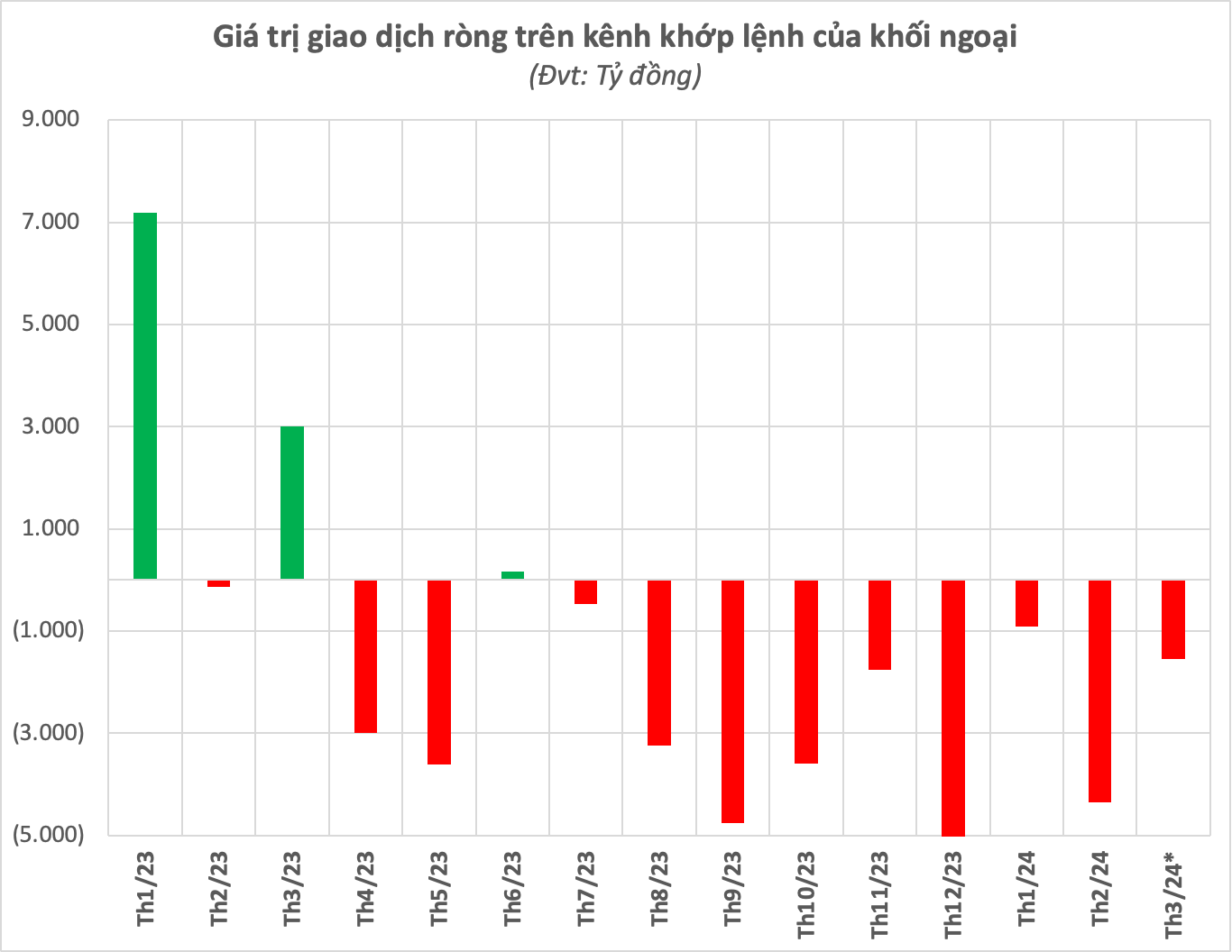

Foreign capital in the Vietnamese stock market continues to be in a net selling state in the first months of 2024. Excluding extraordinary negotiated transactions, foreign investors have net sold over 6,800 billion VND through the order matching channel in just over 2 months.

Contrary to this trend, an ETF fund is actively attracting and disbursing capital to buy Vietnamese stocks recently.

