Efforts to pull the VN-Index back up helped maintain its green color throughout the morning session before reversing sharply downwards after 2 PM. The index closed the 11/3 session with a significant drop of 11.86 points (equivalent to 0.95%), down to 1,235 points. The liquidity remained high with a trading volume of over 22.5 trillion dong on HOSE.

In terms of foreign trading, they net bought 69 billion dong across the entire market.

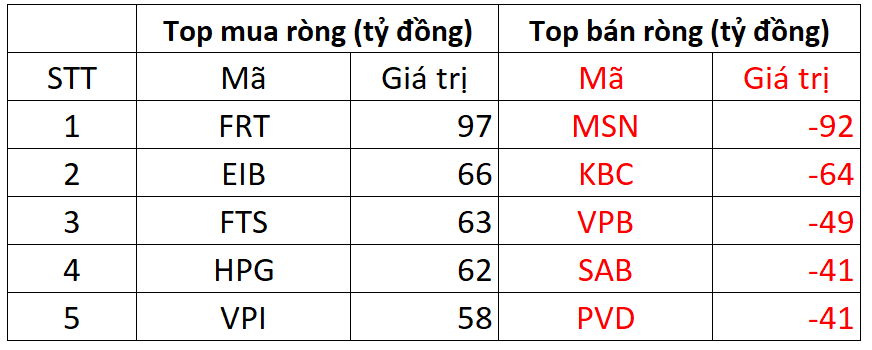

On HOSE, the foreign side net bought approximately 249 billion dong.

In terms of the buying direction, the focal point of net buying was FRT stock with a value of 97 billion dong. Foreign investors also aggressively accumulated EIB stock with a value of 66 billion dong as this stock reached its daily upper limit. In addition, FTS and HPG securities were also net bought with values of 63 billion dong and 62 billion dong respectively on HOSE.

In contrast, MSN faced the heaviest selling pressure from foreign investors with a value of 92 billion dong, followed by KBC and VPB with selling values of 64 billion dong and 49 billion dong per stock respectively.

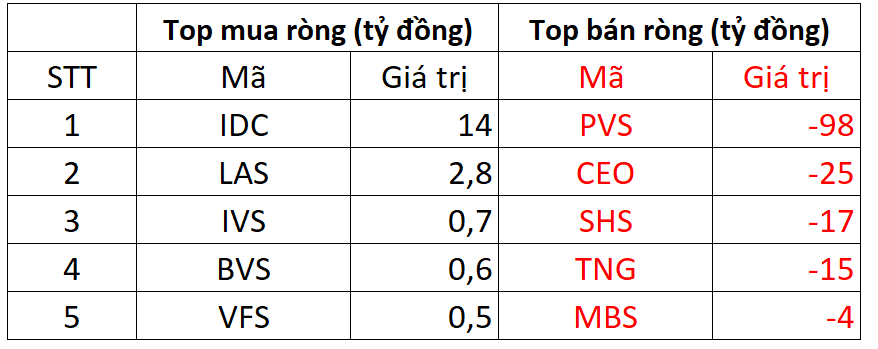

On HNX, the foreign side net sold 152 billion dong

In terms of the buying direction, IDC stock was the most heavily net bought with a value of 14 billion dong. Additionally, SHS ranked next in the list of stocks heavily net bought on HNX with 6.5 billion dong. Furthermore, foreign investors also net bought IVS, VFS, BVS stocks with relatively small values.

In contrast, PVS stock faced selling pressure from foreign investors with a value of 98 billion dong; CEO stock followed with a selling value of about 25 billion dong.

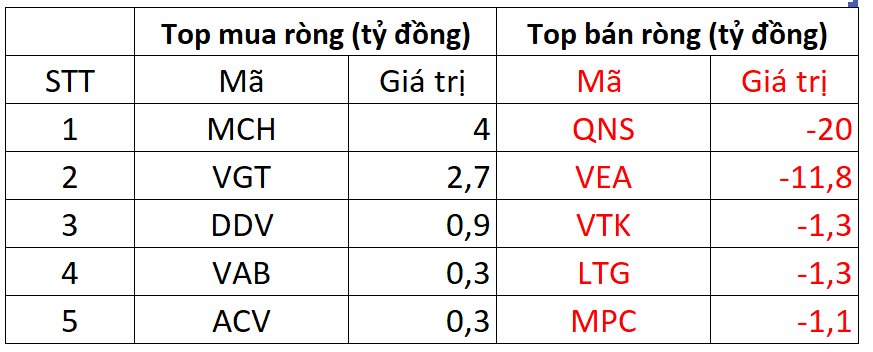

On UPCOM, the foreign side net sold 28 billion dong

In terms of the buying direction, MCH stock was bought by foreign investors for 4 billion dong. Following that, VGT and DDV stocks were also net bought with values of several billion dong per stock.

In the opposite direction, QNS stock today faced net selling from foreign investors of about 20 billion dong; in addition, they also net sold VEA, VTK, LTG, …