Lê Chí Phúc, CEO SGI Capital

|

By heavily betting on the banking sector, the investment fund led by CEO Lê Chí Phúc achieved a respectable performance of 5.81% in February 2024. However, this achievement still fell short of the 6.55% increase of the VN-Index.

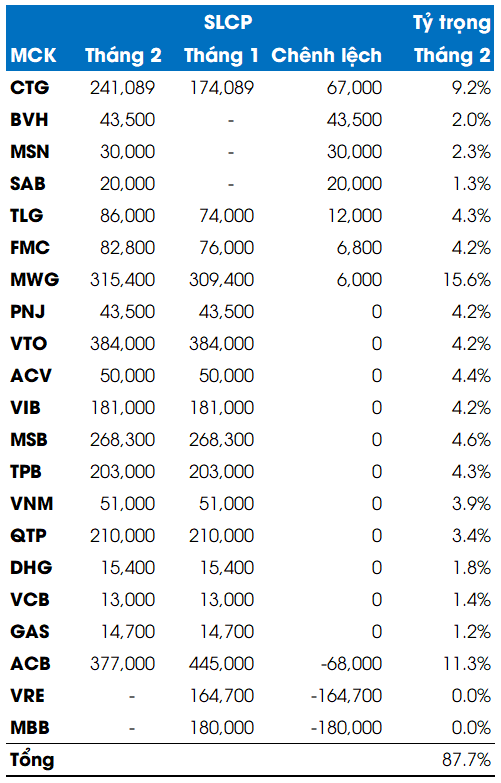

In February, the Ballad fund purchased new shares of BVH, MSN, SAB and increased their stakes in CTG, TLG, FMC and MWG. On the other hand, the fund sold off shares of VRE, MBB, and reduced its holdings in ACB.

As of the end of February 2024, the fund has invested nearly 88% of its capital in stocks, with MWG, ACB, and CTG being the largest holdings, accounting for 15.6%, 11.3%, and 9.2%, respectively. The banking sector has the highest proportion, accounting for nearly 35%.

|

Ballad Fund’s Portfolio as of the end of February 2024

|

Currency risk

In their recent analysis, Ballad Fund believes that major stock markets worldwide are following the soft landing scenario of the US and global economies to avoid a recession while reducing inflation enough for the Fed and central banks to enter an interest rate reduction cycle from the middle of this year.

“This overall scenario is favorable for economies with high openness like Vietnam. The Vietnam stock market can also benefit as global investment flows become less concerned about a recession and seek higher risk opportunities in emerging and neighboring markets,” Ballad Fund evaluated.

Ballad Fund expresses concern as the exchange rate, especially the unofficial rate, continues to heat up (up 3.17%) and has exceeded the peak set in 2022. However, if measured from the beginning of this year, the VND/USD exchange rate has only depreciated at a normal level (1.73%), less than the increase of the USD index (2.47%) and the depreciation of many other currencies.

“In case the exchange rate within the banking system continues to approach the selling price of USD set by the State Bank of Vietnam, concerns about liquidity and interest rates may arise when the SBV takes intervention measures. The exchange rate will be a focal point that we closely observe during this period,” Ballad Fund noted.

In response to the overheating exchange rate, the State Bank of Vietnam (SBV) has intervened by issuing bills. On March 11-12, this agency intervened by issuing nearly VND 30,000 billion of 28-day bills.

About half a year ago, the SBV also carried out a capital withdrawal phase using bills. At that time, the SBV withdrew more than VND 200 trillion of bills.

Attractive valuation

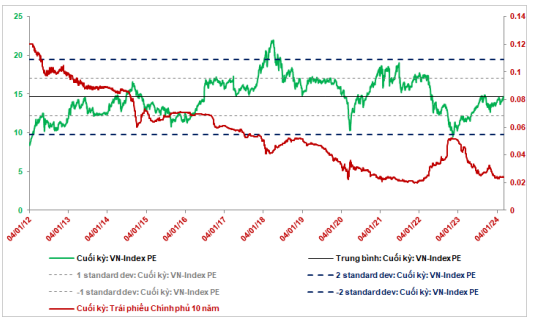

Ballad Fund believes that in recent times, although the P/E ratio of the VN-Index has approached the long-term average and the market’s cheap valuation period due to pessimism about growth prospects has ended.

“Investors are currently expecting the economy to enter a recovery cycle and return to growth. Compared to the yield of government bonds and deposit interest rates which have returned to low levels, the general market valuation is still considered attractive,” the investment fund stated.

Ballad Fund believes that the reduction and maintenance of low interest rates along with strong support measures from the government in the past year have stimulated capital flows into asset channels such as stocks and real estate, as well as promoting production and consumption activities.

This fund believes that this process will continue as the global economy remains stable. Strong financial companies that have restructured their business operations will take better advantage of the opportunities for growth expansion in a low interest rate period. This is also an opportunity for companies with high debt ratios to restructure and gradually recover, creating many investment opportunities this year.

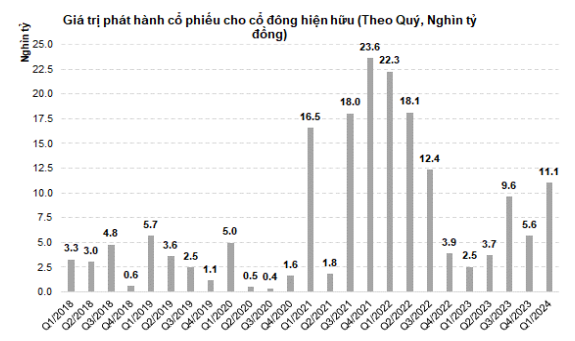

However, Ballad Fund also notes some potential risks, such as the increase in new share issuances along with the increase in registrations for sale by internal shareholders. If the global stock market enters a correction phase along with exchange rate pressures, it may have a greater impact on foreign investor capital flows, causing greater volatility in the Vietnam stock market in the near future.

Ballad Fund also believes that if the S&P 500 falls by more than 5%, it would be a warning signal for the Vietnam stock market. Overall, this investment fund is optimistic about the prospects of the economy and the stock market in 2024, but remains cautious about potential risks.