Principal debt of 8.5 million VND, accrued interest of 8.8 billion VND

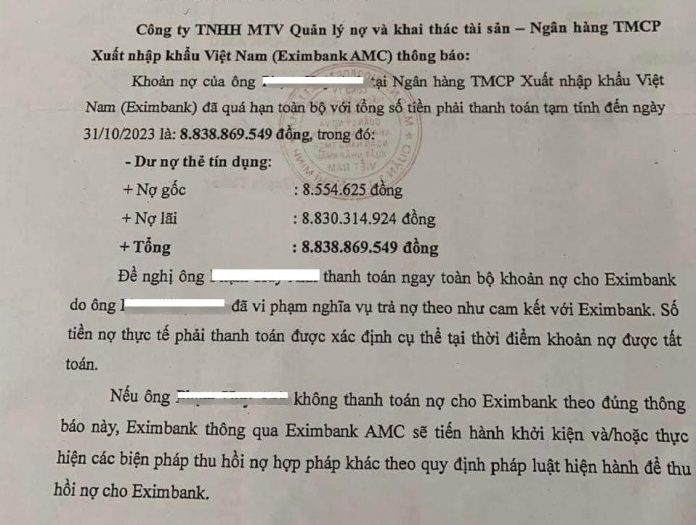

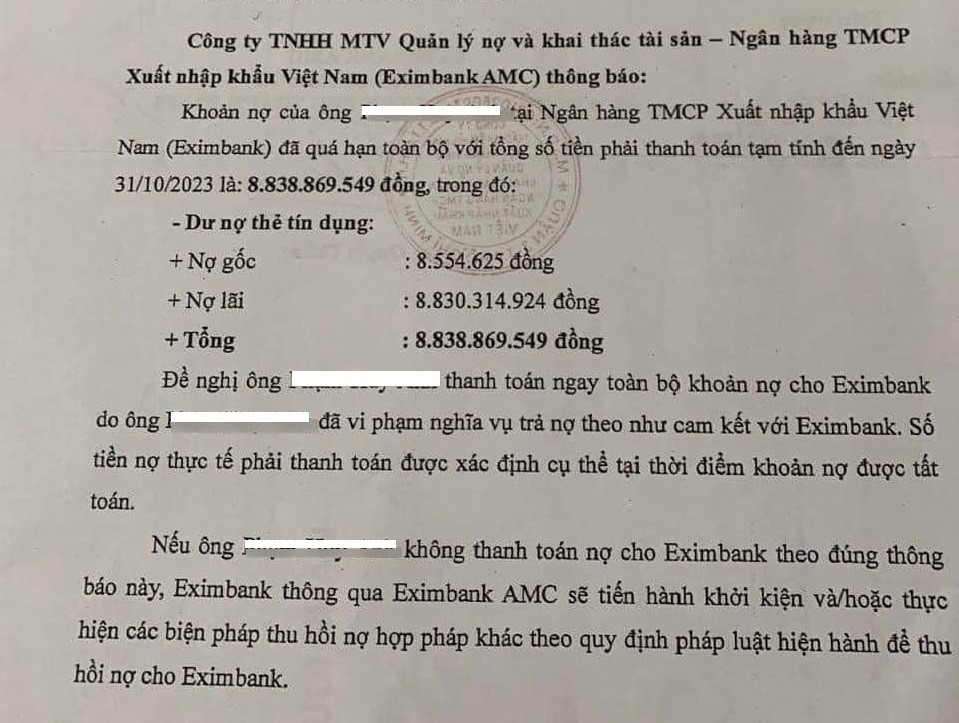

On March 13, on social media platforms, the Debt Reminder Letter from Joint Stock Commercial Bank for Foreign Trade of Vietnam (Eximbank) Asset Management Company (AMC) has been spreading.

According to the content of the letter, Eximbank AMC notifies its customer named P.H.A in Quang Ninh about a debt amounting to over 8.83 billion VND, with a principal debt of over 8.55 million VND.

This information has aroused curiosity among many people, even shock at the sight of “interest that begets interest,” hence the sharing speed increasing.

To learn more about the incident behind this, a journalist contacted Eximbank for information on the “Overdue Debt Reminder Letter sent by Eximbank AMC to the customer.”

