 1972. In 1994, the company was reestablished and renamed as Yen Bai Food and Agricultural Product Processing Company, with its main business activities being processing, manufacturing, and trading of forestry and agricultural products. After its equitization in 2004, CAP officially listed on the stock exchange at the beginning of 2008, introducing unique products to the market.

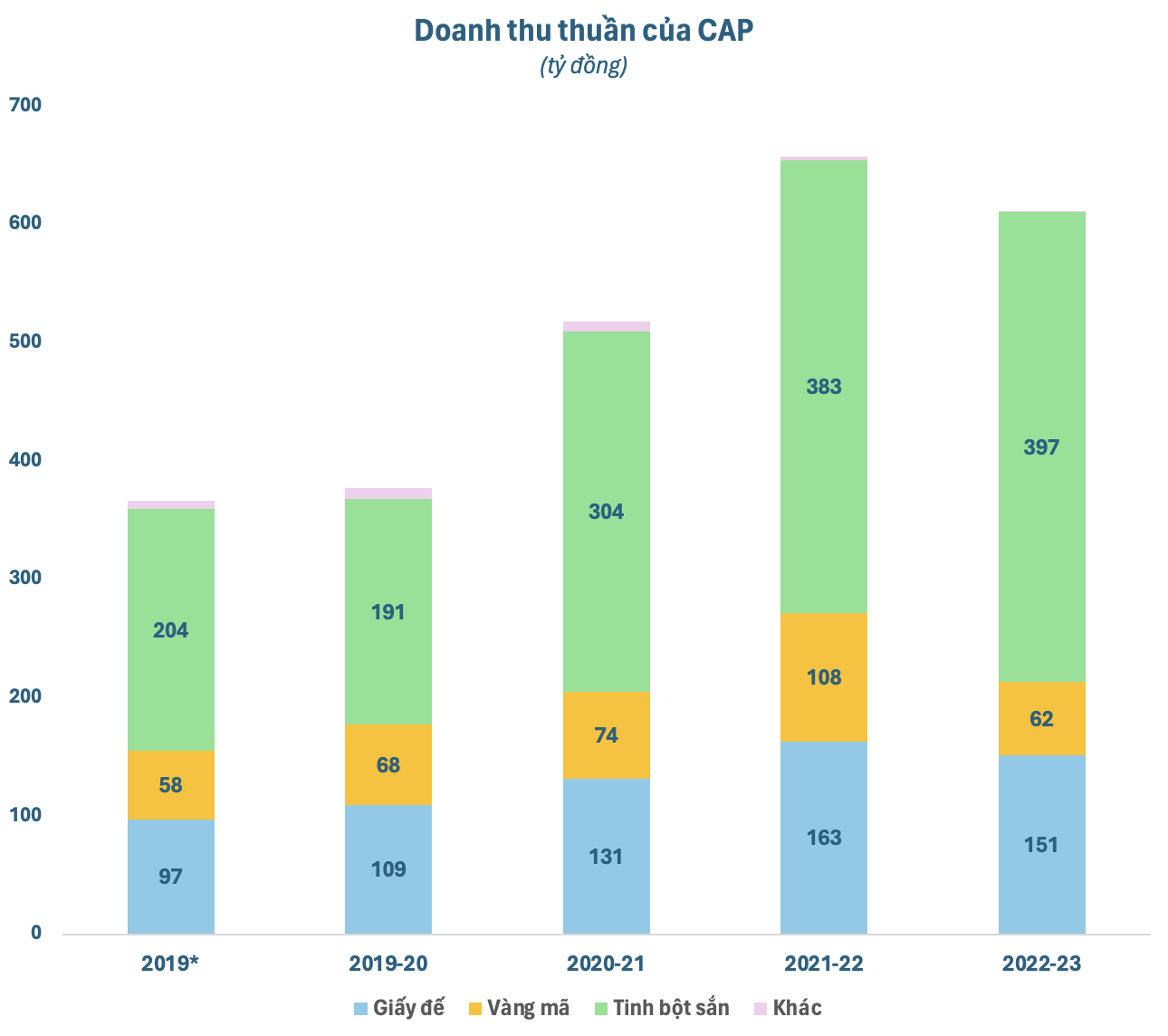

CAP is known as a company that produces and trades rare spiritual products (parchment paper, gold horse) on the stock exchange, alongside names like Hapaco (HAP ticker) and Fishipco (FSO ticker). Each year, this segment generates hundreds of billion VND in revenue for CAP. During the 2019-2022 period, sales of parchment paper and gold horse consistently contributed more than 40% of CAP’s revenue, before decreasing to 35% in the 2022-2023 financial year.

