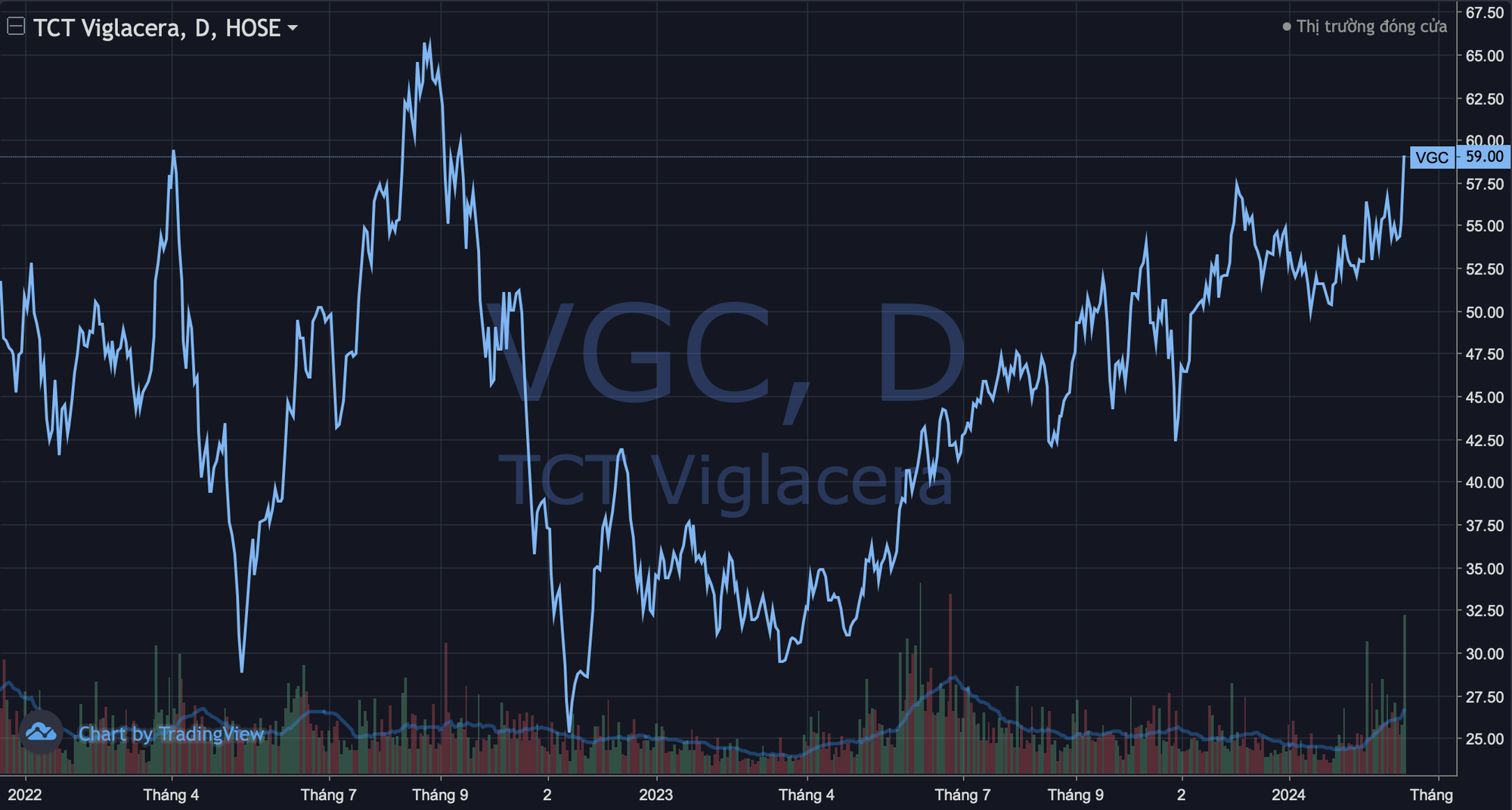

The stock market is quickly recovering after a correction, leading to many stocks making strong breakthroughs. VGC shares of Viglacera Corporation JSC are one of the notable names as they recently surged to the limit price of 59,000 VND per share, the highest level in 18 months since mid-September 2022.

