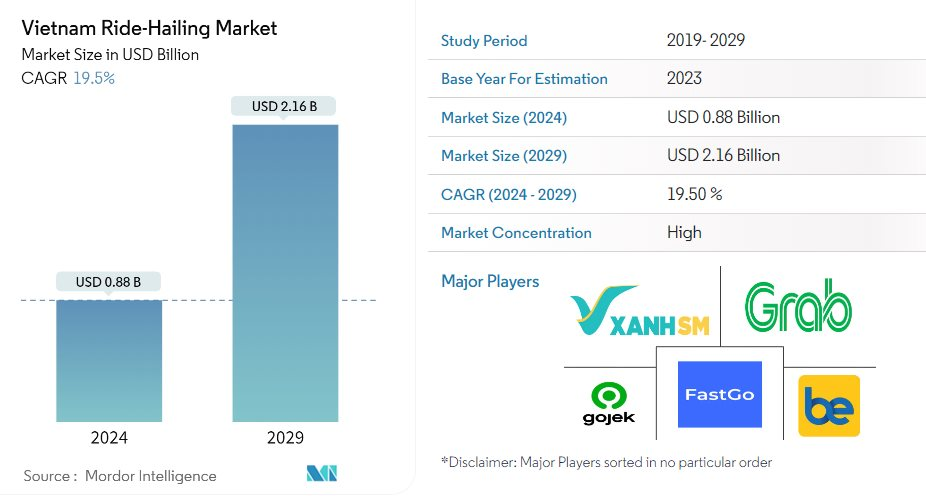

The Ride-Hailing Market is estimated to reach $0.88 billion by 2024

According to Mordor Intelligence, the ride-hailing market in Vietnam was valued at $727.73 million in 2023, estimated to reach $0.88 billion in 2024, and is projected to reach $2.16 billion by 2029, with a CAGR of 19.5% during the forecast period (2024-2029). This shows a promising growth potential for the market.

With the rapid urban population growth in Vietnam and the shortage of public transportation options, the increasing traffic congestion has led to a rise in demand for personal transportation methods in recent years.

The increasing preference of consumers to use personal transportation for travel purposes, as the demand for convenient personal mobility increases and the continuous influx of tourists to Vietnam, are the key factors driving the development of the ride-hailing market in the country.

Ride-hailing market in Vietnam

In addition, the increasing tourism and travel as well as the emergence of the younger population and tech-savvy individuals have continued to drive the adoption of ride-hailing services. Platforms like Xanh SM, Grab, and Gojek are emerging as dominant players in the digital space of the ride-hailing market in Vietnam.

Moreover, the ride-hailing and delivery market is becoming more competitive as the use of smartphones continues to rise, driving the demand for digital services. Recognizing the demand, companies in the industry are focusing on launching new services and investing in expanding ridesharing, delivery, and digital financial services, as well as venturing into new markets and segments of the consumer and transportation sectors.

