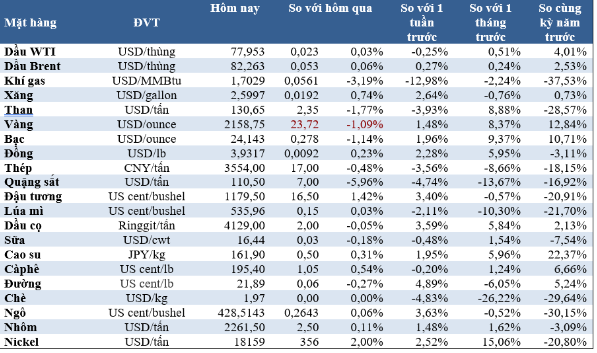

Crude oil slips as US raises crude production forecast

Crude oil prices fell slightly after the US raised its forecast for crude production and data showed that US inflation remains high.

May Brent crude futures fell 29 US cents to $81.92 a barrel. US West Texas Intermediate (WTI) crude futures for April delivery ended down 37 cents at $77.56 a barrel.

The US Energy Information Administration (EIA) raised its forecast for domestic crude production growth in 2024 by an additional 260,000 barrels per day to 13.19 million barrels, up from a previous forecast of 170,000 barrels per day.

The US Bureau of Labor Statistics reported that consumer prices in the country rose sharply in February, with rising fuel and housing costs being the primary drivers of persistent inflation.

Gold declines

Gold prices continued to come under pressure on Tuesday, falling more than 1%, after reports of high inflation in the US overshadowed expectations that the Federal Reserve might soon cut interest rates.

Spot gold fell 1.4% to close at $2,153.05 per ounce; April 2024 gold futures fell 1% to $2,166.1.

Data showed that Consumer Price Index (CPI) rose 0.4% in February compared to January. Year-on-year, consumer prices in February rose 3.2%, higher than the forecasted increase of 3.1%. The data indicates that the US consumer prices remain elevated. High interest rates continue to be a barrier to rising gold prices.

Iron ore at 5-month low

The futures price of iron ore at Dalian Exchange, China, continued to decline to a 5-month low on Tuesday, under pressure from reduced investor sentiment amid weakening demand in China.

The futures contract for May iron ore at China’s Dalian Commodity Exchange (DCE) ended the session with a slight recovery from the low price, closing down 2.23% at 831.5 Chinese yuan ($115.88) per ton, after hitting a low not seen since October 11 at 820.5 CNY/ton.

Analysts at ANZ Bank noted that the most recent meeting of the National People’s Congress did not increase expectations for the real estate market, while the construction season began with early slump figures pointing to poor steel demand.

However, the futures price for April iron ore on the Singapore Exchange rose 1.35% to $108.7 per ton.

Aluminum at 6-week high, copper steady

Aluminum prices rose on Tuesday to nearly a 6-week high as the market saw seasonally increasing demand.

Three-month aluminum on the London Metal Exchange (LME) inched up to $2,270 per ton, its highest level since February 1. It ended the session up 0.1% at $2,260.5.

Data showed that Chinese bank loans are estimated to have sharply declined in February from the record-high level in January due to seasonal factors. Loan data includes measurements of metal consumption in the future.

However, ample supply from China may limit the increase. Aluminum inventories in China have risen 85% this year to 184,358 tons at warehouses monitored by the Shanghai Futures Exchange.

The copper price ended this session unchanged at $8,655 per ton.

Cocoa sets new record

The futures price of cocoa on both the New York and London exchanges continued to rise to record highs on Tuesday due to supply shortages.

May cocoa futures on the New York exchange closed up $321, or 4.8%, at $7,049 per tonne, after reaching a new all-time high of $7,096.

Deliverable cocoa of the same future on the London exchange closed up 5.7%, at £5,829 per tonne, after also reaching a record high of £5,861.

Agents said poor harvests in Ivory Coast and Ghana had led buyers to scramble for supplies amid expected global shortages in the 2023/24 season.

Ivory Coast’s market management agency—the world’s leading cocoa producer—on Tuesday warned exporters not to pay more than the regulated price for the cocoa beans delivered to their bases at the country’s ports, threatening fines and revocation of licenses of violators.

Rubber reaches 7-year high

The futures price of rubber in Japan hit a new 7-year high on Tuesday as rising oil prices boosted new buying power and concerns grew over supplies in Thailand.

August rubber futures on the Osaka Exchange (OSE) closed up 7.9 yen, or 2.48%, at 327 yen ($2.22)/kg, the highest closing level since February 1, 2017.

May rubber futures on the Shanghai Futures Exchange (SHFE) fell 45 yuan, closing at 14,135 yuan ($1,970.03)/tonne.

Coffee rises

May Robusta coffee futures rose $28, or 0.9%, to $3,307 per tonne.

Agents said supplies in Vietnam remain scarce and strong demand for supplies from Brazil, where the harvest of Robusta coffee beans will begin next month.

May Arabica coffee futures rose 0.5% to $1.859/lb.

Soybeans, wheat rise

Both wheat and soybean prices on the Chicago Board of Trade rose on Tuesday due to bad weather conditions in Brazil. Meanwhile, corn prices remained virtually unchanged.

In particular, the wheat contract ended up 1/4 cent at $5.47-1/2 per bushel, corn remained at $4.41-3/4 per bushel, and soybeans rose 16-3/4 cents to $11.96 per bushel.