Market liquidity slightly decreased compared to the previous trading session, with the trading volume of VN-Index reaching over 1 billion shares, equivalent to a value of over 26 trillion dong; HNX-Index reaching over 107 million shares, equivalent to a value of over 2.2 trillion dong.

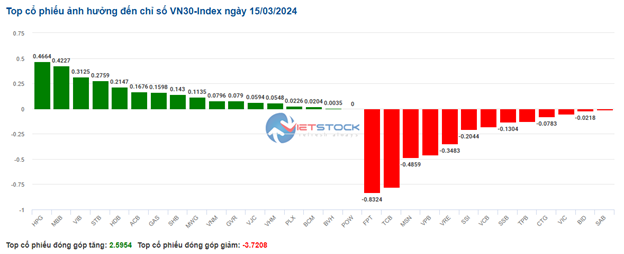

VN-Index opened the afternoon session quite positively with buying pressure appearing right from the beginning of the session, pushing the index to continuously recover and regain its green color. However, selling pressure unexpectedly appeared at the end of the session, causing the index to close below the reference level. In terms of impact, VIC, VCB, VHM, and VNM were the most negatively affected stocks, taking away nearly 3.7 points from the index. On the other hand, GVR, GAS, BID, and VIB were the most positively affected stocks for VN-Index with an increase of more than 3.8 points.

| Top stocks impacting VN-Index session 15/03/2024 |

HNX-Index also had a similar trend, with the index being negatively affected by stocks such as PVC (-2.03%), NTP (-1.53%), BVS (-1.51%), TNG (-1.32%),…

|

Source: VietstockFinance

|

The real estate sector saw the biggest decline in the market with -0.96%, mainly due to stocks like VHM (-1.17%), VIC (-3.37%), VRE (-0.58%) and BCM (-0.59%). Following that, the construction materials and technology and information sectors saw declines of 0.68% and 0.66% respectively. On the other hand, the consulting and support services sector experienced the strongest recovery with 3.59%, mainly driven by stocks like TV2 (+3.56%) and VNC (+9.15%).

In terms of foreign investor trading, they continued to net sell nearly 959 billion dong on HOSE, focusing on stocks such as HPG (173.85 billion dong), VHM (112.91 billion dong), VND (106.77 billion dong), and VIC (88.28 billion dong). On HNX, foreign investors net bought nearly 18 billion dong, focusing on PVS (19.28 billion dong), SHS (13.84 billion dong), and TIG (4.67 billion dong).

| Foreign investor net buy – sell activity |

Morning session: Tug of war ends, VN-Index returns to decline

VN-Index after a continuous seesaw in the first half of the morning session, returned to a decline. At the same time, foreign investors continued to sell strongly, indicating a more negative market sentiment. At the end of the morning session, VN-Index decreased by 6.53 points, equivalent to 0.52%. HNX decreased by 0.24 points, equivalent to 0.1%.

The trading volume of VN-Index recorded in the morning session reached over 456 million units, with a trading value of over 11 trillion dong. HNX-Index recorded a trading volume of nearly 54 million units, with a trading value of nearly 1.1 trillion dong.

Source: VietstockFinance

|

Mid-morning break, stocks like VCB, FPT, and BID were the most negatively affected, taking away nearly 2 points from the index. On the other hand, stocks like GAS, GVR, PGV were the most positively affected, contributing more than 1.2 points to the VN30-Index.

Most industry groups were in the red at the end of the morning session. Many large-cap industry groups were in the red, including the retail, food and beverage, and banking groups recorded significant declines. Other industry groups such as construction materials, real estate, and insurance also saw declines but at a lower rate. This shows that the stocks supporting the VN30 basket were the cause of a not so positive market in the morning session.

The seafood industry recorded quite negative signals at the beginning of the morning session. Most stocks in the industry such as VHC, ANV, ASM, FMC, IDI, CMX,… were mostly in red.

The retail group had a not so positive start as well, with major stocks in the industry all in red such as MWG down 0.74%, PNJ down 1.89%, and FRT down 2.73%.

Foreign investors continued to sell heavily, negatively impacting the morning session of VN-Index. On both HOSE and HNX exchanges, stocks like HPG, VHM, VPB, and VNM were the most heavily sold, accounting for a significant proportion compared to stocks like BID, KBC, STB, and SAB.

| Top 10 stocks with strong foreign investor net buy – sell activity in the morning session on 15/03/2024 |

10:40 AM: Tug of war around the reference level

Buying and selling forces on the market are relatively balanced, so the main indices have not yet broken out. As of 10:30 AM, VN-Index rose slightly over 2 points, trading around the 1,266 level. HNX-Index increased by 1 point, trading around the 240 level.

Stocks in the VN30 basket saw mixed fluctuations, but selling pressure was slightly more dominant. Specifically, FPT, TCB, MSN, and VPB took away 0.83, 0.78, 0.49, and 0.46 points from the index, respectively. On the other hand, HPG, MBB, VIB, and STB were being strongly bought, contributing more than 1 point to the VN30-Index.

Source: VietstockFinance

|

The banking and securities sector is facing strong selling pressure with major stocks: SSI down 0.4%, SHS down 0.52%, HCM down 0.7%, VCB down 0.32%, LPB down 0.3%, CTG down 0.15%, and VPB down 0.53%.

On the other hand, the real estate sector is exhibiting green colors quite well with the presence of notable stocks such as HDC hitting the ceiling, VHM up 0.12%, and BCM up 0.88%.

The plastics-chemical industry group also had a positive trend, with significant but concentrated trading in a few large-cap stocks. Among them, GVR rose 2.29%, DPM rose 0.56%, PHR rose 3.4%, DGC rose 0.31%, and LIX rose 2.07%.

Compared to the market open, the buying side was slightly dominant with 358 stocks increasing (21 hitting the ceiling) while 272 stocks decreased (11 hitting the floor). As of 10:30 AM, the total trading volume on all three exchanges reached over 395 million units, with a trading value of over 9.3 trillion dong.

Source: VietstockFinance

|

Market open: Cautious start

Red dominated the market at the start, with the VN-Index slightly decreasing and fluctuating around the reference level. Showing that investors are still cautious in the market.

VN-Index slightly decreased by nearly 3 points and traded around the 1,262 level; HNX-Index slightly increased to around the 240 level.

Red temporarily had the upper hand in the VN30 basket with 19 decliners, 6 gainers, and 5 unchanged stocks. Specifically, VRE, BID, and MSN were the stocks that decreased the most. On the other hand, VNM, BCM, and GAS were the stocks that controlled the market downtrend.

The banking sector stocks were one of the reasons for the downtrend of the market, with stocks like VCB, CTG, and BID all in slight red.

The energy sector showed positive signals at the beginning of the session, with notable stocks such as BSR up 0.52%, PVD up 1.22%, and PVB up 2.98%.