Xanh SM - The TikTok Shop in the Ride-Hailing Industry

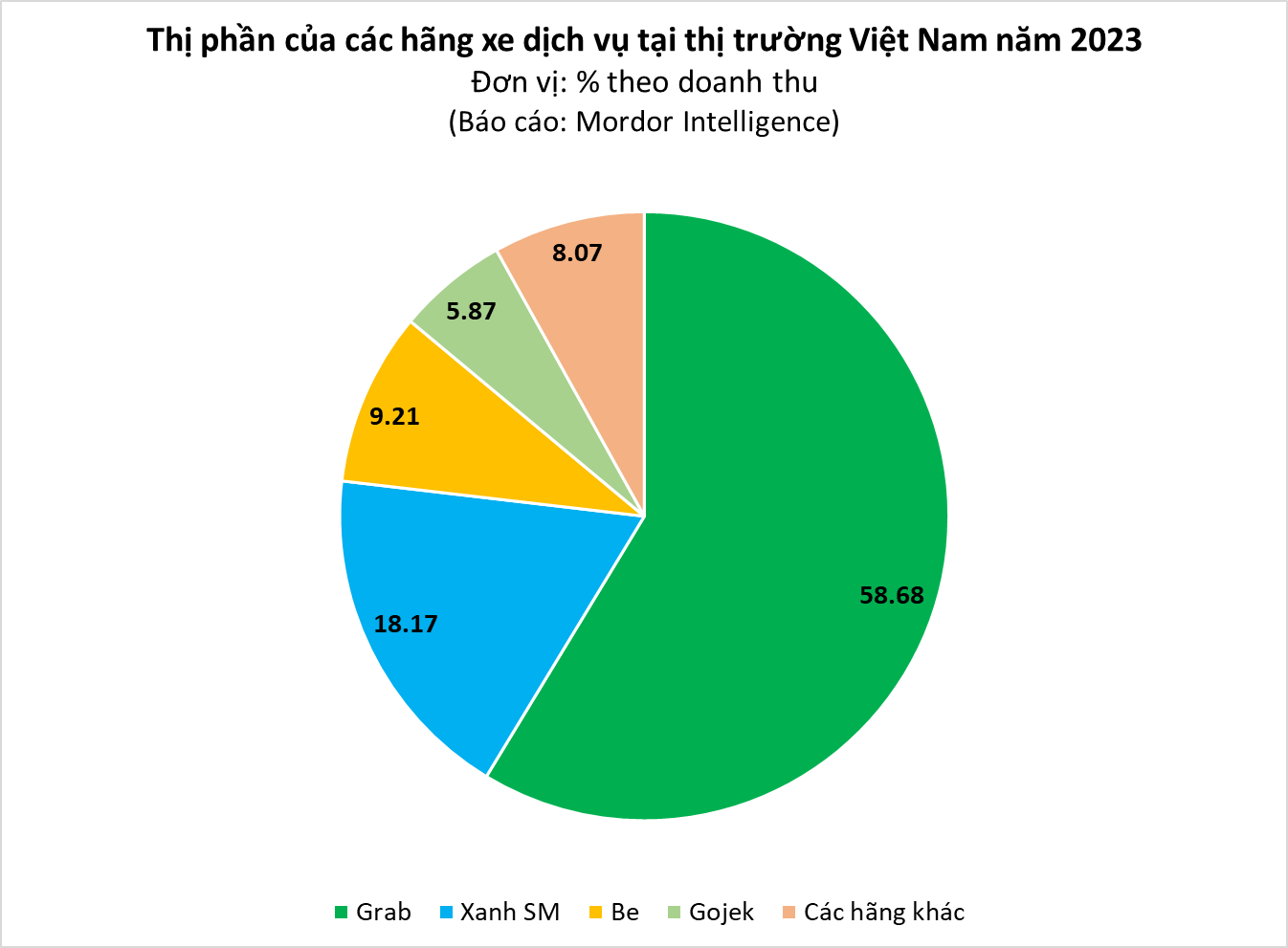

According to Mordor Intelligence, the “market share slice” of the ride-hailing market has significantly changed in terms of ranking and service provider market share in the past year. The largest slice of the market still belongs to the foreign giant Grab with nearly 60%, followed by Xanh SM, Be, Gojek, and FastGo.

It can be seen that the biggest threat to Grab comes from Xanh SM, the first pure electric taxi company in Vietnam. The emergence of Xanh SM in 2023 has revolutionized the domestic ride-hailing industry.

In particular, Xanh SM has quickly captured the second-largest market share in the market in Q4/2023, just over 7 months after officially entering the market. Especially, Xanh SM’s market share is now twice that of the previous second-place holder, Be Group (18.17% compared to 9.21%).

It doesn’t stop at electric taxis, Xanh SM has also quickly developed its ecosystem, with services such as fast delivery by VinFast electric vehicles, Xanh SM bike – electric motorcycle passenger transportation service, self-driving electric car rental service… Just counting the electric motorcycle passenger transportation service, it has reached over 1 million customers in just over 1 month since its launch.

From domestic operations, Xanh SM is also expanding its services to international markets. In early November 2023, GSM inaugurated the first pure electric taxi service in Laos under the Xanh SM brand. This is the first overseas market, launching the Go Green Global strategy, with the aim of becoming Xanh SM’s international pure electric transportation service provider.

In addition, Xanh SM is actively expanding its foothold in the market through the strong development of partnerships. The company has collaborated with several taxi companies across Vietnam, including Lado Taxi, Son Nam, Thanh Ha Transport, ASV Airport Taxi, En Vang, and Taxi Xanh Sapa.

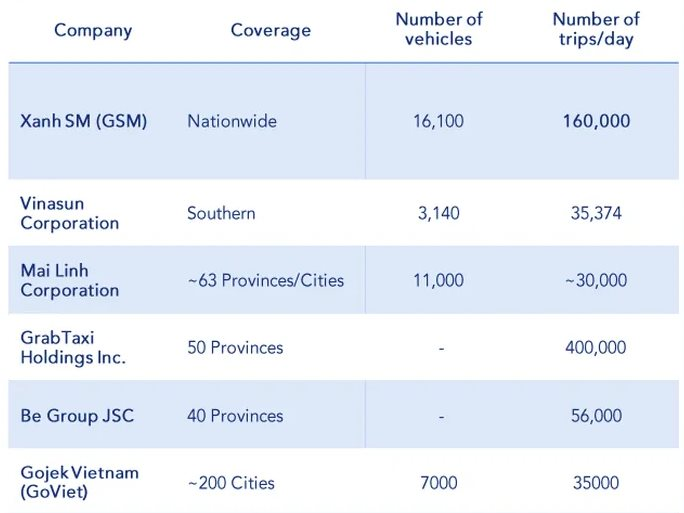

Mordor Intelligence recognized Xanh SM as leading in terms of the number of owned vehicles and daily number of trips in the traditional taxi field compared to self-owned fleet units. Compared to other units in both the traditional taxi and ride-hailing fields, Xanh SM is highly regarded for its service quality, coverage, fleet scale, and customer satisfaction.

In particular, Xanh SM is also collaborating with Be Group to create an even stronger momentum, helping to maintain its current market share and increase its competitiveness with leading platforms like Grab.