According to experts, the real estate market has gone through its toughest time. Although the mechanisms and policies aimed at “rescuing” the real estate market still need time to “permeate” and take effect, the market has started to show and record certain positive results.

Specifically, absorption rates in the two main markets, Hanoi and Ho Chi Minh City, improved simultaneously in the last 6 months of 2023. In Hanoi, both new supply and sales volume have been increasing noticeably through quarters, with an absorption rate of over 100%. In Ho Chi Minh City, the number of apartments sold in the second half of the year was over 101% higher than the first half. In addition, the absorption rate reached 108% compared to 59%.

In addition, housing demand is expected to improve in the coming months thanks to the average mortgage rates at commercial banks currently around 11% per year, down from 13-14% per year. Moreover, many financially strong developers have introduced favorable interest payment terms to support buyers.

VnDirect assesses that Vietnam is in the golden population period, with a high proportion of people in working-age and 31.5% of the population aged 25-44. Based on that, the “golden population structure” will become a driving force for the housing market’s development thanks to the positive growth prospects of the economy.

VnDirect predicts that the real estate market will rebound from 2024.

According to VnDirect, one of the growth drivers of real estate in the upcoming period is credit. Currently, the interest rate level for loans has dropped 2.0-2.5% since its peak. Developers not only have easy access to capital but also reduce the burden of borrowing costs. Furthermore, many financially strong developers have also offered payment terms with preferential interest rates to support the demand of homebuyers.

In conjunction with the average mortgage rates at commercial banks currently around ~11% per year, down from the peak of 13-14% per year. This is also the main driving force to boost the improving housing demand in the near future.

Additionally, VnDirect evaluates that the 15th National Assembly has passed three major amendments to real estate laws – including the Housing Law, the Real Estate Business Law, and the Land Law. The new laws are expected to take effect from January 1, 2025, and are predicted to support real estate activities from 2025.

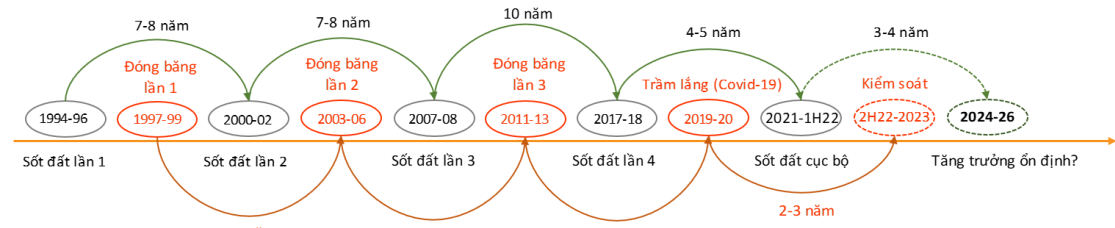

Regarding the signal of recovery in the real estate market in 2024, Mr. Le Hoang Chau – Chairman of the Ho Chi Minh City Real Estate Association (HoREA) said that in the first 2 months of 2024, the national and Ho Chi Minh City real estate markets continue to show steady recovery and growth. With the current recovery momentum, Mr. Chau assesses that the real estate market will return to normal operations and enter a safe, healthy, and sustainable development cycle from the second half of 2024, creating momentum for stronger development from early 2025 onwards.

Sharing the same perspective on the new stage of development in the market this year, representatives of Savills Vietnam also said that the Vietnamese real estate market has shown its ability to recover despite remaining difficulties and challenges. The combination of government policies and market dynamics will further help the real estate industry continue to grow and stabilize in 2024.

From the perspective of the state management agency, Mr. Hoang Hai – Director of the Department of Housing and Real Estate Market Management, Ministry of Construction, said that the real estate market has gone through the most difficult period. Overall, the real estate market is still very challenging at present, but the level of difficulty is gradually decreasing over time, with each month being better than the previous month, and each quarter being better than the previous quarter.