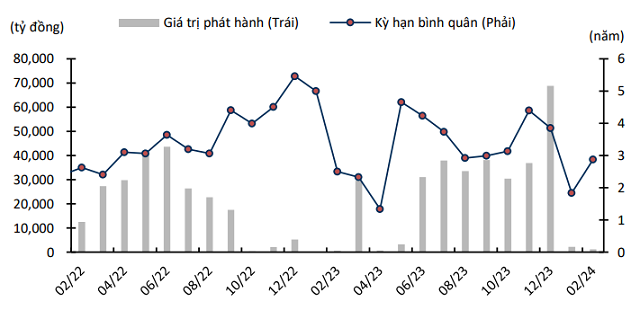

The primary market continued to be lackluster in February.

The corporate bond market saw a decrease in primary issuance in February, with a total value of 1,165 billion VND, a 45.8% decrease compared to the previous month, with an average tenor of 2.87 years. Among them, there were only three private placement bond issuances by three enterprises in the construction (47%), port and maritime transportation (43%), and trade and services (10%) sectors.

According to KBSV Research, the lackluster primary market in the first two months of the year is mainly due to the reapplication of certain provisions in Decree 65, resulting in stricter regulations on bond issuance. Securities companies forecast that issuance volume will pick up in the second half of the year as the economy improves, the real estate market recovers, and the constraints of the corporate bond market are gradually lifted.

|

Corporate bond issuance results

Source: FiinPro, KBSV

|

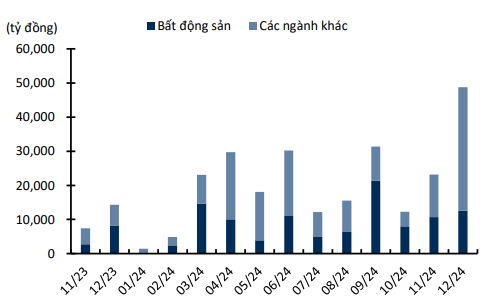

Bond maturities increase significantly in March.

In March, it is estimated that there will be more than 23 trillion VND of bonds maturing, a 372% increase compared to February, with the majority belonging to the real estate sector (63%), followed by trade and services (10%), and construction (9%).

Some companies with a large amount of bonds maturing in March include Hung Yen Urban Investment and Development LLC, BCG Land Joint Stock Company, and Xuan Dinh Construction Investment Joint Stock Company. Among them, Hung Yen Urban Investment and Development LLC has the largest value of bonds maturing in March, with two bond tranches totaling 7,200 billion VND.

For the entire year 2024, it is estimated that there will be around 279 trillion VND of bond maturities, with over 115 trillion VND belonging to the real estate sector (41.4%), followed by the financial institution sector with over 81 trillion VND (29%). These figures do not include maturities that are extended for the second time, so the actual pressure of maturities this year will be higher than reflected in the above numbers.

|

Corporate bond maturities by the end of 2024

Source: HNX, KBSV

|

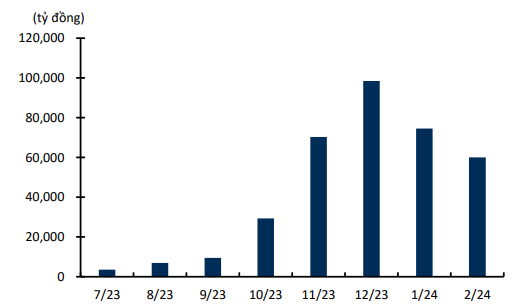

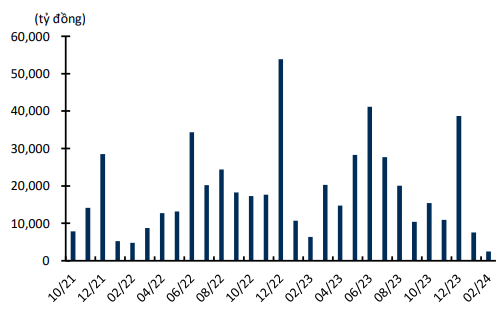

Secondary market trading value and buyback activities continue to decline.

In the secondary market, trading volume has been declining in the first two months of the year, reaching 60 trillion VND in February, a 20% decrease compared to the previous month. Bond buyback activities also slowed down in February, with the volume of bonds repurchased reaching 2,494 billion VND, a 60% decrease.

|

Secondary market trading value on HNX Exchange

Source: HNX, KBSV

|

|

Corporate bond buyback value

Source: HNX, KBSV

|