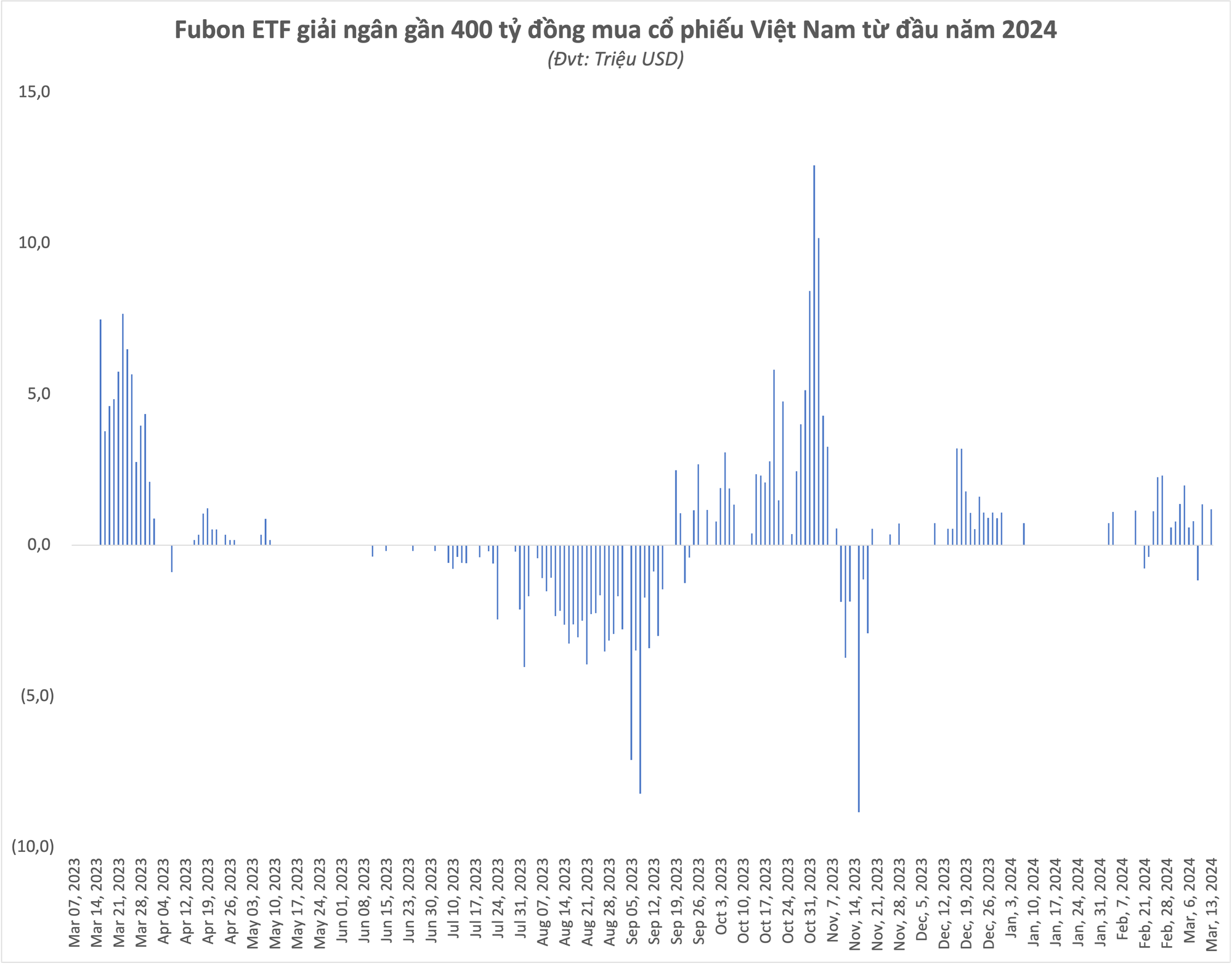

Statistics show that Fubon FTSE Vietnam ETF has recorded a net inflow trend since the second half of November 2023 and continues until now. Just from the beginning of 2024 until now, the fund has issued over 41 million fund certificates, equivalent to about 16 million USD (~385 billion VND), and all of them have been disbursed to buy Vietnamese stocks.

This is the 6th consecutive month of positive money flow into the Fubon ETF. In 2023, the fund had a net inflow of over 73 million USD, equivalent to a net inflow of nearly 1,800 billion VND.

