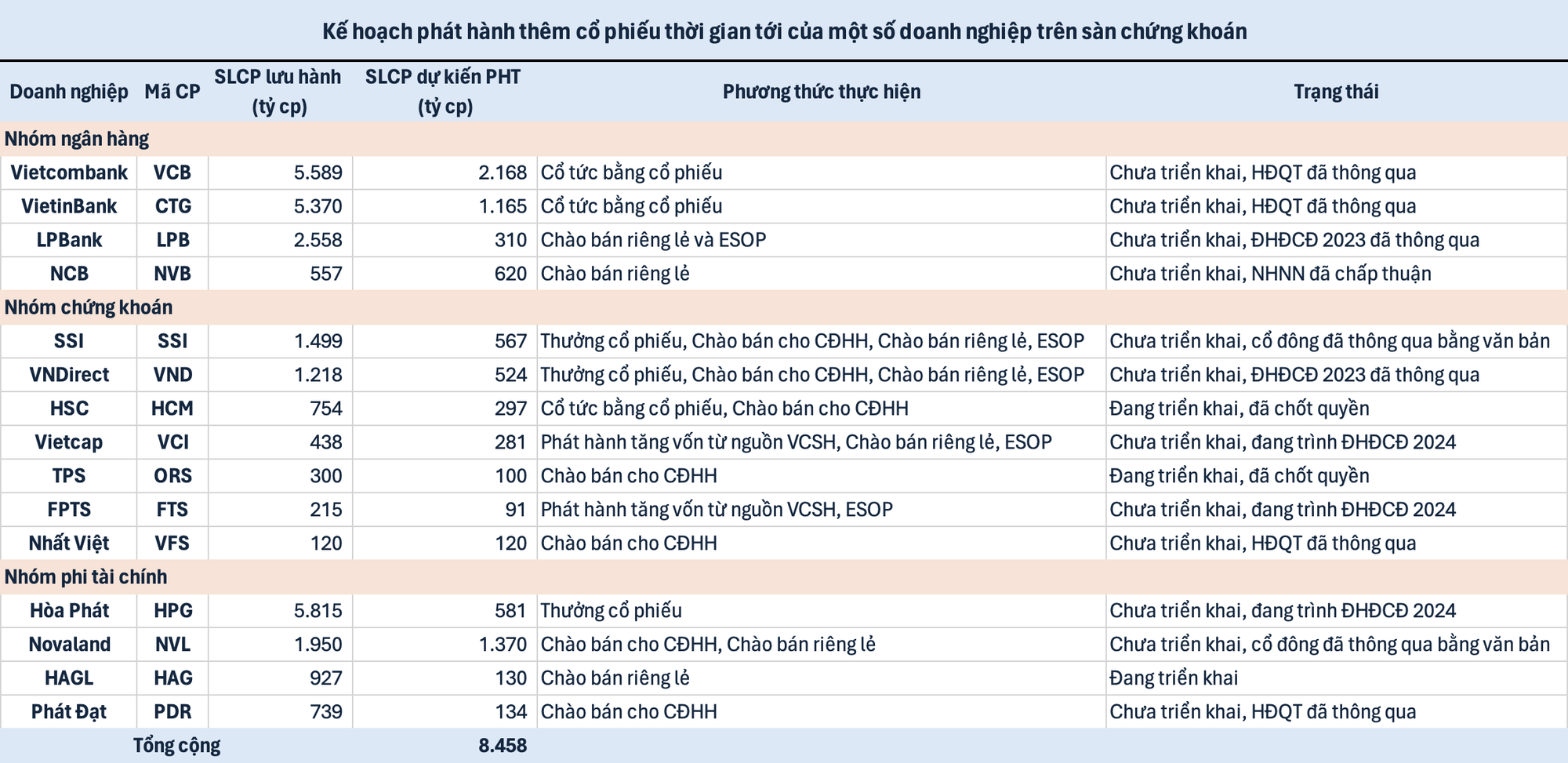

The stock market is getting back on track, and activities such as issuing and increasing capital are heating up. According to preliminary statistics, 15 names on the stock exchange are planning to issue a total of nearly 8.5 billion shares. As the Annual General Meeting of Shareholders approaches, more plans for issuance and capital increase are emerging.

