Oil prices fall

Oil prices fell on Friday, a day after reaching $85 per barrel for the first time since November, but were up 3% for the week.

Brent crude futures ended the session down 9 cents or 0.11% at $85.33 per barrel, while U.S. West Texas Intermediate (WTI) crude fell 17 cents or 0.21% to $81.09.

There are concerns that the U.S. Federal Reserve will not be able to “cut interest rates” as inflation remains above the central bank’s 2% target. Cutting interest rates is seen as an opportunity for increased demand in the U.S.

For the week, oil prices rose as the International Energy Agency (IEA) forecasted a 1.3 million barrels per day increase in global oil demand by 2024, up 110,000 barrels per day from last month. The agency also forecasted a slight supply deficit this year if OPEC+ members maintain their production cuts – previously, it had forecasted a surplus.

Gold slips slightly

Gold prices held steady on Friday as investors lowered expectations of a U.S. interest rate cut following data that showed a sharp rise in prices for the week.

Spot gold was little changed at $2,159.99 per ounce. For the week, spot gold was down 0.8%, marking its first weekly decline since mid-February after reaching a record high of $2,194.99 last week.

April gold futures fell 0.3% to $2,161.50.

This week’s data showed that U.S. consumer prices in February rose higher than expected and producer prices also indicated stable inflation rather than a decline.

The U.S. Dollar Index underwent its strongest weekly gain since mid-January, which put pressure on gold prices.

Iron ore continues to fall

Iron ore prices continued to fall on Friday, and also declined for the week due to investor sentiment worsening amid slowing spot iron ore demand and dim prospects for Chinese demand.

May iron ore futures on the Dalian Commodity Exchange (DCE) fell 3.46% to 781.5 Chinese yuan ($108.61) per tonne, the lowest level since August 22, 2023. For the week, prices were down 11%.

April iron ore on the Singapore Exchange fell 4.1% to $99 per tonne, the lowest level since June 1. For the week, prices were down 14%.

Mysteel data showed that surveyed iron ore inventories at 45 major Chinese ports rose 1% during the week to approximately 142.9 million tonnes as of March 15.

Steel prices on the Shanghai Futures Exchange also fell overall. Rebar steel fell 1.77%, hot-rolled coil steel fell 1.20%, and wire rod steel fell 1.09%, while stainless steel rose 0.22%.

Copper reaches record high

Strong fund buying pushed copper prices to a new high on Friday, but some investors and analysts remained cautious about China’s potential production cuts and whether the momentum can be sustained.

Three-month copper on the London Metal Exchange rose 1.9% to $9,057 per tonne, the highest level since April 2011.

China’s major copper smelters agreed to reduce operating capacity, adjust maintenance plans, and postpone projects, but some traders doubted any production cuts will take effect.

Natural gas rises on China’s new demand

Liquefied natural gas (LNG) prices in Asia edged up on Friday after holding steady this week, amid concerns over delayed cargoes due to poor weather in Australia and Asian buyers accepting lower prices.

The average LNG price for April delivery to Northeast Asia remained unchanged from the previous week at $8.60 per million British thermal units (mmBtu), the closest to its most recent high on April 30, 2021. However, the May contract price increased to $9 per mmBtu.

Rice declines

Asian rice prices generally declined this week. Indian 5% broken parboiled rice fell to $548-555 per tonne, down from last week’s $552-560, as buyers sought cheaper alternatives. On March 15, the Indian government announced it has extended the ban on non-basmati rice exports until July 31. India is the world’s largest exporter of non-basmati rice, which is used in animal feed.

Thai 5% broken rice also fell from $620 per tonne last week to $615 this week. Vietnamese rice increased slightly from $580 per tonne to $585 per tonne.

Rubber reaches 13-year high

Rubber futures in Japan extended their gains for the ninth straight session, closing Friday at their highest level in nearly 13 years. This marked the best week in over 3 years amid winter and weather concerns in major producing countries.

The August 2024 rubber contract on the Osaka Exchange (OSE) rose 19 yen or 5.71% to 352 yen ($2.26) per kg, its highest closing level since September 22, 2011. At the start of the session, prices reached 352.2 yen, their highest intra-day level since February 1, 2017. For the week, this contract rose 12.46%, the largest weekly gain since October 2020.

The May 2024 rubber contract on the Shanghai Futures Exchange (SHFE) in China rose 435 Chinese yuan to 14,790 Chinese yuan ($109.80) per tonne.

Coffee rises

May robusta coffee rose 0.9% to $3,308 per tonne.

Traders said the Vietnamese robusta coffee market has been one of the tightest in recent memory, while they added expectations for a 2-3% downward adjustment for the 2023/24 crop year.

May arabica coffee decreased 0.5% to $1.8295 per lb.

Cocoa at record high

Cocoa futures on the Intercontinental Exchange (ICE) rose on Friday amid concerns that tightening supply after Reuters previously reported that major cocoa plants in top-producing countries Ivory Coast and Ghana had either stopped or reduced operations due to a lack of funds to buy beans.

July cocoa traded on London exchange rose 5.4% to 5,775 pounds per tonne, after touching its recent peak of 5,799 pounds.

July cocoa traded on the New York exchange rose 6.9% to $7,224 per tonne, after reaching its highest level yet, that is $7,379.

Wheat and soybeans continue to fall, corn rises

Chicago Board of Trade (CBOT) wheat and soybean futures fell on Friday due to abundant global supply and weak demand.

Corn futures rose following news that U.S. private sector sold 125,000 tonnes of corn for new crop 2023/24 to unknown destinations.

May wheat futures traded on the Chicago exchange fell 1-1/4 US cents to $5.31 per bushel.

May soybean futures fell 2.5 cents to $11.92-3/4 per bushel, while corn rose 4 cents to $4.37-3/4 per bushel.

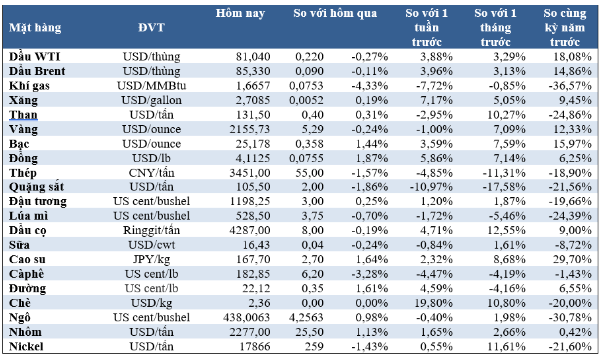

Key commodity prices on March 16: