Illustrative image

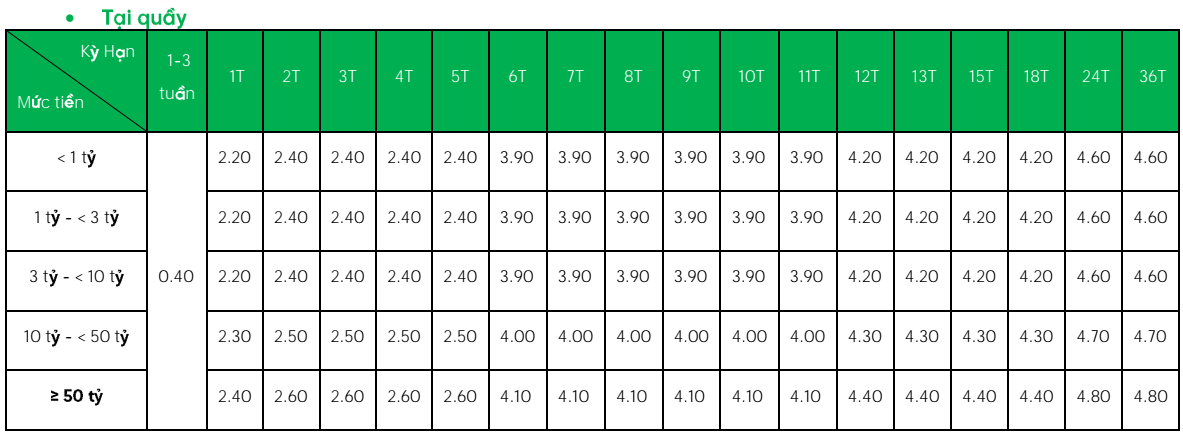

Deposit interest rates for individual customers at counter

VPBank has just announced the deposit interest rates applicable to individual customers from 05/03/2024. Accordingly, the interest rate range for traditional savings at the counter, receiving interest at the end of the period fluctuates from 2.2 – 4.8% per year, depending on each term and depending on different deposit levels.

VPBank implements corresponding interest rates for 5 deposit levels: Below 1 billion VND; From 1 billion VND to below 3 billion VND; From 3 billion VND to below 10 billion VND; From 10 billion VND to below 50 billion VND; From 50 billion VND and above

Among them, VPBank applies the same interest rate for 3 deposit levels: Below 1 billion VND; From 1 billion VND to below 3 billion VND and From 3 billion VND to below 10 billion VND. Accordingly, the interest rate for a 1-month term deposit is 2.2% per year, the 2-5 month term is 2.4% per year; the 6-11 month term is 3.9% per year; the 12-18 month term is 4.2% per year; the 24-36 month term is 4.6% per year.

For deposits from 10 billion VND to below 50 billion VND: Deposits for 1-month term have an interest rate of 2.3% per year; the 2-5 month term is 2.5% per year; the 6-11 month term is 4% per year; the 12-18 month term is 4.3% per year; the 24-36 month term is 4.7% per year.

Currently, VPBank applies the highest mobilizing interest rate for deposits from 50 billion VND and above. Specifically, the interest rate applied to a 1-month term is 2.4% per year; the 2 – 5 month term is 2.6% per year; the 6-11 month term is 4.1% per year; the 12-18 month term is 4.4% per year; the 24-36 month term is 4.8% per year.

For the 1 – 3 week term, the interest rate applied is 0.4% per year for all deposit levels.

Deposit interest rates at the VPBank counter in March 2024

Source: VPBank

Online deposit interest rates at VPBank

Customers depositing online through the VPBank app will receive an interest rate 0.1% per year higher than depositing at the counter. The interest rate applied by VPBank for this form fluctuates in the range of 2.3 – 4.9% per year for end-of-period interest receiving form.

With online deposits, VPBank implements corresponding interest rates for 5 deposit levels: Below 1 billion VND; From 1 billion VND to below 3 billion VND; From 3 billion VND to below 10 billion VND; From 10 billion VND to below 50 billion VND; From 50 billion VND and above

Among them, the 3 deposit levels: Below 1 billion VND; From 1 billion VND to below 3 billion VND and From 3 billion VND to below 10 billion VND are determined with the same mobilizing interest rate. Specifically, the 1-month term has an interest rate of 2.3% per year; the 2-5 month term is 2.5% per year; the 6-11 month term is 4% per year; the 12-18 month term is 4.3% per year; the 24-36 month term is 4.7% per year.

Customers depositing money from 10 billion VND to below 50 billion VND will enjoy interest rates for the 1-month term as follows: 2.4% per year; the 2-5 month term is 2.6% per year; the 6-11 month term is 4.1% per year; the 12-18 month term is 4.4% per year; the 24-36 month term is 4.8% per year.

The highest interest rate for personal customers when depositing online applies to a minimum amount of 50 billion VND. Specifically, the mobilization interest rate for a 1-month term is 2.5% per year; the 2-5 month term is 2.7% per year; the 6-11 month term is 4.2% per year; the 12-18 month term is 4.5% per year; the 24-36 month term is 4.9% per year.

The interest rate of 0.4% per year is applied to the 1-3 week term for all deposit levels.

Online deposit interest rates at VPBank in March 2024

Source: VPBank

Note: For priority customers who deposit a minimum of 100 million VND and a minimum term of 1 month, an additional 0.1% per year will be added to the prescribed interest rate table.

In addition to end-of-period interest payment method, VPBank also applies other flexible interest payment methods for customers to refer to and choose: Prepayment of interest (Interest rates from 2.2 – 4.21% per year); Regular interest payment (Interest rates from 2.4 – 4.5% per year)

VPBank also implements other savings packages for customers to choose from such as: Good Fortune; Flexible Prosperity, Prime Savings; Monthly savings.