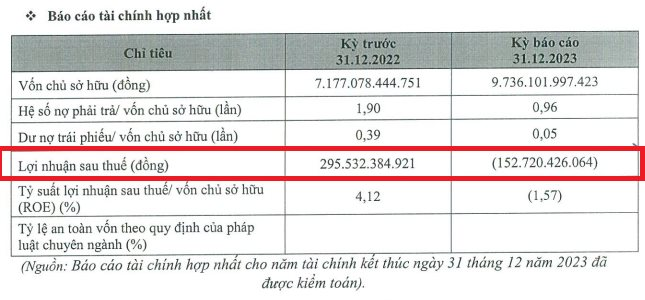

BCG Energy has just reported its consolidated financial statements for 2023, with dismal business results, the company reporting a loss after tax of over 152 billion VND.

Earlier, in 2022, the company reported a profit of over 295 billion VND.

According to the report, despite the poor business results, BCG Energy’s equity capital increased sharply in 2023 by over 35.6% compared to the beginning of the year, reaching over 9,736 billion VND. The debt-to-equity ratio decreased from 1.9 times (equivalent to 13,636 billion VND) at the beginning of the year to 0.96 times (equivalent to 9,346 billion VND) at the end of 2023. Thus, the company’s outstanding debt has decreased by nearly 4,300 billion VND in 2023.

The company’s bond-to-equity ratio also decreased from 0.39 times (equivalent to 2,800 billion VND) at the beginning of the year to 0.05 times (equivalent to 486 billion VND) at the end of 2023. Thus, BCG Energy’s bond debt has decreased by over 2,300 billion VND in 2023.

The poor business results have caused BCG Energy’s return on equity (ROE) to drop to -1.57%, compared to 4.12% in 2022.

Another noteworthy point is that, although BCG Energy reported a loss of over 152 billion VND in 2023 in its consolidated financial statements, its separate financial statements recorded a profit of over 121 billion in the 2023 financial year.

According to our research, BCG Energy Joint Stock Company was established on June 08, 2017, with headquarters at 27C Quoc Huong, Thao Dien Ward, Thu Duc City, Ho Chi Minh City. Its primary business line is electricity production. The legal representative of the company is businessman Pham Minh Tuan and businessman Nguyen Ho Nam.

Businessman Nguyen Ho Nam is the Chairman of the Board of Directors of Bamboo Capital Joint Stock Company (Bamboo Capital Group Joint Stock Company, stock code: BCG). At the end of 2023, Bamboo Capital was the parent company of BCG Energy with a controlling stake and ownership interest of 50.66%.

Bamboo Capital is introduced as a conglomerate currently operating more than 70 member and affiliated companies in 7 sectors: renewable energy; construction – infrastructure; real estate; production – trading; financial services – insurance; supply of operational and distribution solutions for real estate; pharmaceuticals.

BCG Energy shares “rise” 85% before IPO

Specifically, in November 2023, the Board of Directors of Bamboo Capital agreed to use 5.6 million shares held directly in BCG Energy – a subsidiary company of Bamboo Capital holding over 82% of the capital – to replace 7.43 million other BCG Energy shares owned by individuals serving as collateral for the credit obligations arising at NamABank.

In particular, 1 million BCG Energy shares owned by Bamboo Capital will be used as collateral for 1.43 million BCG Energy shares owned by Mr. Pham Minh Tuan, Deputy Chairman of the Board of Directors and Deputy CEO, serving as collateral for the loan of Duong Phong Company at the bank.

Similarly, the remaining 4.6 million BCG Energy shares held directly by Bamboo Capital will be used as collateral for the remaining 6 million BCG Energy shares owned by Ms. Hoang Thi Minh Chau, former Deputy CEO in charge of finance, as collateral for the credit obligations arising at NamABank in relation to Industrial and Transportation Development Investment Joint Stock Company (Tradico).

Notably, in both collateral restructuring transactions, the price that NamABank offered for each BCG Energy share increased from 10,000 VND/share to 18,500 VND/share, equivalent to an 85% increase in valuation even before the IPO.