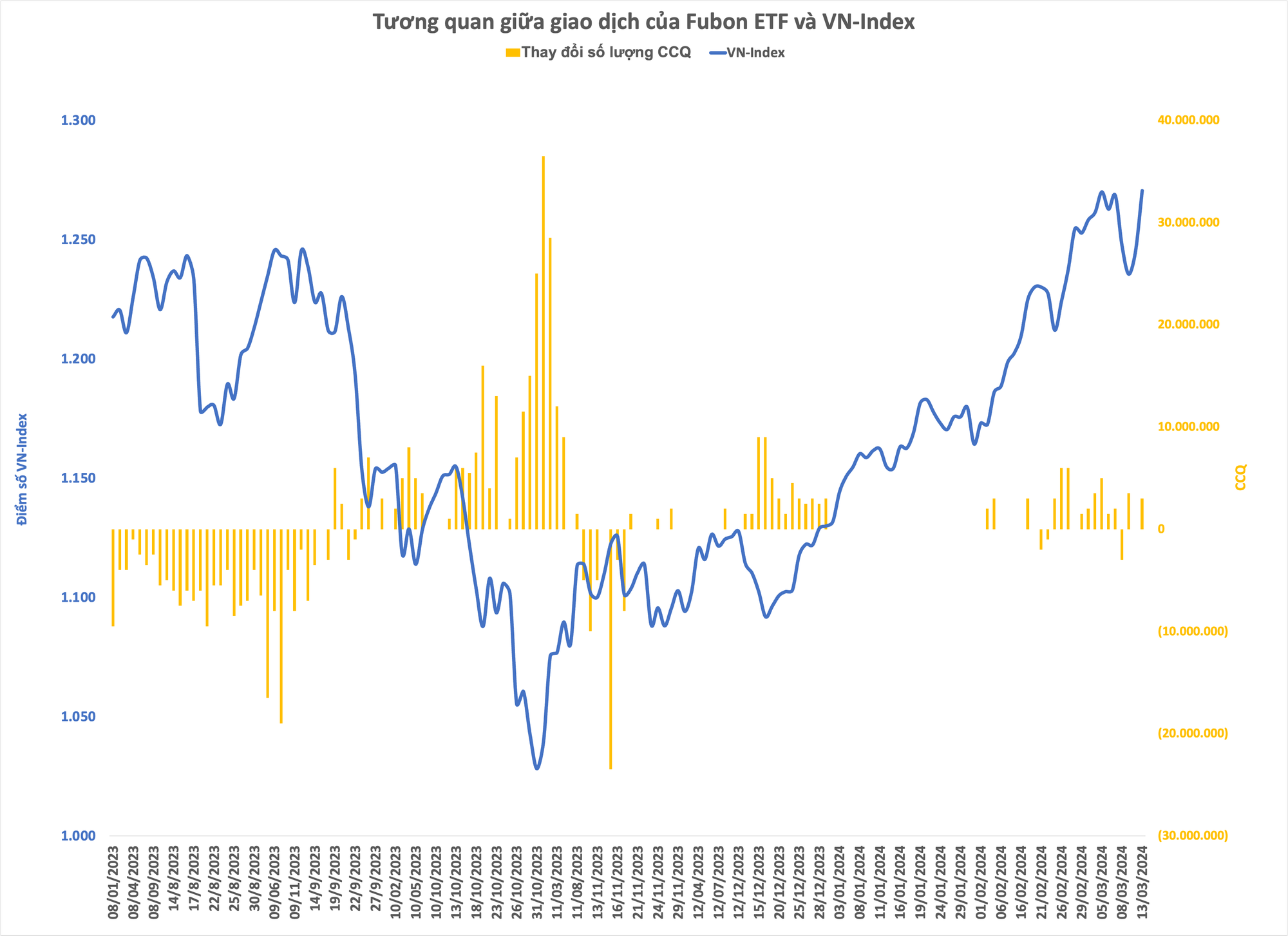

It is worth noting that in the past, Fubon ETF used to have net inflows when the overall market adjusted sharply and the VN-Index fell deeply. When the index turned around and recovered, the fund tended to withdraw capital and sell stocks.

However, currently VN-Index is in a flourishing period with a 12% increase since the beginning of the year, surpassing 1,270 points. But Fubon ETF still maintains its net inflow status and increases its purchases of stocks.

The scale of Fubon FTSE Vietnam ETF is rapidly expanding, reaching 28.9 billion TWD (about 920 million USD, equivalent to 22,700 billion VND) as of the end of March 13, increasing nearly 2,400 billion VND compared to the beginning of the year, making it the largest ETF fund in the Vietnamese stock market. The fund allocates 100% of its investment to Vietnamese stocks according to the reference index, FTSE Vietnam 30 Index.