Viglacera’s market capitalization is approximately 26.5 trillion VND (~1 billion USD), an 84% increase compared to a year ago. This figure makes Viglacera the only company in the GELEX group to enter the billion-dollar market capitalization list on the stock exchange. However, the market capitalization is still about 10% lower than its peak in late August 2022.

Viglacera was established in July 1974 as a precursor to the Ceramic Construction Tile Company, formed from the merger of 18 brick and tile production factories and kilns. Since the 1990s, Viglacera has been a pioneer in the production of new products such as construction glass, sanitary ware, ceramic tiles, and granite tiles…

In April 2014, Viglacera converted from an LLC to a joint stock company. From that point on, Viglacera officially expanded its scope of operations in two main sectors: construction materials and real estate. More than a year after the initial public offering (IPO), Viglacera listed its shares on the UPCoM with the code “VGC” from mid-October 2015.

In mid-December 2016, Viglacera officially listed on the HNX with a charter capital of over 3 trillion VND. After nearly 3 years, VGC shares transferred to the HoSE exchange at the end of May 2019. At that time, Viglacera’s charter capital was nearly 4.5 trillion VND after two rounds of offering in 2016-17. Therefore, VGC is a rare name that has been traded on all three stock exchanges.

Accelerating profits after coming under GELEX

The presence of GELEX at Viglacera was officially announced in 2020. After two rounds of public offering, GELEX’s subsidiaries owned a total of 206.54 million shares, accounting for 46.07% of Viglacera’s capital. Among them, Vietnam Electrical Equipment Corporation owned 26.64%, and Gelex Electrical Equipment Company owned 19.43%.

After many rounds of acquisitions, the GELEX group officially increased its ownership in Viglacera to over 50% in April 2021, thereby consolidating business results with the group. Currently, Viglacera is an indirect subsidiary of GELEX as GELEX Infrastructure Corporation (GELEX directly owns 82.65% of capital) holds a 50.21% stake.