Meanwhile, another core product of CAP, cassava starch, continues to experience growth and achieve a new record in revenue. However, the revenue from this product in the 2022-2023 fiscal year only increased by a modest 4% compared to the previous year, reaching nearly 400 billion VND, accounting for 65% of total revenue. The growth of this segment is not sufficient to compensate for the decline in revenue from parchment paper and gold horse, causing CAP’s revenue to decrease by 7% compared to the previous fiscal year, reaching 611 billion VND.

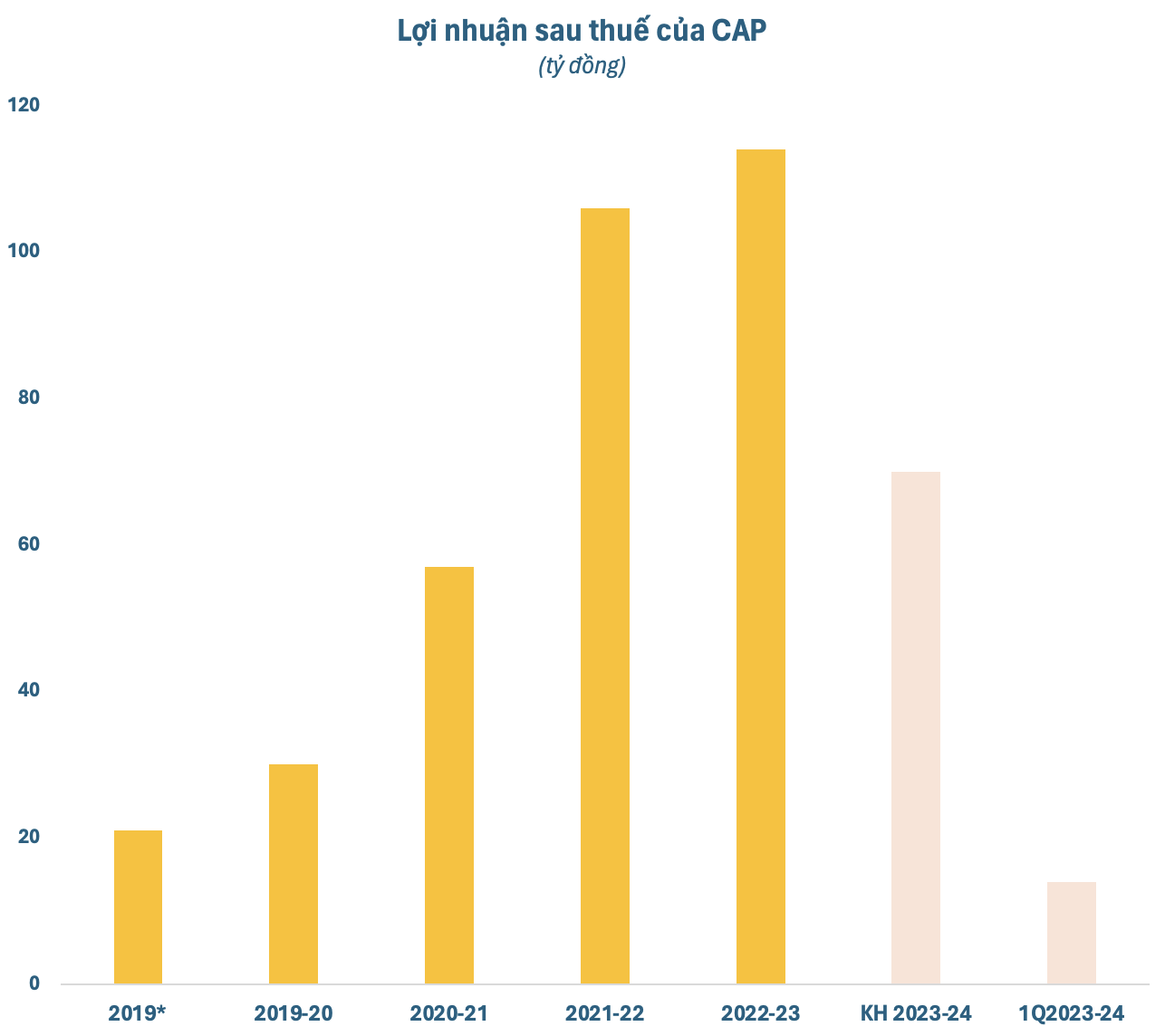

Nevertheless, thanks to a significant reduction in costs and expenses, CAP’s after-tax profit for the 2022-2023 fiscal year still increased by 7.5% compared to the previous fiscal year, reaching a record high of 114 billion VND. Among them, gross profit from gold horse sales was recorded at over 13 billion VND, gross profit from parchment paper sales was 73 billion VND, and gross profit from cassava starch was 90 billion VND.

