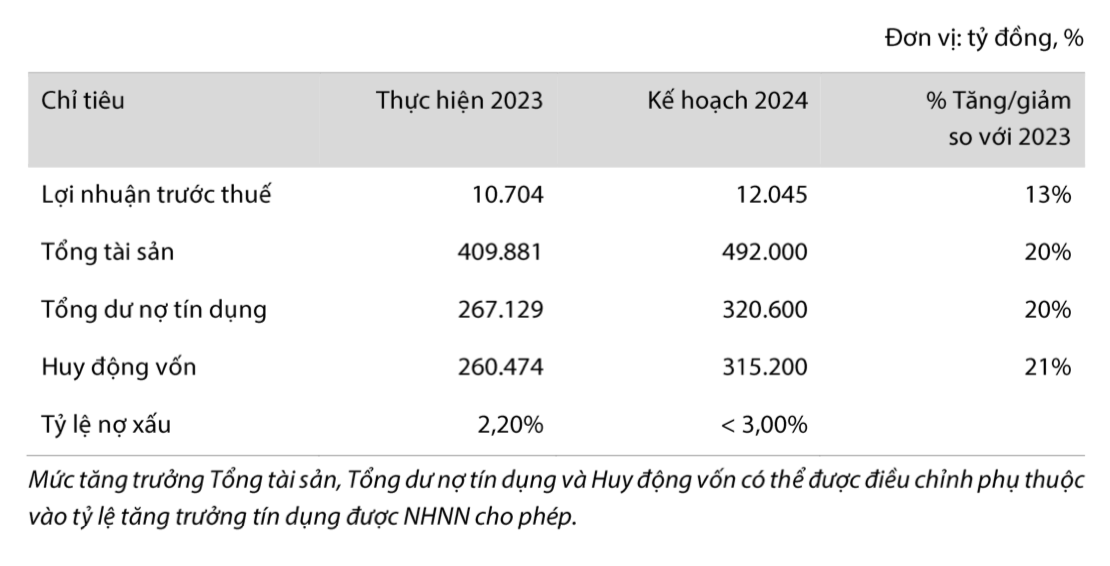

Regarding the business plan for 2024, VIB will present to shareholders the target of pre-tax profit reaching VND 12,045 billion, a 13% increase compared to 2023. Total assets are expected to increase by 20%, reaching VND 492,000 billion by the end of 2024. Credit outstanding is projected to increase by 20%, reaching VND 320,600 billion. Capital mobilization is expected to grow by 21% to VND 315,200 billion. The non-performing loan ratio is controlled below 3%.

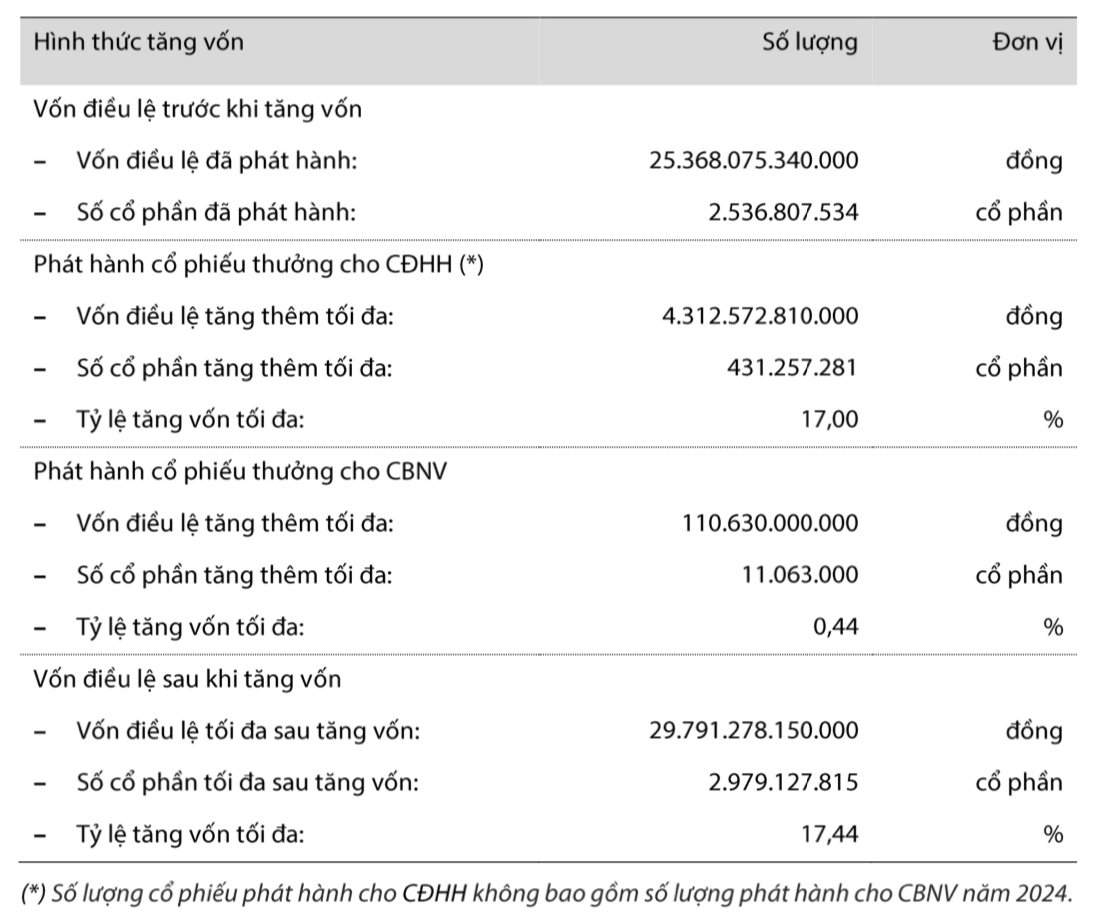

At the shareholders’ meeting, VIB will propose a 2024 increase in charter capital. Specifically, the bank will issue 431.3 million bonus shares to existing shareholders, equivalent to a 17% ratio, contributing to an additional VND 4,312.6 billion in charter capital. In addition, VIB will also issue 11.1 million bonus shares to employees, equivalent to a 0.44% ratio, contributing to an additional VND 110.6 billion in charter capital.

Bonus shares for shareholders are not restricted from transfer, while the shares for employees are restricted from transfer within 1 year.

After completion, VIB’s charter capital is expected to increase from VND 25,368 billion to VND 29,791 billion, corresponding to a capital increase ratio of 17.44%.

Along with the 17% bonus shares, VIB also plans to distribute cash dividends with a maximum ratio of 12.5%. Specifically, the bank will distribute dividends in two installments: 6% interim dividend in cash and 6.5% final dividend in cash. The total amount used to pay cash dividends is VND 3,171 billion.

The first interim dividend in cash has been approved by VIB’s General Meeting of Shareholders at the end of 2023 and has been paid on February 21, 2024.