Recently, in the agenda of the upcoming Annual General Meeting of Shareholders in 2024, Hoa Phat Corporation proposed a plan to reward shareholders with a 10% dividend payout, equivalent to more than 581 million shares, in order to increase its charter capital to VND 63,962 billion. Similarly, two securities companies, Vietcap and FPTS, also have capital increase proposals in their upcoming Annual General Meeting of Shareholders in 2024.

Other ongoing cases include HSC issuing 69 million bonus shares and offering 228.6 million shares to existing shareholders, HAGL’s private placement of 130 million shares. The majority of other plans have been approved by the Annual General Meeting of Shareholders and the Board of Directors earlier but have not been implemented yet and are expected to be carried out in the near future.

It comes as no surprise that the financial group (banks, securities companies) dominates this activity. Among them, the two major banks, Vietcombank and VietinBank, are both expected to use all of the remaining profits after setting up reserves in 2022 to distribute dividends in the form of shares. Vietcombank plans to issue an additional 2.17 billion shares, while VietinBank plans to issue 1.16 billion new shares.

The leading securities companies, SSI and VNDirect, also have “big” capital increase plans through bonus shares, offering to existing shareholders, private placement, and ESOP. Specifically, SSI has been given the green light by shareholders through a written decision at the end of last year, while VNDirect’s plan has been approved at the Annual General Meeting of Shareholders in 2023.

In reality, there is a great demand for increasing capital capacity in the financial group. Securities companies need to continuously increase capital to expand their scale of operations, gain market share, improve capacity for margin lending and even proprietary trading. Additionally, there is also the story of corporate bonds.

For the banking sector, owning a larger charter capital will allow for the expansion of asset size, improve financial capacity, further expand business operations, and ensure the safety of the system… According to the Project to Restructure the System of Credit Institutions Linked to NPL Resolution by 2025, the banking sector strives to achieve a minimum capital adequacy ratio of 11-12%. Fitch Ratings forecasts that the banking system needs to supplement $10.7 billion in capital.

