DIC Corp Records First Quarterly Loss in Company History

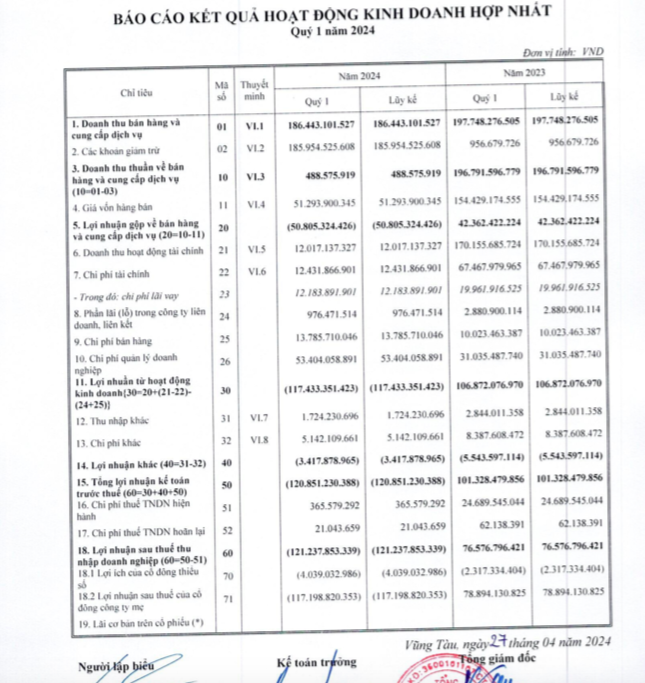

According to the Q1 2024 financial report released by DIC Corp (DIG), the company recorded a loss of 121.2 billion VND in the first quarter of this year. This marks the company’s first quarterly loss since its initial public offering.

DIC Corp’s revenue for Q1 2024 reached 186.4 billion VND, a 5.7% decrease compared to the same period in 2023. Real estate revenue contributed 111.8 billion VND (60% of total revenue), service provision generated 37 billion VND (19.8%), sales of semi-finished products achieved 20.2 billion VND (10.8%), and investment real estate revenue came in at 843.5 million VND.

During this quarter, DIC Corp recorded an unusually high amount of returned sales, reaching close to 185.7 billion VND. As a result, the company’s net revenue totaled only 489 million VND, a 99.8% decline compared to Q1 2023.

In its explanatory notes, DIC Corp did not provide a detailed explanation for the returned sales. The company merely stated that its Q1 revenue was primarily derived from the sale of apartments at the CSJ project, the sale of unfinished houses at the Dai Phuoc project, and the sale of unfinished houses at the Hau Giang project.

DIC’s consolidated financial report for Q1 2024. Screenshot.

Gross profit for the quarter was a loss of 50.8 billion VND, compared to the gross profit of 42.3 billion VND in the same period last year, due to the company engaging in below-cost sales.

Financial revenue also declined by 92.9% compared to the same period in 2023, equivalent to a decrease of over 158 billion VND and reaching 12 billion VND. Financial expenses decreased by 81.6%, or 55.1 billion VND, to 12.4 billion VND. Selling and general administrative expenses increased by 38% and 72.2%, respectively, to 13.8 billion VND and 53 billion VND.

Consequently, DIC Corp reported a record loss in Q1 2024 due to below-cost sales, reduced financial revenue, and elevated selling and general administrative expenses.

As of March 31, 2024, DIC Corp’s total assets increased by 5.6% from the beginning of the year, representing an increase of 938 billion VND, reaching 17,765.6 billion VND. Inventories amounted to 6,784.5 billion VND, accounting for 38.2% of total assets; short-term receivables were recorded at 4,830.6 billion VND, contributing 27.2% of total assets; cash and short-term financial investments totaled 2,964.4 billion VND, comprising 16.7% of total assets.

DIC’s total debt increased by 36.2% compared to the beginning of the year, equivalent to an increase of 1,127 billion VND, reaching 4,238.7 billion VND. Among this, the company’s outstanding bonds accounted for 2,444.4 billion VND as of the end of March 2024.

In a separate event, DIC Corp successfully held its 2024 annual general meeting of shareholders (AGM) on April 26.

At the AGM, DIG approved its 2024 business plan, aiming for consolidated revenue and other income of 2,300 billion VND, a 72% increase compared to 2023. Pre-tax profit is targeted to be 1,010 billion VND, a 508.9% surge from the previous year’s actual results. This is the third year in a row that DIC Corp has set a profit target of over 1,000 billion VND. However, the company missed these targets in each of the previous two years.