The Western area of Ho Chi Minh City includes districts Binh Tan, District 8, District 6, Tan Binh District, Tan Phu District, and part of Binh Chanh District and Hoc Mon District. These are all large districts with a high population density, strong economic development with many industrial parks, export processing zones, and large production and business households. However, the real estate market is experiencing mixed trends: high housing demand but very limited affordable supply.

According to observations, the demand for real estate in this area mainly comes from real buying power. The majority of people are small businesses and traders who have accumulated a considerable amount of money. In recent years, mid-range real estate with prices ranging from 2-4 billion VND has good liquidity. However, at present, in the context of scarce new supply, the high housing demand has caused new apartment projects in the Western area to continuously set new price levels.

During the period from 2018 to 2020, the Western area of Ho Chi Minh City still had many residential projects with prices ranging from 30 to 40 million VND/m2. However, in the past three years, the price level of apartments in the Western districts has increased rapidly along with the overall increase in the Ho Chi Minh City real estate market. Currently, apartment projects with prices below 45 million VND/m2 have become scarce in this area.

The supply of new apartments in the Western area of Ho Chi Minh City is becoming increasingly scarce, especially those with proper legal procedures and good construction quality. Photo: Illustration

Recently, some condominium projects in Binh Tan District and Hoc Mon District with relatively good purchasing power are also priced in the range of 45-50 million VND/m2 (the average price of apartments in Ho Chi Minh City is currently 61 million VND/m2 – according to CBRE). Sales at this price level are slow. Below this price level, there are few projects available, except for secondary products from previously deployed projects being re-offered.

For example, at present, Akari City project by Nam Long company located on Vo Van Kiet Street in Binh Tan District is attracting active attention with prices starting from 45 million VND/m2. In addition to being the remaining supply with reasonable prices in the area, the attractive sales policy from the investor is also stimulating buying demand. Of late, the company has introduced an appealing sales policy which allows customers to pay 40% of the total price in 5 installments until receiving the house (in December 2024). In which, the banks will disburse corresponding amounts from the 3rd installment. Accordingly, customers only need to have 30% of the capital, while the bank will support loans up to 70% of the property value, with no principal payment within 2 years, only paying the fixed interest rate of 1% per year until the end of August 2026. For example, if customers purchase a 2-bedroom, 2-bathroom AK NEO apartment with an area of 80.7m2, after receiving the house, the total amount the customer needs to pay is the fixed interest rate of 1% per year – equivalent to 2.5 million VND/month until the end of August 2026.

Looking at the current situation, in the near future, the supply of apartments with prices ranging from 3-4 billion VND/unit in the Western area of Ho Chi Minh City – which used to be the “price valley” of the city – will continue to narrow.

“House prices will continue to rise, especially in the central areas. Therefore, buyers tend to look for properties in the outskirts, where infrastructure is increasingly being completed and suitable for financial resources. Recently, in the Western area of Ho Chi Minh City, apartment projects with prices below 50 million VND/m2 have had positive absorption rates. However, it is certain that in the future, there will continue to be price fluctuations in the apartment segment,” shared Mr. David Jackson, General Director of Avison Young.

