The decision was made based on the consideration that the audited financial statements for 2023 of SD2 have received a qualified opinion from the auditing organization for three consecutive years or more. In addition, HNX has also requested SD2 to explain the reasons and propose solutions within 15 days.

|

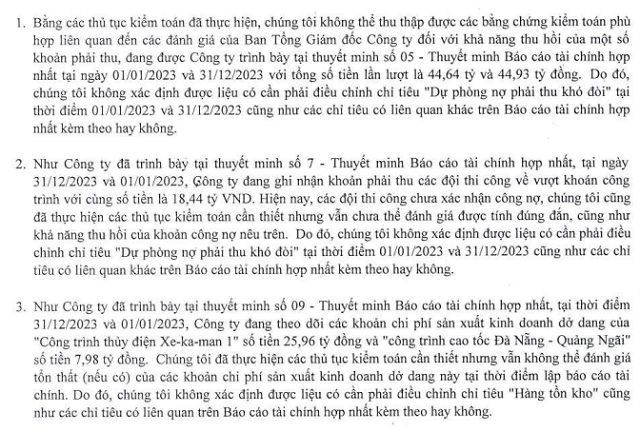

Basis of the qualified audit opinion on the audited financial statements for 2023 of SD2

Source: Audited financial statements for 2023 of SD2

|

On March 7th, SD2 also provided an explanation for this qualified opinion. Specifically, regarding the first qualified opinion, SD2 stated that it relates to receivables related to the construction of the Danang – Quang Ngai package 4 and the receivables for the Danang – Quang Ngai package A4 project. These are outstanding receivables awaiting settlement.

As for the receivable from SONG DA Tay Nguyen Hydropower Joint Stock Company, SD2 explained that it relates to the construction volume of the Hanoi Tay hydropower project. However, SONG DA Tay Nguyen Hydropower Joint Stock Company is currently facing difficulties and cannot settle the mentioned receivable. SD2 and SONG DA Tay Nguyen Hydropower Joint Stock Company have a working record on receivable payment, according to which SONG DA Tay Nguyen Hydropower Joint Stock Company is working with Agribank Gia Lai branch to negotiate extension of the repayment period and balance its financial sources to transfer to SD2.

Regarding the second qualified opinion regarding the exceeded quota at the subsidiary company, with a total amount of 18.44 billion VND, SD2 will request E&C Joint Stock Company SONG DA 2 MTV to provide supporting documents to specifically determine the receivable object and implement measures to recover the receivables.

As for the final qualified opinion regarding the unfinished production and business costs, SD2 stated that this is a project currently under settlement and is undergoing inspections and checks by state authorities, leading to delayed settlement.

In the stock market, SD2’s stock ended the session on March 13th, 2024 at 5,200 VND/share, which is still trading poorly after a sharp drop from above 14,000 VND/share in November 2021.

| Price movement of SD2 shares in recent years |

In another development at the end of 2023, the State Securities Commission (SSC) imposed an administrative penalty of 77.5 million VND on SD2 for failure to disclose information as required by law.

Specifically, SD2 did not disclose the information on the electronic information page of Hanoi Stock Exchange (HNX) and the information disclosure system of the State Securities Commission (SSC) regarding documents such as the explanation of qualified audit opinions on the semi-annual consolidated financial statements for 2021.

In addition, SD2 also did not disclose the information on time on the electronic information page of HNX and the information disclosure system of SSC regarding documents such as the removal of Vice General Director Tran Van Truong, the removal of Chief Accountant – Ms. Pham Thi, the appointment of the person in charge of the Finance and Accounting Department – Mr. Le Manh Doan, the explanation of qualified audit opinions on the semi-annual consolidated financial statements for 2022, the removal of Vice General Director – Mr. Dao Duc Phong, and the notice of the extraordinary Shareholders’ General Meeting and related documents (meeting date: February 28th, 2022).

Huy Khai