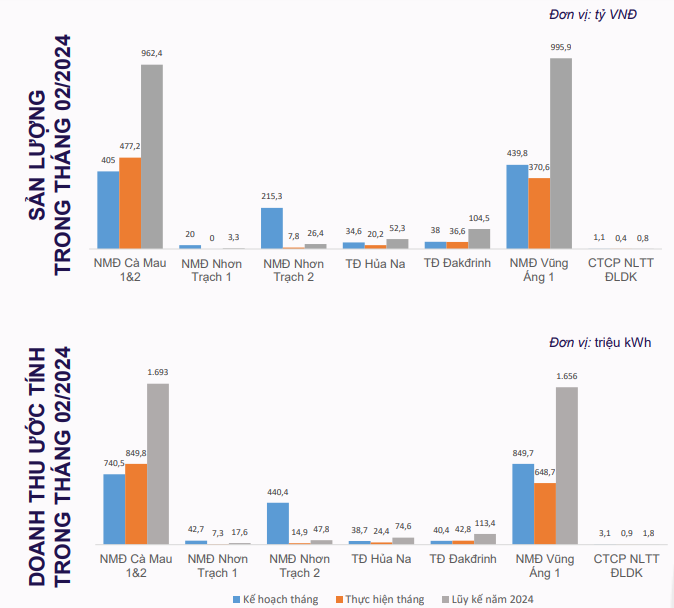

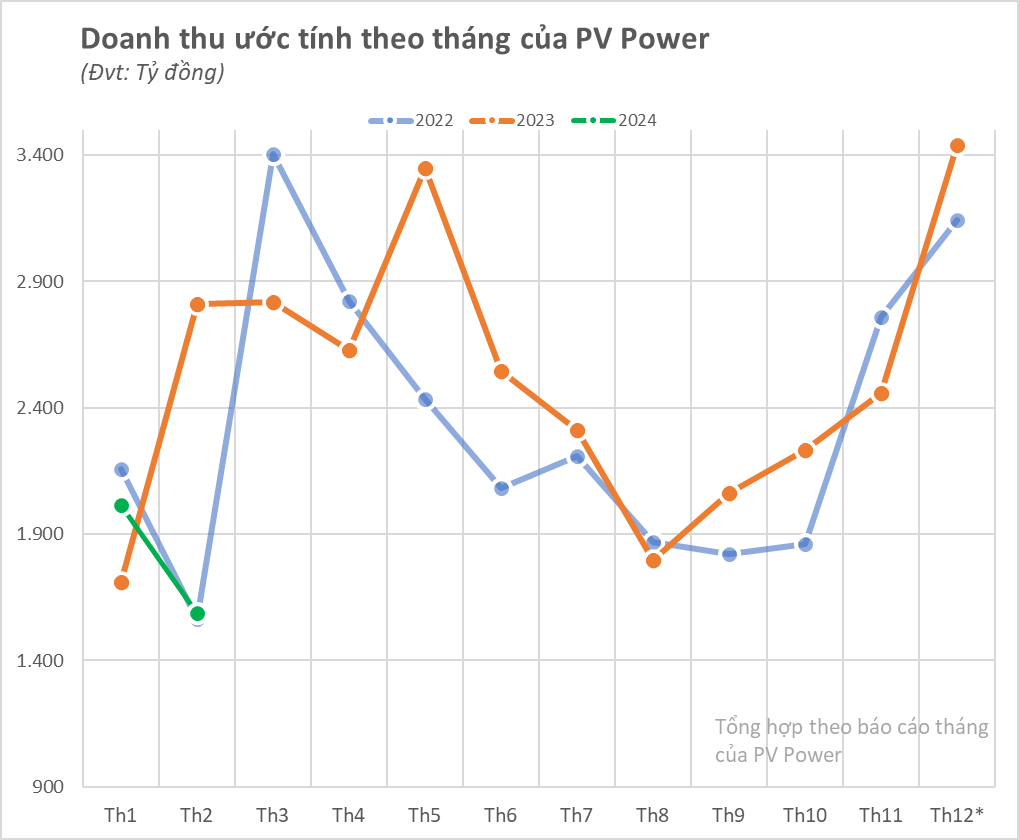

PV Power Vietnam Electricity Company (PV Power, code: POW) has announced the estimated business results for February 2024 with revenue estimated at VND 1,589 billion, a decrease of 43% compared to the same period last year and achieving 74% of the monthly plan. The Cà Mau 1&2 power plant contributed the most with VND 850 billion in revenue, while the Vũng Áng 1 power plant contributed VND 649 billion in revenue.

Electricity sales revenue in February was estimated at VND 1,560 billion. Electricity production output was estimated at 912 million kWh. According to PV Power, February is the end of the dry season in the North and South and the beginning of the dry season in the Central region. In February, there was the Tet holiday, and the overall system load decreased significantly, reducing the mobilization capacity of power plants across the system. The full market price of FMP electricity is expected to be about VND 1,420/kWh, lower than the average fuel adjustment price for PV Power’s gas power plants. This affects the bidding and operation capability of power plants.

Accumulated revenue for the first two months of 2024 is estimated at VND 3,604 billion, a decrease of 20% compared to the same period last year.

Regarding the operation of power plants, at Cà Mau 1&2 power plants, the plants operated without gas off-take obligations to achieve optimal efficiency. In the final phase of the month, the market price increased compared to the beginning of the month, so the Cà Mau 1&2 power plants were mobilized with high production capacity.

At the Vũng Áng 1 power plant, the market price is higher than the cost of converting fuel to coal, and the plant’s bidding operation ensures efficiency, achieving relatively high production output with low system load demand.

However, at Nhơn Trạch 1 power plant, in the context of a low market price compared to the cost of conversion and low demand load, the plant was not mobilized with a bidding operation higher than the market price.

Similarly, with low system load demand, Nhơn Trạch 2 power plant was only mobilized with low production output when bidding operation was higher than the market price.

At Đakđrinh power plant, the power plant balanced the bidding operation to meet the assigned Qc, prioritizing high production output during cycles with high market prices.

Meanwhile, Hủa Na power plant was assigned a low Qc (27.4 million kWh, adjusted A0 of 14.0 million kWh). The plant’s bidding operation achieved a balanced optimization of profit and water retention for the hot and dry season of high market prices.

Regarding the investment status of new projects, PV Power said that as of January 26, 2024, the overall progress of the EPC of Nhon Trạch 3 and Nhon Trạch 4 power plants reached 80.2% against the plan of 86.2%. With the PPA contract, PV Power and EPTC have agreed on the electricity price for Nhon Trạch 3&4 power plants.

The company will continue to arrange capital, negotiate gas contracts, and electricity purchase contracts for the project according to the schedule.

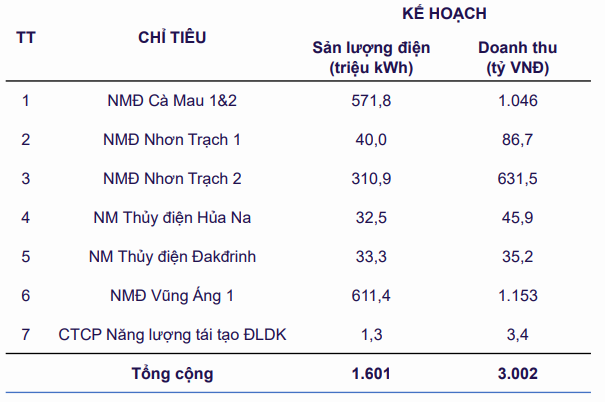

Entering March, PV Power sets a revenue target of VND 3,002 billion, with expected electricity production of 1,601 million kWh.