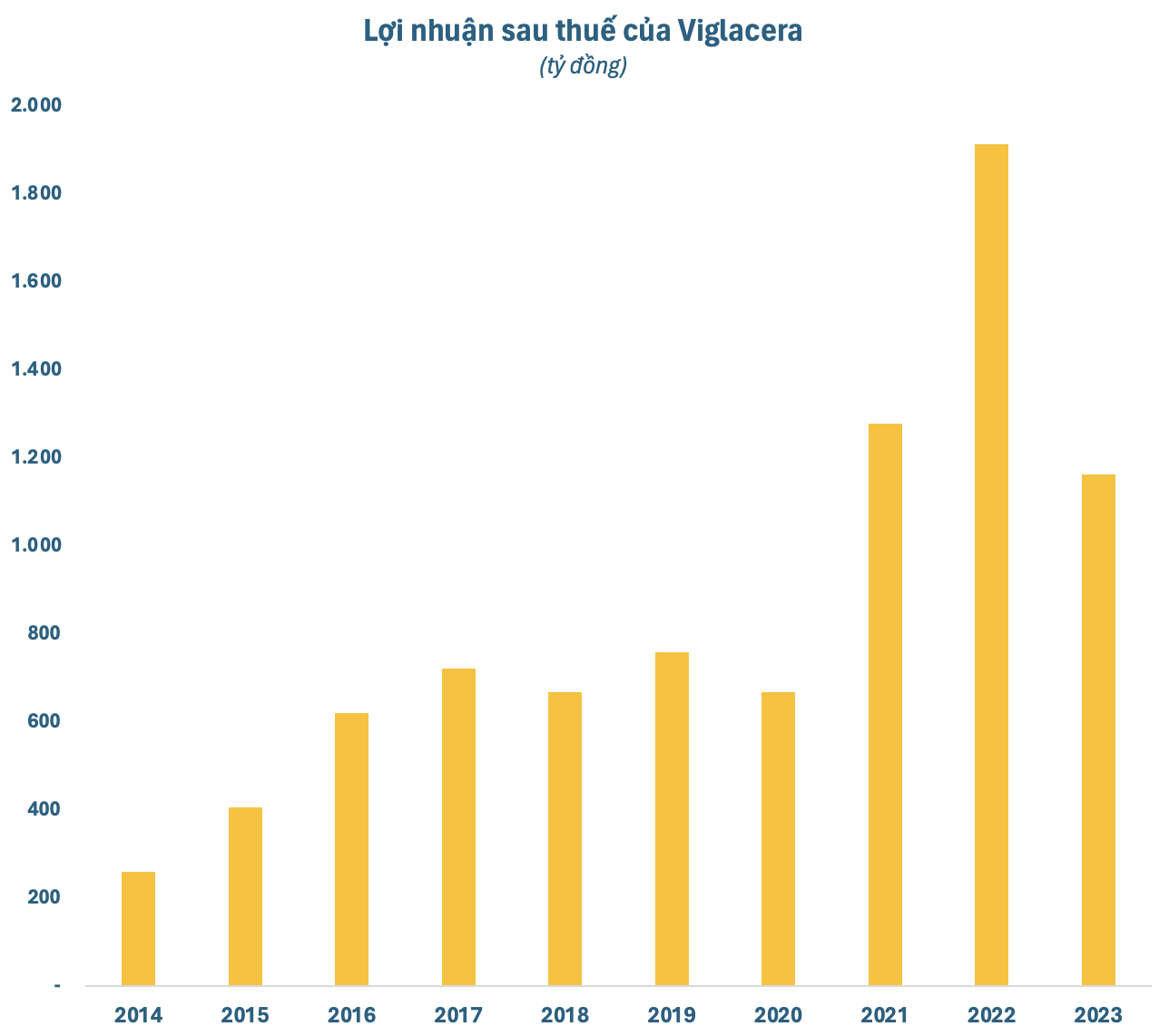

After coming under GELEX, Viglacera experienced a significant improvement in business performance. Profits, which previously ranged from around 600-800 billion VND, soared to nearly 1,300 billion VND in 2021. This figure continued to grow strongly by 50% to over 1,900 billion VND in 2022 before facing difficulties at the end of last year.

In Q4 2023, the company reported a loss for the first time since its disclosure, mainly due to difficulties in the glass segment. Cumulatively for the year 2023, Viglacera had a net profit of 1,162 billion VND, a 39% decrease compared to the previous year, but still exceeded the 32% annual target. This figure is also much higher than before GELEX’s entry.

Entering 2024, Viglacera plans for consolidated revenue of 13,468 billion VND and a pre-tax profit target of 1,216 billion VND. After an unexpected loss in the previous quarter, the situation has become more optimistic. In the first two months of the year, the company is estimated to have achieved 14% of the annual profit target, equivalent to an estimated pre-tax profit of about 170 billion VND.