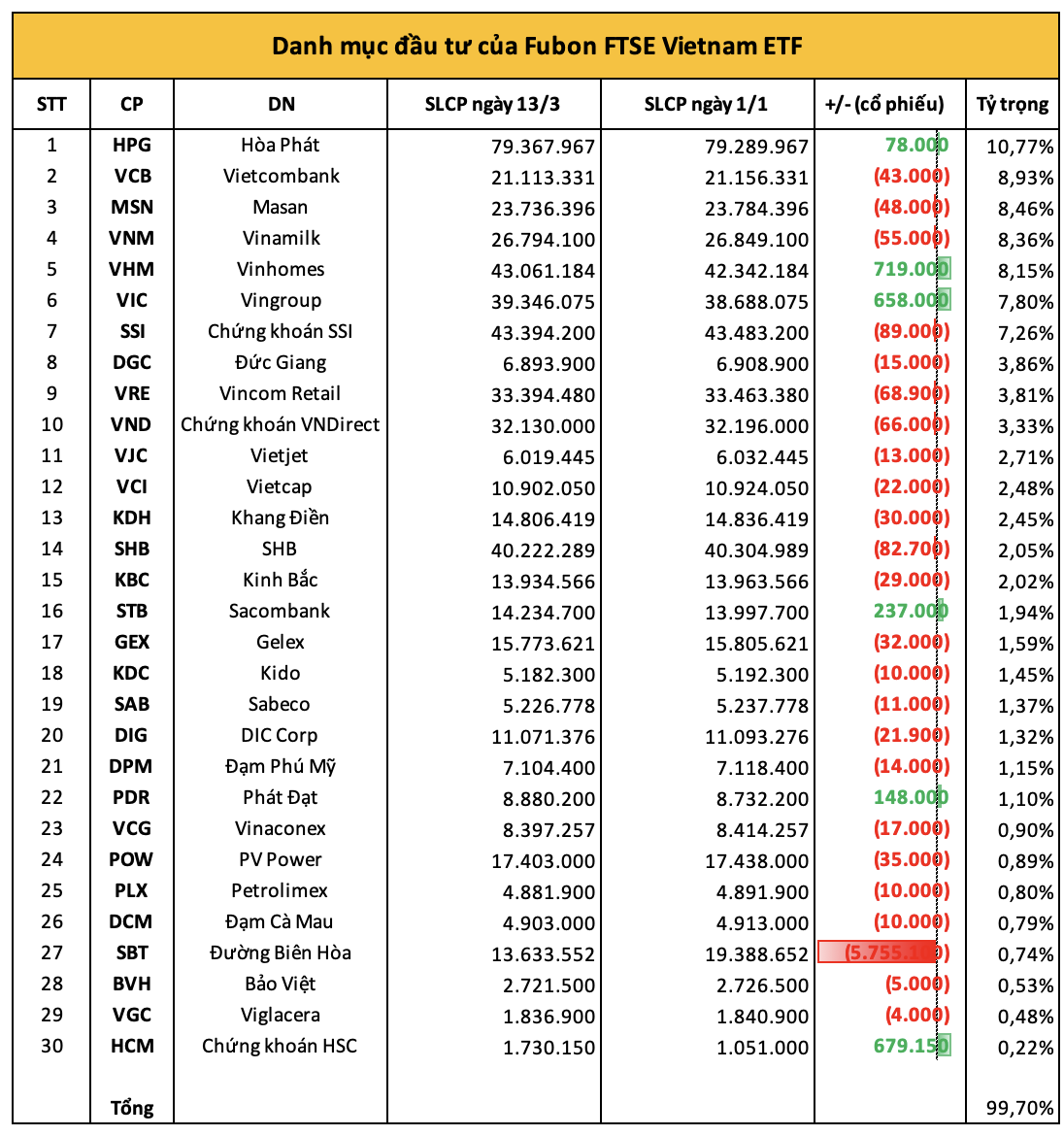

In the portfolio structure, HPG is the stock with the largest proportion, accounting for 10.77% (holding 79.4 million shares), followed by VCB (8.9%), MSN (8.46%), VNM (8.36%), VHM (8.2%)…

Based on the net inflow from the beginning of 2024 until now, Fubon ETF has focused on net purchasing 719 thousand VHM shares, 679 thousand HCM shares, and 658 thousand VIC shares. On the contrary, nearly 5.8 million SBT shares have been sold, and besides that, SSI, SHB, VRE, VND, VNM… are the stocks that have been net sold by tens of thousands of units in just over 2 months.

In a previous report, BIDV Securities (BSC) stated that in the Q1/2024 review, the FTSE Vietnam 30 Index, which Fubon ETF refers to, did not disclose its official portfolio. However, BSC still made a forecast that this index will add NVL shares and remove SBT shares.

With this scenario, BSC forecasts that Fubon ETF will buy nearly 16.5 million NVL shares to add to its portfolio. At the same time, the fund may also buy an additional 8.2 million HPG shares, 7.6 million HCM shares, 4.2 million STB shares, 2 million PDR shares, 1.7 million VCI shares, 1.5 million POW shares,…

On the contrary, with the forecast of being removed, nearly 20.5 million SBT shares could be completely sold by Fubon ETF. At the same time, the fund may also sell off 6.3 million SHB shares, 5 million KBC shares, 4.5 million SSI shares, 2.8 million GEX shares,…

The restructuring activities of the ETF fund are expected to be completed on March 15, 2024.