Expected transaction is scheduled from 14/03-13/04/2024, by agreement method. Calculated at the closing price of KHD on the nearest session (12/03) is 10,100 dong/share, it’s estimated that HGM can earn nearly 12 billion dong after the deal, while reducing ownership ratio from 35.7% to 0%.

It is noteworthy that this is the 3rd time HGM registered to sell the share volume. In the previous 2 times, the Company failed to sell the shares with the same reason “no investor purchased shares”, respectively in the period from 12/10-10/11 and 16/11-15/12 in 2023.

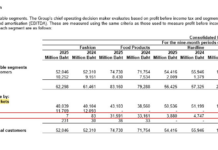

|

HGM failed to divest from KHD in 2023

Source: VietstockFinance

|

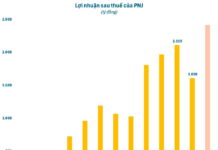

HGM invested in KHD since April 2015 with nearly 409 thousand shares, total amount nearly 14.6 billion dong, equivalent to 35.7% of chartered capital and became the largest shareholder in KHD. In the same year June, HGM received 1.8 billion dong in dividend from KHD, deducted from the original price of nearly 12.8 billion dong.

Through share dividend and stock bonus issuance, at present, HGM is holding nearly 1.2 million KHD shares, equivalent to the original price of about 11,000 dong/share. However, as of December 31, 2023, HGM determined the reasonable value of this investment is less than 7.7 billion dong, equivalent to about 6,600 dong/share, based on the average closing price in the nearest 30 consecutive trading days.

About the relationship between two companies, Mr. Vu Thang Binh – Chairman of the Board of Directors and Mr. Nguyen Ngoc Tuan – Member of the Board of Directors of KHD are both representatives of HGM‘s contributed capital in KHD. Both of these leaders do not hold any KHD shares.

In addition to KHD, HGM also invested in another unit, which is Cao Bang Iron and Steel Corporation (UPCoM: CBI) with original price of nearly 69.5 billion dong, but is currently required to make provision of nearly 42 billion dong, remaining value is only about 27.6 billion dong.

Source: 2023 auditing financial statements of HGM

|