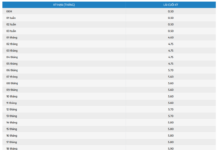

According to VietstockFinance, out of the 33 companies that have released their Q4/2023 financial statements on the HOSE, HNX, and UPCoM exchanges, 14 companies reported an increase in profit, while 19 companies experienced a decrease in profit (with 2 companies reporting losses). Considering the accumulated results, the number of profit-increasing companies reached 16, while 17 companies saw a decrease in profit (with 2 companies reporting losses).

The growth group: Cost reduction, record net profit

|

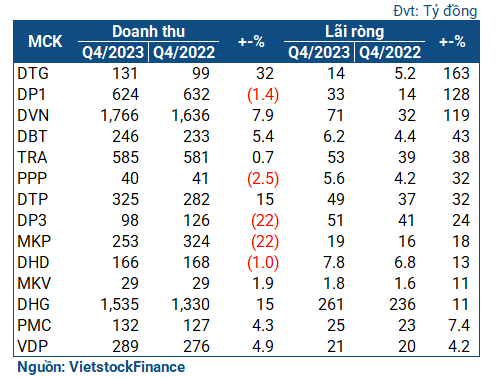

Business results of the profit-increasing group in Q4/2023

|

Tipharco (HNX: DTG) took the lead in terms of profit growth in Q4, with a net profit of 14 billion VND, 2.6 times higher than the same period last year. This also marks the highest quarterly profit in the past 14 years. According to Tipharco, this growth is attributed to efforts to increase revenue and optimize costs.

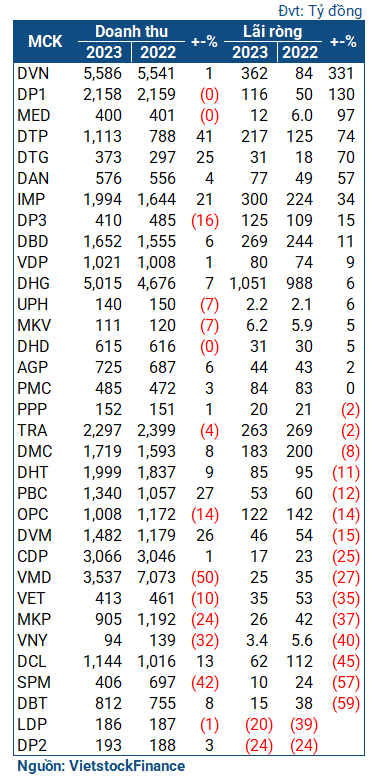

With these results, DTG achieved a 70% increase in profit in 2023, reaching 30 billion VND. The company also exceeded the after-tax profit target approved at the 2023 Shareholders’ Meeting by 3%.

Dược phẩm Trung ương CPC1 (UPCoM: DP1) ranked second in the list of profit-increasing companies in Q4. The company achieved a net profit of 33 billion VND, 2.3 times higher than the same period last year. The main reason for this growth was the good control of cost items. In the accumulated results for the year, DP1 recorded a profit of 116 billion VND, 2.3 times higher than the previous year, and the highest annual profit since its listing on UPCoM in 2018.

| DP1 achieved a solid profit in 2023 |

Dược Việt Nam (UPCoM: DVN) followed closely in the list of profit-increasing companies in Q4. The company achieved a net profit of 71 billion VND, 2.2 times higher than the same period last year. This growth was also attributed to increased revenue and significant reduction in costs (excluding business management expenses). Thanks to favorable business performance in previous quarters, DVN even reached a record annual profit since its listing on the stock exchange in 2017, amounting to 362 billion VND, 4.3 times higher than the previous year.

| DVN also achieved a record profit in 2023 |

Several major players in the pharmaceutical industry, such as Traphaco (HOSE: TRA) and Dược Hậu Giang (HOSE: DHG), also reported profit growth in Q4. Traphaco recorded a profit of 53 billion VND, a 38% increase, while Dược Hậu Giang achieved a profit of 261 billion VND, an 11% increase. In the accumulated results for the year, Dược Hậu Giang also recorded a record profit of over 1 trillion VND (a 6% increase compared to 2022). On the other hand, Traphaco, despite a slight 2% decrease in profit (263 billion VND), achieved the second highest annual profit since its listing in 2008.

