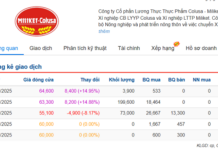

The pressure to take profits in the early week trading session caused the market to continue its downward trend, with the VN-Index retreating to the 1,235 point range, marking the second consecutive deep decline session. The market seemed to have “found a reason to correct” when the State Bank of Vietnam announced the issuance of promissory notes. The money flow continued to be maintained after the explosive session with a trading volume on HOSE reaching 22,500 billion VND.

Despite this, the above-mentioned decline level is “not significant” compared to the over 200-point surge of the market since the beginning of November 2023. So, what will be the next trend of the market and where might the VN-Index go after two sharp declines?

Possibility of approaching the 1,200 point range

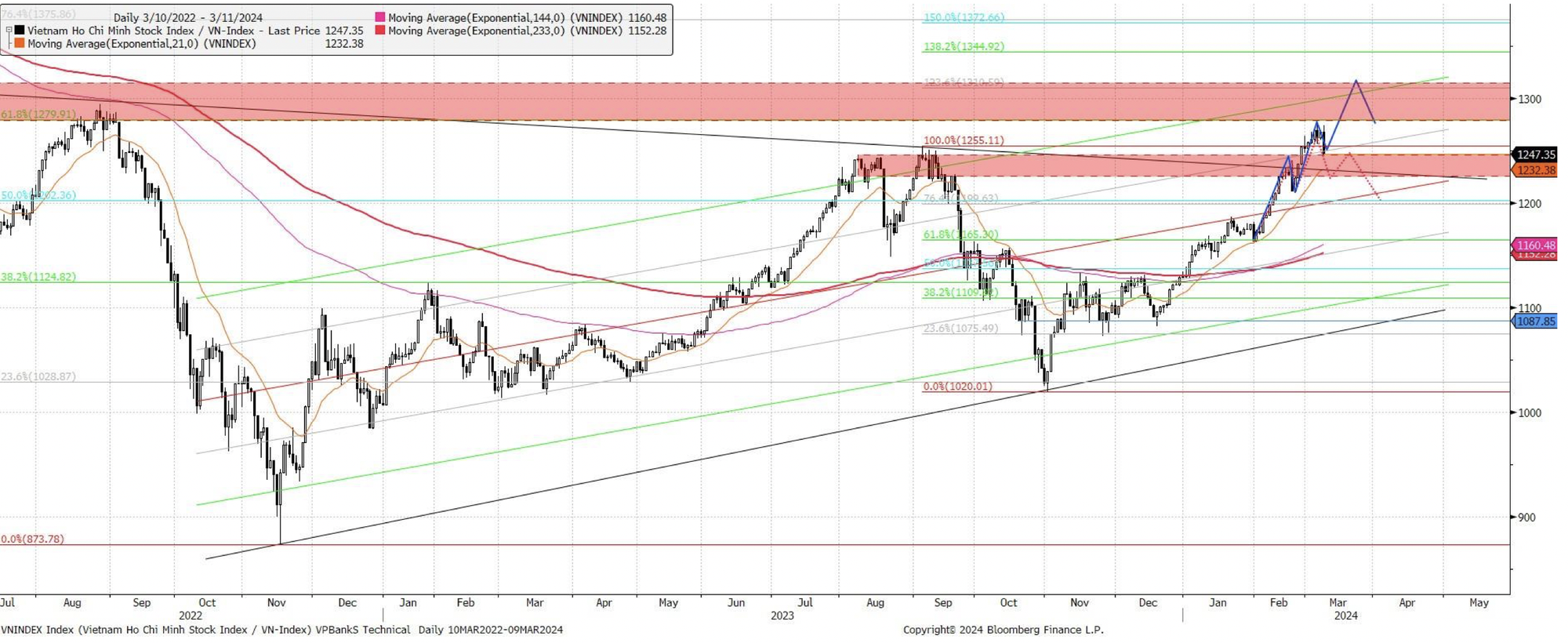

Commenting on the market’s developments, Mr. Tran Hoang Son – Director of Market Strategy at VPBank Securities, evaluated that the VN-Index retreated before the strong resistance zone at 1,280 points, after 4 months of consecutive gains since the bottom of November 2023. The signal of a reversal along with maintained liquidity indicates that the “distribution zone” is clearly taking place.

From a technical perspective, the VN-Index has shown a Bearish Engulfing candlestick with a large trading volume, reinforcing the ongoing distribution signal with at least 3 sessions of 1 billion shares being transferred. This is an important warning signal after the RSI has deepened into the overbought zone in the past 2 weeks and started to decline from this zone. In addition, the VN-Index has also fallen below the P.SAR line, indicating caution is necessary after transitioning to a downward price signal from this indicator.

Despite the appearance of many reversal signals, experts believe that the short-term upward trend has not been broken as the VN-Index is still above the MA20 at the level of 1,232 points. However, losing the 1,250 mark is also an early signal of violating the trend. The strong support level is the intersection of 2 major Fibonacci zones located at the 1,200 point range.

In a cautious scenario with a 70% probability, Mr. Son predicts that the MA support zone equivalent to 1,232 points may be broken, and the VN Index will fall into a sideways down phase, approaching two strong support zones at 1,200 and the second zone at 1,160-1,170 points.

VPBank Securities experts believe that a cautious strategy should be prioritized and maintained during this period when distribution signals are clearly occurring. Investors can continue to take profits with hot stocks and consider trading certain sectors such as securities, retail, chemicals, etc.

Medium-term investors can seize the opportunity to accumulate stocks

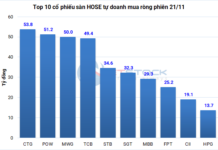

Sharing the same view, Mr. Nguyen Anh Khoa – Head of Analysis and Research Department at Agriseco Securities, believes that the market is facing continuous profit-taking pressure after a strong upward chain since the beginning of the year, which is understandable. In addition, the appearance of many concerns with complex exchange rates, as well as continuous net selling by foreign and proprietary investors, has negatively affected the psychology of many investors.

The distribution session at the end of the previous week and the decline session on March 11th have expanded the short-term corrective risk that still exists. However, experts believe that the support level near the 1,230 (+-5) point range, corresponding to the MA20 on the daily timeframe, is still expected to play a noteworthy support role and the index will have a technical rebound here. In case the index does not soon successfully conquer the 1,250 point resistance level, the risk of the index decreasing below the 1,200 point threshold needs to be considered.

Regarding the future trend of the market, experts at Agriseco believe that “differentiation” will continue to be the dominant trend. With the current upward trend still playing a leading role in the medium term, investors are recommended to increase their proportion and prioritize stocks that are already in their portfolios and stocks that are trading near the accumulation price range. However, it is important to avoid chasing after gains in enthusiastic uptrends and prioritize risk management for the portfolio in the scenario where the mentioned support level is breached.