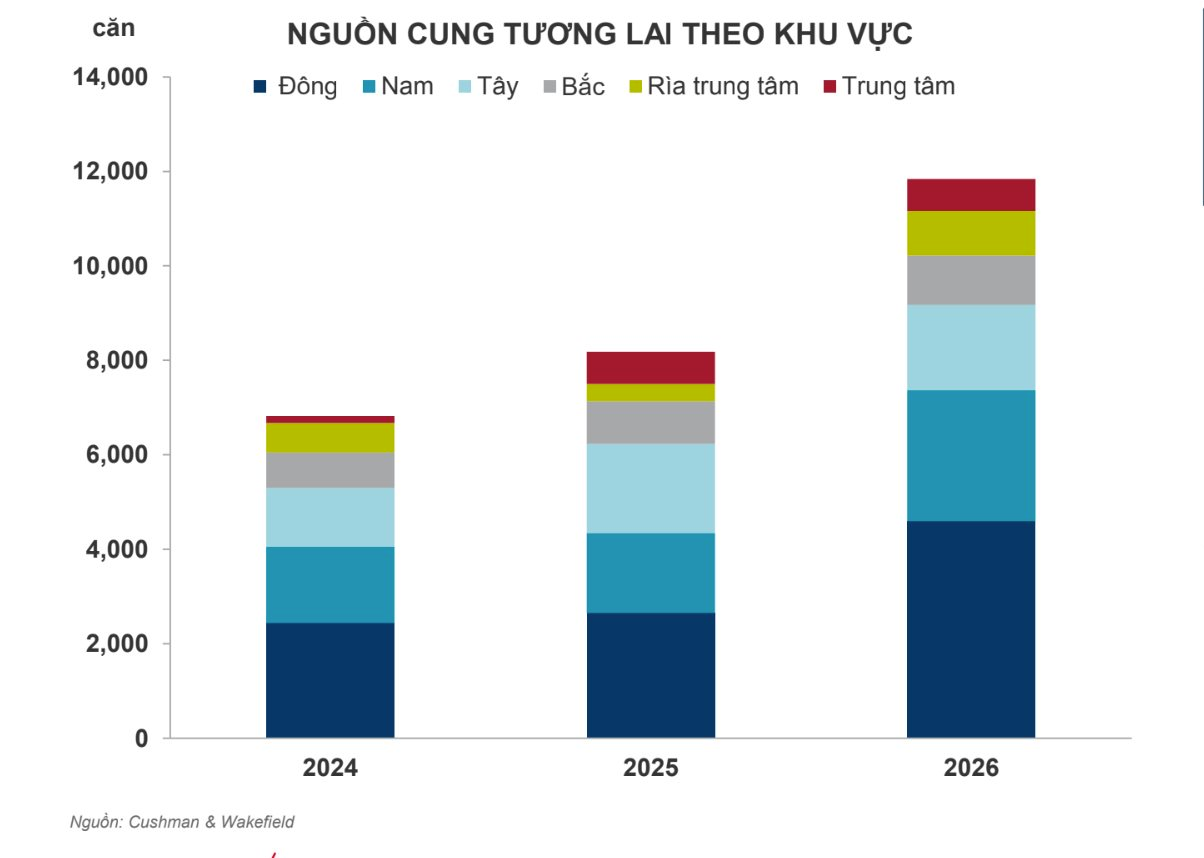

The apartment supply rate in the next 3 years in the Western area of Ho Chi Minh City is forecasted to remain low. Source: Cushman & Wakefield

Looking ahead, the housing demand in the Western area of Ho Chi Minh City remains stable. The driving force for the real estate market here comes from many factors. In addition to the high population density, high mechanical migration capacity, and the large housing demand of the people, this area is also a “hub” for well-invested transportation infrastructure, which is conveniently connected to the city center.

Therefore, in recent years, real estate projects in Binh Tan District, especially those along Vo Van Kiet Street (which extends from Eastern Ho Chi Minh City – central districts – to the Western area of the city), have attracted a large number of buyers from the city center and the Eastern area. This is understandable when the land fund for developing apartments in the city center is scarce with high prices, while the prices of houses in the Western area of Ho Chi Minh City are still low and easily accessible.

Recently, the Ho Chi Minh City Department of Transport proposed extending Vo Van Kiet Street (in the Western area of Ho Chi Minh City) to Long An province. This information has attracted attention as many people expect that the real estate market in these areas will greatly benefit from the transportation infrastructure plan. This road, when completed, will help solve the traffic congestion in the Western area, and at the same time, the commute from the Western area to the city center through Vo Van Kiet Street will become more convenient.

Additionally, many infrastructure facilities and amenities have already been established or are being invested in the Western area of Ho Chi Minh City in recent years, such as National Highway 1A, National Highway 50, Nguyen Van Linh Boulevard, Ho Chi Minh City – Trung Luong – My Thuan Expressway, Belt Road 3, etc. These are driving forces for the real estate market.

High housing demand but limited supply at reasonable prices. Photo: Illustration

Previously, Vo Huynh Tuan Kiet, Director of Residential Department at CBRE Vietnam, commented that considering the supply in 2023, up to 80% of new projects would be concentrated in the Eastern area of Ho Chi Minh City, but the selling prices would be high, mostly ranging from 60-100 million VND/m2. Meanwhile, the Western area, especially new projects, is developing less. Most of the supply comes from previously launched projects. Although the price of real estate in the Western area has increased significantly in recent years, if compared to the overall price level of Ho Chi Minh City, this area still tends to offer reasonably priced properties. Prices from 3-4 billion VND/unit are suitable for young families who want to own a house in the city.

However, the increasingly scarce supply of new properties poses many challenges for the real estate market in the Western area of Ho Chi Minh City. Among them, the pressure of price increases and the imbalance between demand and supply may occur in this area in the near future.