The rights fulfillment ratio is 1:1 (shareholders owning 1 share will have 1 right to purchase, and 1 right to be purchased for 1 additional share issuance). The selling price is not disclosed. The General Meeting of Shareholders delegates the Board of Directors to determine the specific selling price based on the actual conditions when conducting the issuance procedures.

If successful, the Company’s charter capital can double, from VND 693.5 billion at the end of 2023 to VND 1,387 billion.

The additional shares offered to existing shareholders are not restricted for transfer, while the remaining shares not exercised by existing shareholders when offered will be restricted from transfer within 1 year from the end date of the offering.

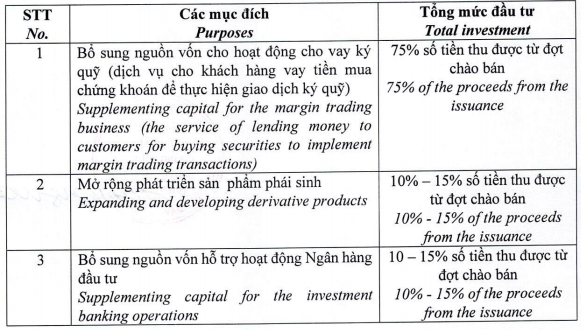

The General Meeting of Shareholders also approves the plan for using the proceeds from the offering. Specifically, 75% of the funds raised will be used to supplement capital for margin lending; the remaining 2 purposes are expanding the development of derivative products and supplementing capital to support the expected investment banking activities, with the same proportion of 10-15% of the funds raised.

|

Use of funds for IVS

Source: Extraordinary General Meeting Resolution 2024

|

In terms of business operations, in 2023, the Company achieved a revenue of over VND 80.5 billion, a decrease of 8% compared to the previous year, mainly due to a decrease in brokerage business revenue. Operating and business management expenses also decreased by nearly 24% to over VND 53.5 billion, due to a reduction in brokerage business expenses and a reversal of provision for financial assets. With this fluctuation, the Company’s after-tax profit increased by 57% to VND 27 billion.

| Profit/loss after tax of IVS from 2010-2023 |

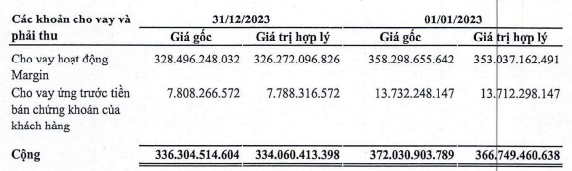

The Company’s asset scale at the end of 2023 reached VND 766 billion, a decrease of 6% compared to the beginning of the year. Among them, margin lending was at VND 328 billion, a reduction of 8%.

Source: Company’s Financial Statements

|

On the other side of the balance sheet, the amount payable was nearly VND 11 billion, a decrease of 86%; and there is almost no short-term debt, down from nearly VND 73 billion at the beginning of the year. The Company also has no long-term debt.

|

IvS Securities Corporation (formerly Vietnam Investment Securities Corporation) was established on August 28, 2007, with a charter capital of VND 161 billion. In 2011, the Company officially listed its shares on the Hanoi Stock Exchange (HNX) under the code IVS. On November 20, 2016, IVS increased its charter capital to VND 340 billion. By October 2019, Goutai Juan International Holdings Limited (based in Hong Kong) became a major shareholder of the Company with a 50.97% ownership stake after completing the private placement of 35.35 million shares of IVS, increasing the charter capital of the Company to VND 693.5 billion. Two years later, in July 2021, the Company officially changed its name to IVS Guotai Junan Securities Corporation (Vietnam). Currently, Mr. Huang Bo (American nationality, born in 1985) is the CEO of the Company. According to the list of shareholders as of February 15, the Company has 3 major shareholders owning 68.55% of the capital (47.5 million shares). Among them, 2 foreign shareholders are Goutai Juan International Holdings Limited with 50.97% and Pan Zhirong with 5.56%; 1 domestic shareholder is Dazhong (Vietnam) International Co., Ltd. holding 12.02%. |