Large-cap group diversified, market struggling to find upward momentum. After a morning session of tug of war, light fluctuations around the reference, through the lunch break, selling pressure increased. VN-Index at times dropped more than 10 points.

Banking group adjusted together, VCB became the leading negative impact on the index. BID and CTG followed suit. On HoSE, no banking stock increased. The collective about-face of the largest market cap group made the overall market difficult and created a not-so-positive sentiment.

Red also made a comeback in the VN30 group , with 22 out of 30 stocks declining. The decline of the VN30-Index is nearly twice as large as the main index. The stocks that had strong gains recently all “gave back points” today. MWG suffered the sharpest drop with a rate of 2.7%, followed by MSN at 2.5% decline.

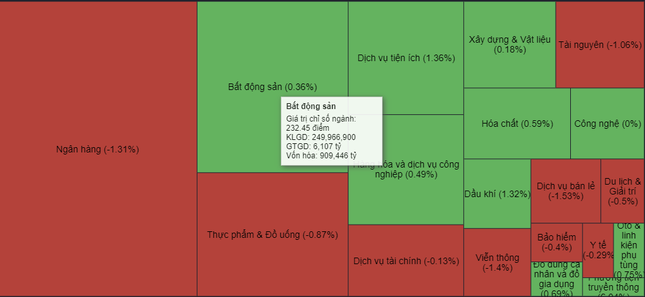

Real estate stocks unexpectedly attracted capital inflows.

While many large-cap banking stocks were adjusting, real estate stocks unexpectedly attracted capital inflows. The trading value of the real estate group was nearly twice as high as that of the banking sector, reaching over 6,100 billion VND. This morning, at the conference on the implementation of monetary policy tasks in 2024, many real estate business leaders expressed their desire to access lower-cost credit capital and reduce borrowing costs to create favorable conditions for business recovery.

Within the real estate group, IJC drew attention with its limit-up momentum, high liquidity stocks like DIG, GEX, KBC… remained in the green, although the rate of increase and contribution to the main index were still limited. On the other hand, NVL, VHM, PDR, and DXG declined.

Notable trading activities today came from the oil and gas group. Early this morning (March 14), Vietnamese time, Brent crude oil prices increased by about 3% to the highest level in 4 months as US crude inventories unexpectedly decreased. US gasoline inventories also decreased more than expected, and the supply disruption possibilities due to the impact of the Russia-Ukraine conflict. A series of stocks in the industry like PVS, PVD, PVC, GAS, PLX, BSR… were flooded in green.

Transportation and port group also performed better than the overall market, with VSC, HAH, VOS, DXP, VIP, GSP, SGP… experiencing gains. The new listing on HoSE, Viettel Post (VTP), continued to increase by the limit for the third session. Since being listed on HoSE, from March 12 until now, VTP has increased by 35%.

At the end of the trading session, the VN-Index decreased by 6.25 points (0.49%) to 1,264.26 points. The HNX-Index increased by 1.48 points (0.62%) to 239.68 points. The UPCoM-Index increased by 0.09 points (0.1%) to 91.62 points. The liquidity increased with a trading value on HoSE of over 26,790 billion VND. Foreign investors sold net 834 billion VND, focusing on VHM, VNM, FRT, SBT