The trading volume of VN-Index recorded in the morning session reached over 456 million units, with a value of over 11 thousand billion dong. HNX-Index recorded a trading volume of nearly 54 million units, with a trading value of nearly 1.1 thousand billion dong.

Source: VietstockFinance

|

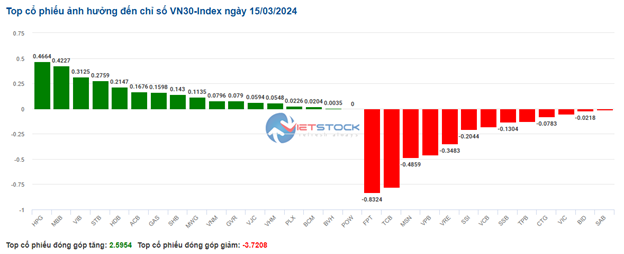

Pausing in the morning session, the stocks VCB, FPT, and BID were the most negatively impacted stocks, causing the index to drop by nearly 2 points. On the other hand, the stocks GAS, GVR, and PGV were the most positively impacted stocks, compensating for more than 1.2 points of the index.

Most industry groups were in the red at the end of this morning’s session. Many large-cap industry groups were in the red, notably the retail industry, food and beverages, and banking, which saw a fairly negative decline. Other industry groups, such as construction materials, real estate, and insurance, also saw a decrease with a lower rate. This shows that the basket of stocks in the VN30 index is the cause of the market’s lack of positivity in the morning session.

The seafood group had a fairly negative start to the morning session. Most stocks in the industry, such as VHC, ANV, ASM, FMC, IDI, and CMX, were in the red.

The retail group did not have a positive start as the major stocks in the industry were in the red, such as MWG down 0.74%, PNJ down 1.89%, and FRT down 2.73%.

Foreign investors continued to be net sellers, negatively affecting the decline of the VN-Index in this morning’s session. Taking into account both the HOSE and HNX exchanges, stocks such as HPG, VHM, VPB, and VNM were the most heavily sold, accounting for a significant proportion compared to underperforming stocks such as BID, KBC, STB, and SAB.

| Top 10 stocks with the strongest foreign net buying – selling in the morning session on 15/03/2024 |

10:40 AM: Struggling around the reference level

The buying and selling forces in the market are relatively balanced, so the main indexes have not been able to break out. As of 10:30 AM, the VN-Index increased slightly by more than 2 points, trading around the 1,266 level. The HNX-Index increased by 1 point, trading around the 240 level.

The stocks in the VN30 index had mixed movements, but the selling pressure was slightly stronger. Specifically, FPT, TCB, MSN, and VPB respectively contributed to a decrease of 0.83 points, 0.78 points, 0.49 points, and 0.46 points to the overall index. On the contrary, HPG, MBB, VIB, and STB were being heavily bought and contributed more than 1 point to the VN30-Index.

Source: VietstockFinance

|

The securities and banking sectors are under strong selling pressure from major players: SSI down 0.4%, SHS down 0.52%, HCM down 0.7%, VCB down 0.32%, LPB down 0.3%, CTG down 0.15%, and VPB down 0.53%.

On the other hand, real estate is a sector with a good spread of green color, with the presence of notable stocks such as HDC up limit, VHM up 0.12%, BCM up 0.88%, and NVL up 1.52%.

Following the plastics and chemicals sector, there are also quite positive developments, but trading is concentrated in a few large-cap stocks. Highlighted are GVR up 2.29%, DPM up 0.56%, PHR up 3.4%, DGC up 0.31%, and LIX up 2.07%.

Compared to the beginning of the session, buying prospects are slightly dominant as the number of rising stocks is 358 (including 21 stocks reaching the upper limit) while the number of falling stocks is 272 (including 11 stocks reaching the lower limit). As of 10:30 AM, the total trading volume on the three exchanges reached over 395 million units, with a trading value of over 9.3 thousand billion dong.

Source: VietstockFinance

|

Market open: Cautious start

With widespread red color at the start of the session, the index VN-Index showed a slight decrease and fluctuated around the reference level, indicating the cautiousness of investors in the market.

VN-Index decreased by nearly 3 points and traded around the 1,262 level; HNX-Index slightly increased to the 240 level.

The red color temporarily prevailed in the VN30 basket with 19 declining stocks, 6 gaining stocks, and 5 stocks unchanged. Among them, VRE, BID, and MSN were the stocks that experienced the most significant decrease. On the other hand, VNM, BCM, and GAS were the stocks that controlled the market’s downward trend.

The banking sector is one of the reasons for the market’s score decline, as stocks such as VCB, CTG, and BID were slightly in the red.

The petroleum and gas sector showed positive signals at the beginning of the trading session, with prominent stocks such as BSR up 0.52%, PVD up 1.22%, and PVB up 2.98%.