The trading volume of VN-Index recorded in the morning session reached more than 418 million units, with a value of over 11 thousand billion dong. HNX-Index recorded a trading volume of more than 47 million units, with a trading value of more than 987 billion dong.

As for the industry groups, the most outstanding is the seafood group, which has achieved breakthrough growth by consistently leading in the morning session. Stocks in this group have all shown positive growth, such as VHC (+5.07%), ANV (+2.56%), ASM (+1.78%), FMC (+1.23%), IDI (+2.72), CMX (+1.24%).

Following closely is the plastics – chemicals group, most of which are covered in green. Specifically, stocks such as GVR (+2.37%), DCM (+3.57%), DPM (+4.37%), BMP (+2.16%), CSV (+3.35%), DPR (+2.97%), LAS (+4.33%)… DGC alone reached the ceiling level at 6.98%.

The technology and information group continue to contribute positively to the growth of the index in recent times, including FPT (+2.86%), CTR (+2.63%), CMG (+3.82%), ELC (+1.26%), ICT (+6.81%),…

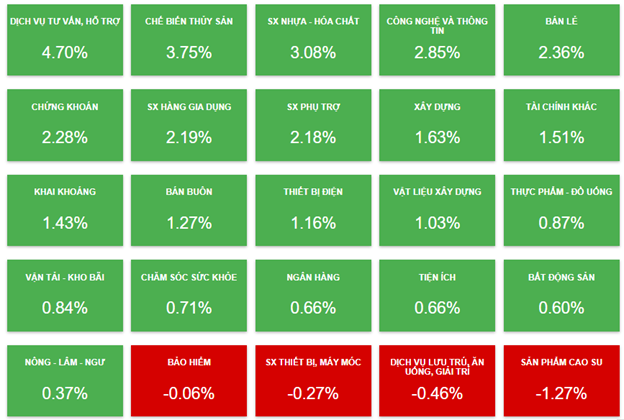

Trends of industry groups at the end of the morning session on March 13th. Source: VietstockFinance

|

At the end of the morning session, green temporarily dominates when looking at the overall industry. Specifically, the consulting and support service industry has the highest growth rate with a 4.7% increase. On the contrary, the rubber products industry is at the bottom with a 1.27% decrease.

10:30 AM: Buyers maintain dominance

As of 10:30 AM, VN-Index increased by more than 9 points, trading around 1,254 points. HNX-Index increased by more than 1 point, trading around 235 points.

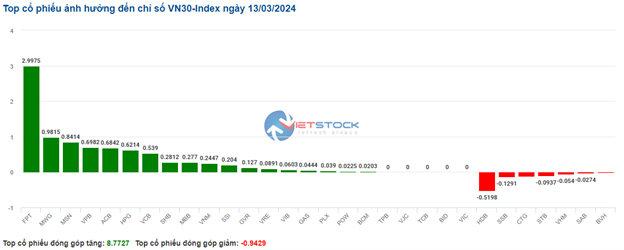

The breadth of stocks in the VN30 group is leaning towards green. Specifically, stocks like FPT increased by 2.99 points, MWG increased by 0.98 points, MSN increased by 0.84 points, and VPB increased by 0.70 points. Meanwhile, 4 banking stocks HDB, SSB, CTG, and STB are still facing selling pressure and taking away nearly 1 point from the overall index.

|

Source: VietstockFinance

|

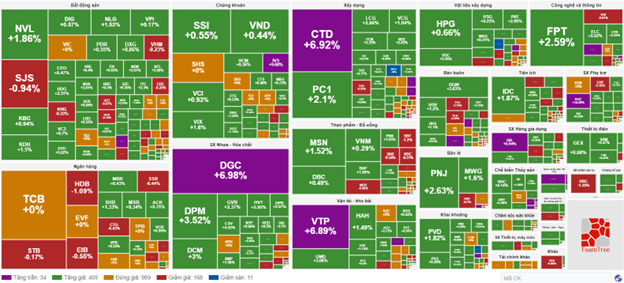

The real estate stock group is showing green and leading the upward trend. Specifically, VIC increased by 2.33%, KDH increased by 1.73%, VRE increased by 1.47%, and NVL increased by 1.27%… On the other hand, there are still some stocks that have recorded minor declines, such as VHM decreased by 0.12%, AGG decreased by 0.17%, and KHG decreased by 0.68%.

The construction industry continues to attract investors’ attention, with most leading stocks in the sector gaining from the beginning of the session. Notable stocks include CTD with a ceiling increase, REE increased by 2.9%, VCG increased by 1.46%, and LCG increased by 4.19%….

On the contrary, the insurance group still has unfavorable developments. Among them, large-cap stocks such as BVH decreased by 0.35%, PVI decreased by 0.42%, VNR decreased by 0.83%…

Compared to the beginning of the session, buyers have a somewhat dominant position, but the proportion of standing stocks is still quite high. Specifically, the number of standing stocks is 989 stocks, the number of increasing stocks is 439 stocks (including 34 stocks hitting the ceiling), and the number of decreasing stocks is 179 stocks (including 11 stocks hitting the floor).

Source: VietstockFinance

|

Market Opening: Construction industry in the lead

After a positive increase in points yesterday, VN-Index opened this morning with a positive sentiment. Among them, the construction and real estate groups made a significant contribution.

The Industrial zone real estate stock group seems to have a strong increase thanks to the information that a delegation of 50 leading US companies will visit and work in Vietnam from March 18-21. Notable stocks include BCM increased by 0.59%, KBC increased by 1.09%, SZC increased by 0.67%.

Investors expect securities stocks to benefit from the strong market liquidity in the first quarter and positive proprietary trading profits. This group recorded positive point increases with SSI increased by 0.28%, VND increased by 0.44%, VIX increased by 0.53%

The technology stock group also had a strong simultaneous increase at the beginning of the session, VTP unexpectedly hit the ceiling, followed by stocks CTR 0.51%, ELC 3.35%.

Lý Hỏa