The SSI Research Department has issued an updated report on the business activities of the Vietnam National Petroleum Group (Petrolimex).

SSI Research expects Petrolimex to have the opportunity to gain additional market share by tightening control over the operations of petroleum distributors.

First, Hai Ha Petro and Xuyen Viet Oil are large petroleum distributors with a total revenue of about 40,000 billion VND in 2022. Their licenses have been revoked and their petroleum customs clearance has been suspended due to not meeting the conditions and having related violations regarding tax debts or misuse of the price stabilization fund for petroleum.

Secondly, Petrolimex can also benefit from the government’s requirement for retail agents to issue electronic invoices for each transaction to enhance transparency in the Vietnamese petroleum industry.

Currently, only about 36% of the estimated 17,000 domestic retail units have issued electronic invoices as of early February. Petroleum stations that do not issue electronic invoices may face the risk of having their operating licenses revoked.

Meanwhile, Petrolimex is a pioneering unit in issuing electronic invoices and has implemented this system at its 2,700 retail points since mid-2023. Therefore, the new regulations may help Petrolimex gain market share in the future.

SSI Research maintains its pre-tax profit forecast for Petrolimex in 2024 at 4,400 billion VND, equivalent to a 12% growth rate compared to the same period.

SSI Research assumes that petroleum consumption will increase by 4.1% to reach 10.8 million m3/ton, with retail sales volume possibly increasing by 4.5% compared to the same period to reach 7.3 million m3. The company plans to open about 60-80 new petroleum retail stations in 2024, equivalent to about 2-3% of the current number of stores. Pre-tax profit in Q1/2024 may increase by more than 15% compared to the same period due to oil prices recovering in the past 2 months.