Optimistic prospects

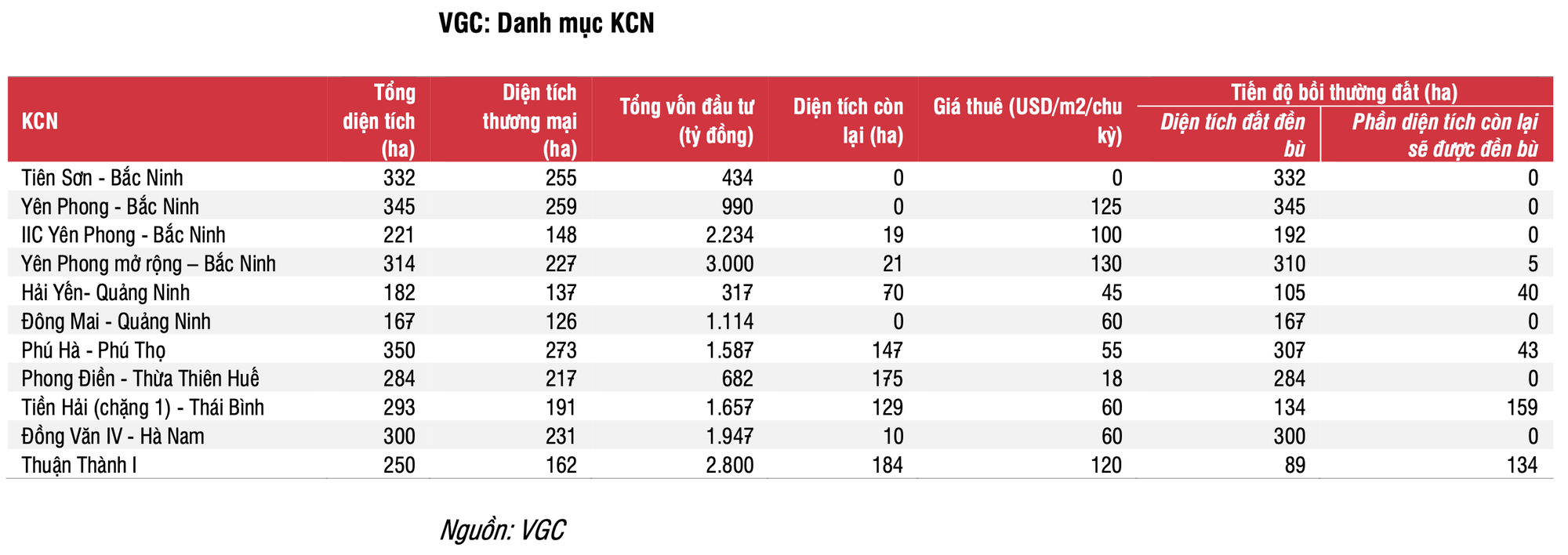

Viglacera is currently a leader in the construction materials (VLXD) sector, including construction glass (with a 42% market share) and ceramic tiles (with a 30% market share). Additionally, the company has developed 11 industrial parks with remaining land area of 560ha, mainly located in the North and Central regions, attracting large customers such as Samsung, Accor, BYD,…

SSI Research expects Viglacera to maintain stable profits from leasing existing industrial parks for a long time. In the long run, the company can maintain higher profit margins thanks to the remaining 560ha of land – including 200ha ready for lease. Revenue from granite and ceramic tiles will increase when the Eurotile factory starts operations at the end of 2023.

In the short term, positive news about i) leasing of large industrial park areas, ii) growth in granite and ceramic tile exports, iii) higher land lease prices leading to higher profit margins, and iv) information about the Ministry of Construction’s divestment (currently the Ministry of Construction owns 38.58%) after having a valuation report can have a positive impact on VGC shares.

On the other hand, risks for Viglacera may come from (i) slower construction demand affecting the consumption of VGC construction materials, (ii) intense competition in the construction materials industry, and (iii) higher compensation costs for land clearance for new industrial parks.

In 2024, SSI Research forecasts Viglacera’s revenue and pre-tax profit will reach 13,400 billion VND and 2,020 billion VND, respectively, an increase of 2% and 12.8% compared to the same period last year. Among them, the construction glass segment is expected to reach 2,400 billion VND, an increase of 19% and accounting for 18% of the company’s revenue; the sanitary ware segment is expected to reach 982 billion VND, an increase of 2% and accounting for 10% of revenue; the granite & ceramic tile segment is expected to reach 3,600 billion VND, an increase of 3% and accounting for 25.6% of revenue. Revenue from industrial parks is forecasted to reach 3,700 billion VND, a decrease of 11.9% and accounting for 23% of the planned revenue.