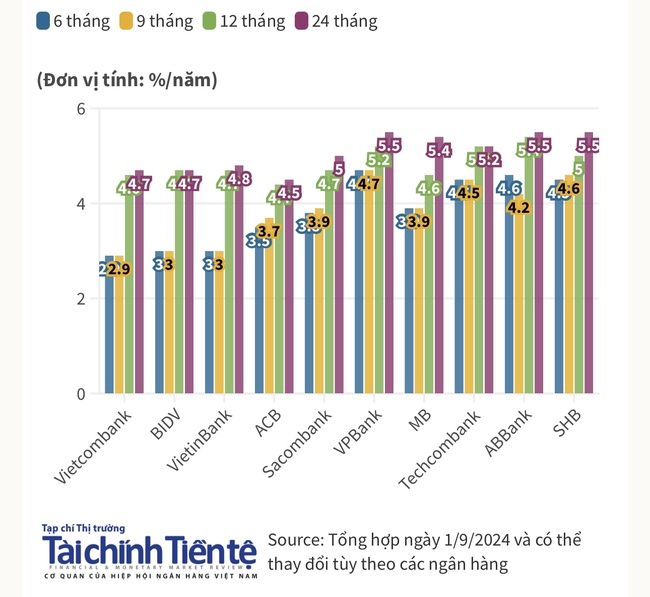

Credit institutions are required to publicly disclose lending rates

|

The State Bank of Vietnam has issued Official Dispatch No. 1628/NHNN-CSTT regarding the disclosure of lending rates.

According to the State Bank of Vietnam, based on reports from credit institutions and foreign bank branches as requested in Official Dispatch No. 1117/NHNN-CSTT dated 7th February 2024 by the State Bank of Vietnam on reporting the situation of interest rate disclosure, up to now, credit institutions have essentially disclosed information about lending rates as instructed by the Prime Minister and the State Bank of Vietnam.

However, some credit institutions are still in the process of implementing the disclosure of lending rates. Therefore, in order to synchronize and effectively disclose interest rates, the State Bank of Vietnam requests credit institutions to continue implementing the disclosure of average lending rates, interest rate spreads between deposits and average lending rates, lending rates for credit programs, credit packages, and other lending rates (if any) as instructed by the Prime Minister and the State Bank of Vietnam.

Credit institutions are responsible for the completeness, timeliness, and accuracy of the information and data disclosed on the credit institution’s website. Clear explanations should be provided regarding the content of the disclosed information and data. Proactive reception, response, and resolution of customer issues (if any) should be carried out.

The official dispatch stipulates that credit institutions (Board of Directors, Executive Board, Audit Committee, Compliance Department, Internal Audit Department, and related functional departments of credit institutions) are responsible for regular supervision to ensure the proper implementation of the instructions of the Prime Minister and the State Bank of Vietnam.

This agency also requests credit institutions to submit the link to the section disclosing various interest rates on the website of the State Bank of Vietnam before 1st April 2024. In case the credit institution changes the link, it must be updated within 2 working days with the State Bank of Vietnam.

Prior to this, the State Bank of Vietnam requested commercial banks to report to the State Bank of Vietnam the situation of average lending rates, interest rate spreads between deposits and average lending rates, with a deadline of 23rd February. However, many banks suggested only disclosing lending rates to individuals as it affects the majority of the population and is of public concern. On the other hand, average lending rates for business customers are not publicly disclosed.

|

On 5th March, Prime Minister Pham Minh Chinh signed Official Dispatch No. 18/CD-TTg on credit growth management in 2024, which requires the banking industry to continue reducing and publicly disclosing lending rates… Prohibition of improper lending, lending to leaders, executive boards and related personnel of credit institutions, ecosystem enterprises, and shadow enterprises… with preferential interest rates, while individuals and businesses with legitimate and legal needs encounter difficulties in accessing credit and foreign currencies. At the same time, implementing tools to control inflation and minimize and restrict the increase of bad debts for credit institutions. |