In the 2023-2024 fiscal year, CAP aims to achieve high revenue growth of 500 billion VND (+26%), but the expected after-tax profit is modest at 70 billion VND, a nearly 39% decrease compared to the previous fiscal year. In the first quarter of the fiscal year (from October 1, 2023, to December 31, 2023), the company recorded net revenue of 186 billion VND, an increase of approximately 18%, but after-tax profit decreased by 31% compared to the same period of the previous fiscal year, reaching 14 billion VND.

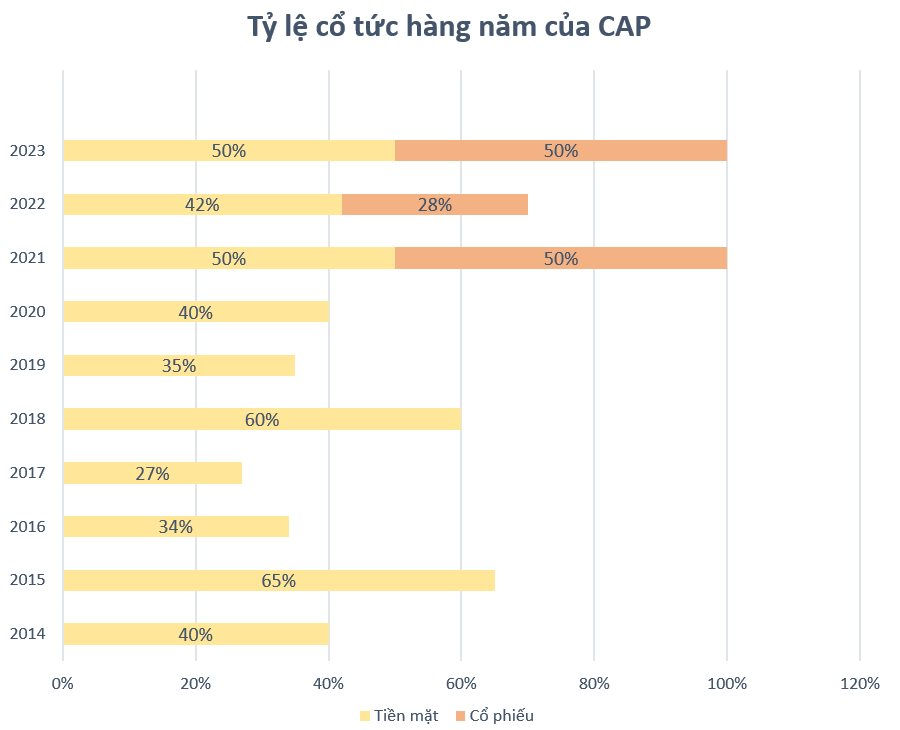

Thanks to its unique and diverse products, CAP has a tradition of regularly paying high dividends to shareholders, reaching tens or even hundreds of percent. With the record profit in the 2022-2023 fiscal year, the company will distribute a massive dividend to shareholders at a rate of 100%, including 50% in cash and 50% in shares.

With over 10 million shares in circulation, CAP plans to spend over 50 billion VND to pay cash dividends. At the same time, the company will issue an additional 5 million shares as dividend payment, increasing its charter capital to over 150 billion VND. The last registration date to finalize the list of shareholders eligible for dividends is March 19.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)