The Debt Reminder Letter is sent by Eximbank AMC to the customer P.H.A. Photo: ManTV. |

According to the information provided by Eximbank, the customer P.H.A opened a Master Card at Eximbank’s Quang Ninh Branch on March 23, 2013, with a credit limit of 10 million VND, and had two payment transactions on April 23, 2013, and July 26, 2013 at a point of sale.

Since September 14, 2013, the mentioned credit card debt has turned into bad debt, with a delinquency period of nearly 11 years by the time of the notification.

Since then, Eximbank has conducted procedures to recover the debt from Mr. P.H.A according to regulations. This proves that the claim of customers “forgetting” to pay interest, as circulated on social media, is unfounded.

Specifically, on September 16, 2013, Eximbank’s Quang Ninh Branch sent a written notice to the customer regarding the violation of repayment obligations.

On December 12, 2017, the customer filed a complaint letter regarding the failure to receive a notice about the violation of payment obligations.

On December 23, 2017, Eximbank’s Quang Ninh Branch responded, clarifying the payment obligations and requesting Mr. P.H.A to propose a repayment plan for the debt to the bank.

On August 19, 2021, Eximbank AMC, under delegation, worked and resolved the debt issue with Mr. P.H.A.

On May 10, 2022, Eximbank AMC continued to have a meeting with Mr. P.H.A to exchange information and find solutions to support the customer in managing the debt.

On November 8, 2023, Eximbank AMC sent Letter No. 2155/2023/EIBA/CV-TGĐ to Mr. P.H.A to notify the payment obligations and coordinate with the bank to handle the mentioned debt.

“This is an overdue debt that has lasted for nearly 11 years. Eximbank has notified and worked directly with the customer multiple times; however, the customer has not yet come up with a repayment plan,” stated Eximbank.

Regarding the circulating debt reminder letter on social media, Eximbank confirms that notifying customers of their debt obligations is a routine business activity in the process of handling and recovering debt. As of now, Eximbank has not received any payments from the customer.

The key point of this story is the accrued interest of over 8.8 billion VND. Eximbank asserts that the method of calculating interest and fees is fully compliant with the agreement between Eximbank and the customer, as stated in the card issuance documents on March 15, 2013, with the customer’s full signature (fee and interest regulations are clearly specified in the Fee Schedule displayed publicly on Eximbank’s website).

“Eximbank continues to work and cooperate with the customer to find solutions to support the customer in managing the debt,” the bank said.

Overdue interest rate of up to 150% per year

Eximbank does not disclose the interest calculation formula in the above case; however, according to the regulations in Article 13 of Circular 39/2016/TT-NHNN, in case of overdue payment or insufficient repayment of the principal and/or interest as agreed upon, the interest rate calculation is as follows:

Interest on the outstanding principal at the agreed lending interest rate corresponding to the remaining unpaid period;

In the case where the customer fails to pay the interest on time as prescribed, the late payment interest must be paid according to the interest rate agreed upon by the credit institution and the customer, but not exceeding 10% per year calculated on the overdue interest balance corresponding to the late payment period;

In case the loan becomes overdue, the customer must pay interest on the overdue principal, corresponding to the late payment period, at an interest rate not exceeding 150% of the lending interest rate in effect at the time of the overdue debt transfer, according to the following formula:

Overdue interest = Remaining amount x Contractual interest rate (per year) x 150% x Overdue period

Currently, customers with overdue credit will have to bear late payment fees of about 5% and interest rates of around 20-45% depending on the bank.

In the case where the cardholder does not repay any amount to the bank and allows the debt to become overdue for more than 60-70 days, the entire outstanding debt will accrue overdue interest and late payment fees on the total debt.

Based on Circular 11/2021/TT-NHNN, credit debts exceeding 2 million VND and overdue within 36 months are eligible for pursuing legal action. However, banks rarely apply this measure and instead offer customers opportunities to repay the debt as specified.

At the same time, when this situation occurs, the customer’s debt information will be recorded as a bad debt in the Credit Information Center (CIC), and they are prohibited from participating in any other loans from banks.

Tuan Nguyen