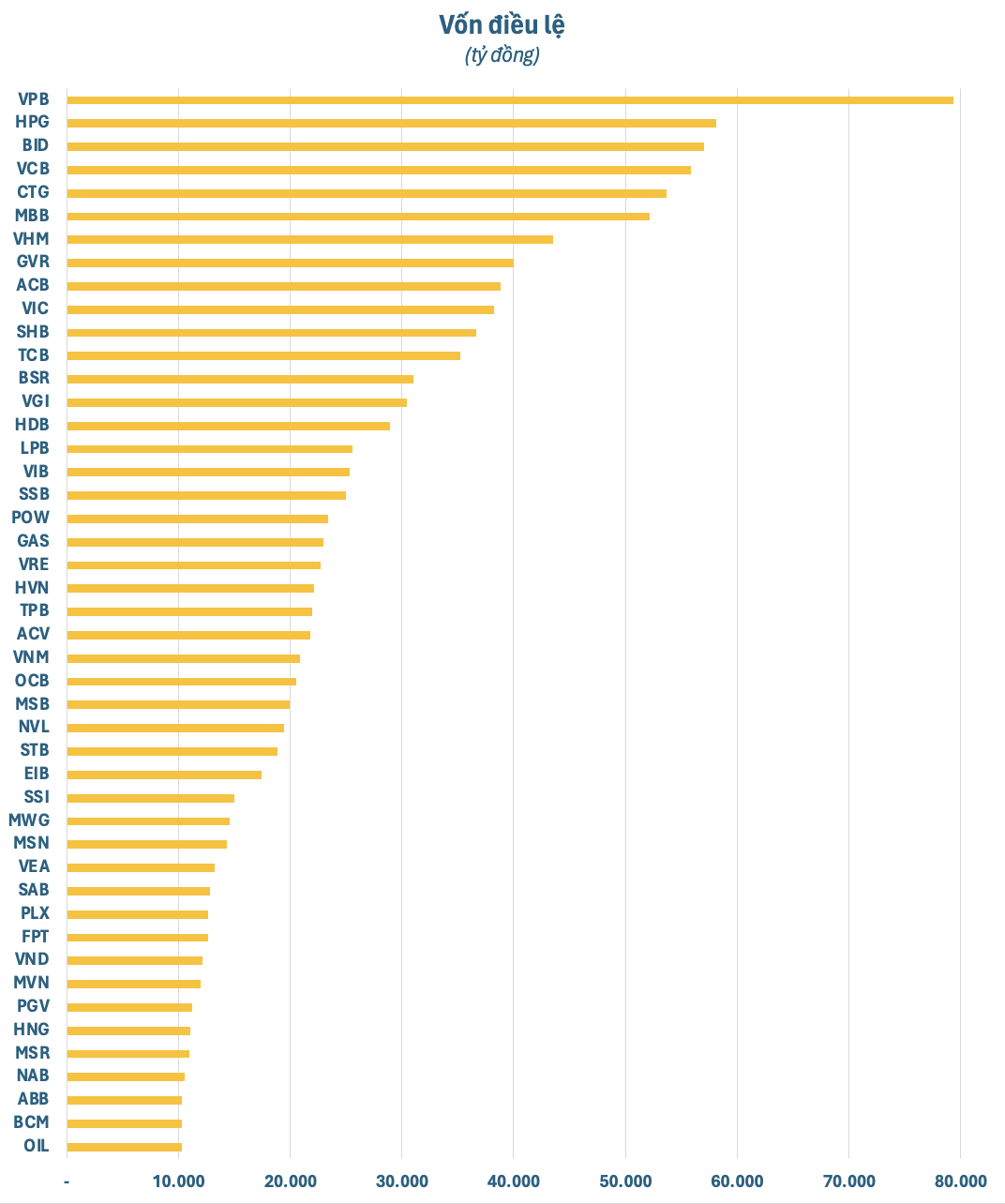

Stock splits, capital increases are common activities that make it difficult to maintain stock prices at high levels. Furthermore, the financial group also bears the burden of being cyclical, and maintaining continuous growth over a long period of time is not easy. This explains why the financial group is absent from the 3-digit stock price club on the stock exchange.

In return, in the list of companies with the largest charter capital on the stock exchange, the financial group completely dominates. According to statistics, there are currently 46 companies on the entire exchange with charter capital of over VND 10 trillion (circulating volume of over 1 billion shares), with banks and securities companies accounting for nearly half with 21 representatives.

In the non-financial group, Hoa Phat Corporation is currently the company with the largest charter capital, with over VND 58,000 billion. This figure is only second to VPBank in terms of the overall stock exchange. Following them are a series of state-owned companies such as GVR, BSR, Viettel Global, PV Power, PV Gas, Vietnam Airlines, ACV, Vinamilk, VEAM, Sabeco, Petrolimex, Vinalines, EVNGENCO 3, Becamex IDC, PV Oil.

In addition to Hoa Phat, privately-owned companies with charter capital of over VND 10 trillion can be counted on the fingers, including Vingroup, Vinhomes, Vincom Retail, Novaland, The Gioi Di Dong, Masan, Masan Resources, FPT, HAGL Agrico. However, some stocks in this group can be considered “national” in terms of having a large number of shareholders and active trading in each session.

In general, stock splits, issuances, and capital increases are legitimate activities of each company. However, a large amount of shares being “pumped” out will inevitably create some pressure on the market. Active trading is a positive point, but it also means that stocks need larger capital inflows in each upward wave.