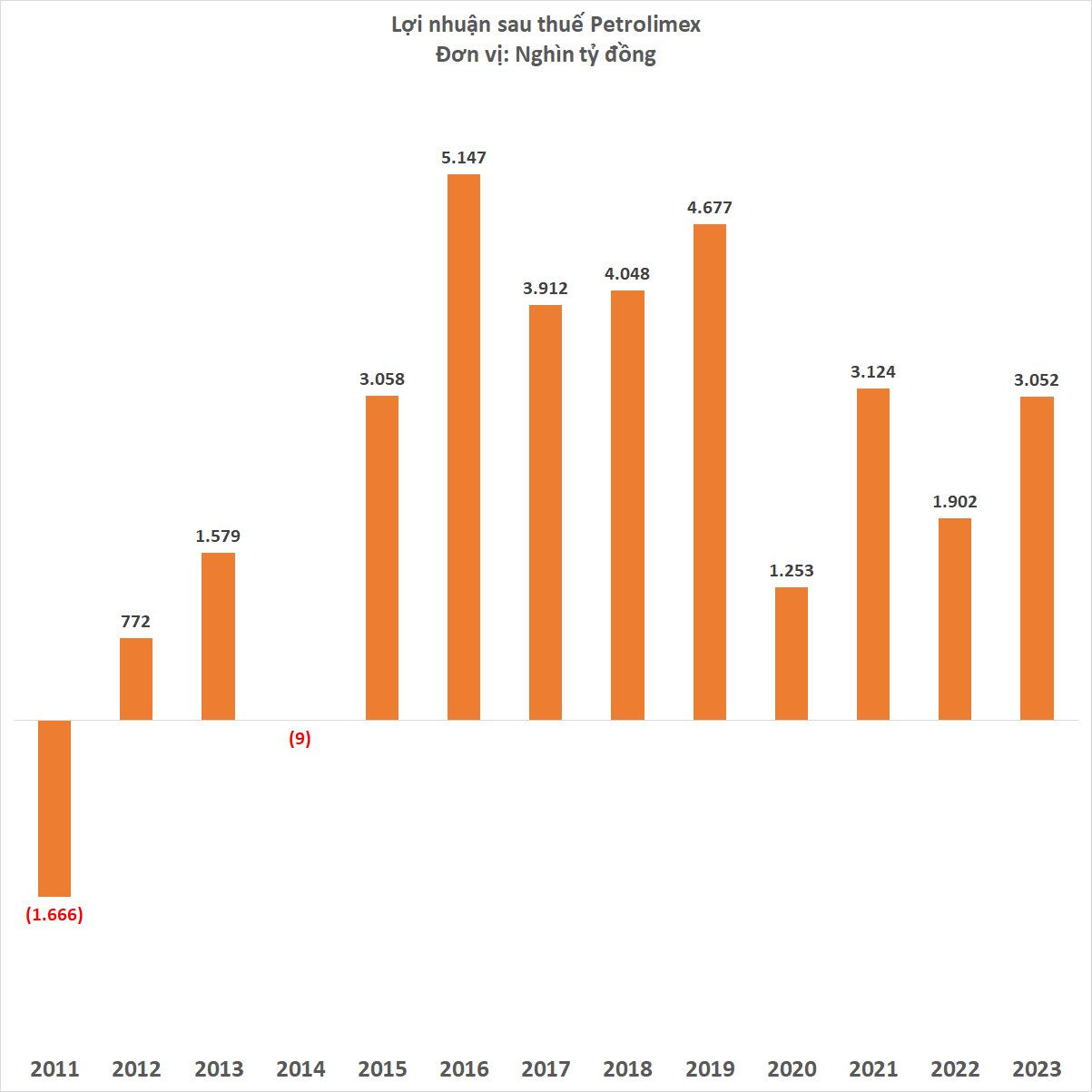

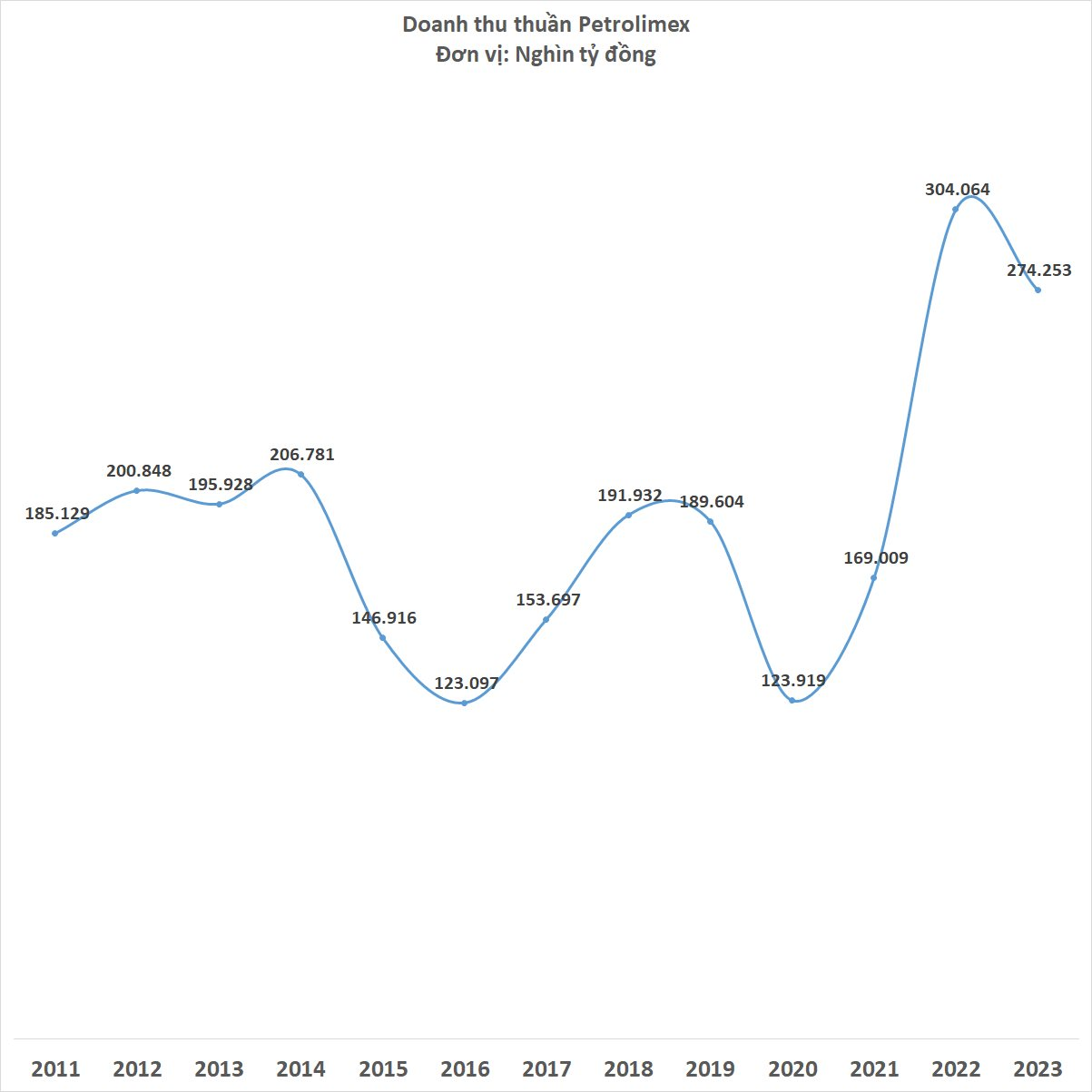

Previously, in 2023, Petrolimex achieved net revenue of 274 trillion VND and after-tax profit of 3,052 billion VND. Revenue decreased by nearly 10% but profit increased by 60%.

Petrolimex stated that the market competition became increasingly fierce last year, especially through intermediary sales channels. Meanwhile, the situation of trademark violations, unclear origins, and poor quality led to unhealthy competition.