Dược Bình Định (Bidiphar, HOSE: DBD) is a special case. In Q4, the company reported a 25% decrease in profit, reaching 59 billion VND, mainly due to a decrease in revenue and an increase in cost of goods sold. However, in the accumulated results, DBD had an impressive business performance with a net profit of 269 billion VND, an 11% growth, the highest level since 2008.

| Despite a decline in Q4, DBD achieved record results |

Similar to DBD, Imexpharm (HOSE: IMP) faced challenges in Q4 due to cost pressures, resulting in a slight decrease in profit to 72 billion VND (an 8% decrease). However, the company still achieved a record annual profit of nearly 300 billion VND, the highest level since its listing in 2006.

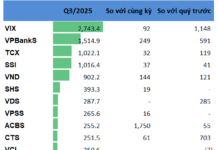

The declining group: Sales difficulties, significant profit decline

|

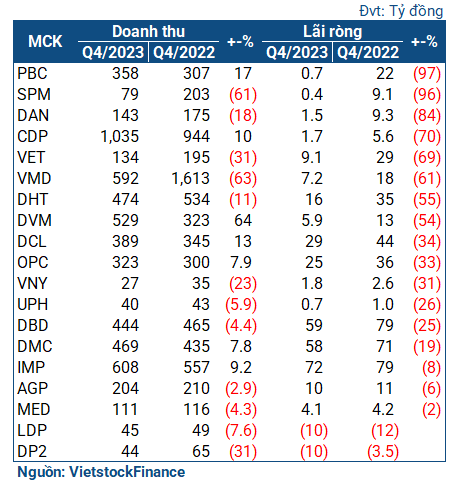

Business results of the profit-decreasing group in the pharmaceutical industry in Q4/2023

|

Q4/2023 also witnessed several companies experiencing significant profit declines. Pharbaco (UPCoM: PBC) led the pack with a 97% decrease in profit, reaching approximately 700 million VND. This was mainly due to a sharp increase in cost of goods sold caused by provisions for a batch of test kits worth nearly 8 billion VND, leading to a decline in gross profit. However, thanks to good business performance in previous quarters, PBC ended the year with a net profit of 53 billion VND, only about 12% lower than the previous year.

Next is SPM. In Q4, SPM saw a 61% decrease in revenue to 79 billion VND, and a 96% decrease in net profit to nearly 400 million VND compared to the same period last year. The company attributed these declines to difficulties in sales due to overall economic conditions, with reduced orders both domestically and for export. Additionally, selling expenses increased significantly due to discount programs aimed at boosting sales, leading to a decline in profit.

Q4 results also contributed to the overall decline in SPM’s performance for the year, with a net profit of 10 billion VND, a 57% decrease compared to the previous year.

Dược Hà Tây (HNX: DHT) also experienced a significant decline in profit, with more than half of its profit decreasing to 16 billion VND due to a decline in revenue and excessive business management expenses. Despite this, the company achieved a net profit of 85 billion VND for the year, an 11% decrease. However, it still exceeded the pre-tax profit target by 38%.

| Thanks to stable performance in previous quarters, DHT’s accumulated results only saw a slight decline and still exceeded the annual target |

Two companies reported losses in the period, namely Dược Lâm Đồng (Ladophar, HNX: LDP) and Dược phẩm Trung ương 2 (UPCoM: DP2). LDP had a loss of 10 billion VND (compared to a loss of 12 billion VND in the same period), while DP2 had a loss of over 10 billion VND (compared to a loss of 3.5 billion VND in the same period). Accumulated losses for the two companies were 20 billion VND and 24 billion VND, respectively.

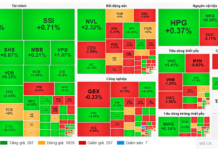

Accumulated results of pharmaceutical companies in 2023 |

Prospects for 2024: Legal breakthroughs

According to Mirae Asset Vietnam Securities, 2023 saw the approval of many legal documents that created major opportunities for the development of domestic generics, limiting imports from abroad, and promoting the production of generic drugs domestically. As a result, pharmaceutical manufacturing companies will benefit greatly in 2024 and the period until 2027.

Furthermore, Mirae Asset believes that the government’s direction to increase hospital bed ratio, nursing staff ratio, and improve financial autonomy mechanisms will help public hospitals enhance their preference for high-quality domestic drugs and promote the ETC (Ethical To Consumer) drug distribution channel within hospitals.

It is projected that the value of the pharmaceutical industry in 2024 will reach 7.89 billion USD (a 9.1% growth compared to the same period). In this, the ETC channel will experience stronger growth than the OTC (Over The Counter) channel, thanks to the nationwide health insurance coverage rate reaching 93%. The value of the ETC channel is projected to reach 6 billion USD in 2024, representing a 9.4% growth.