Regarding the case of a customer of Eximbank in Quang Ninh province who opened a credit card and accumulated a debt of over 8.5 million VND but did not make any payments, which eventually grew to over 8.8 billion VND, causing a stir in public opinion, on the afternoon of March 14th, Mr. Pham H.A. (residing in Ha Long city, Quang Ninh province), the customer mentioned in Eximbank’s debt reminder notice, affirmed that he is the victim in this case.

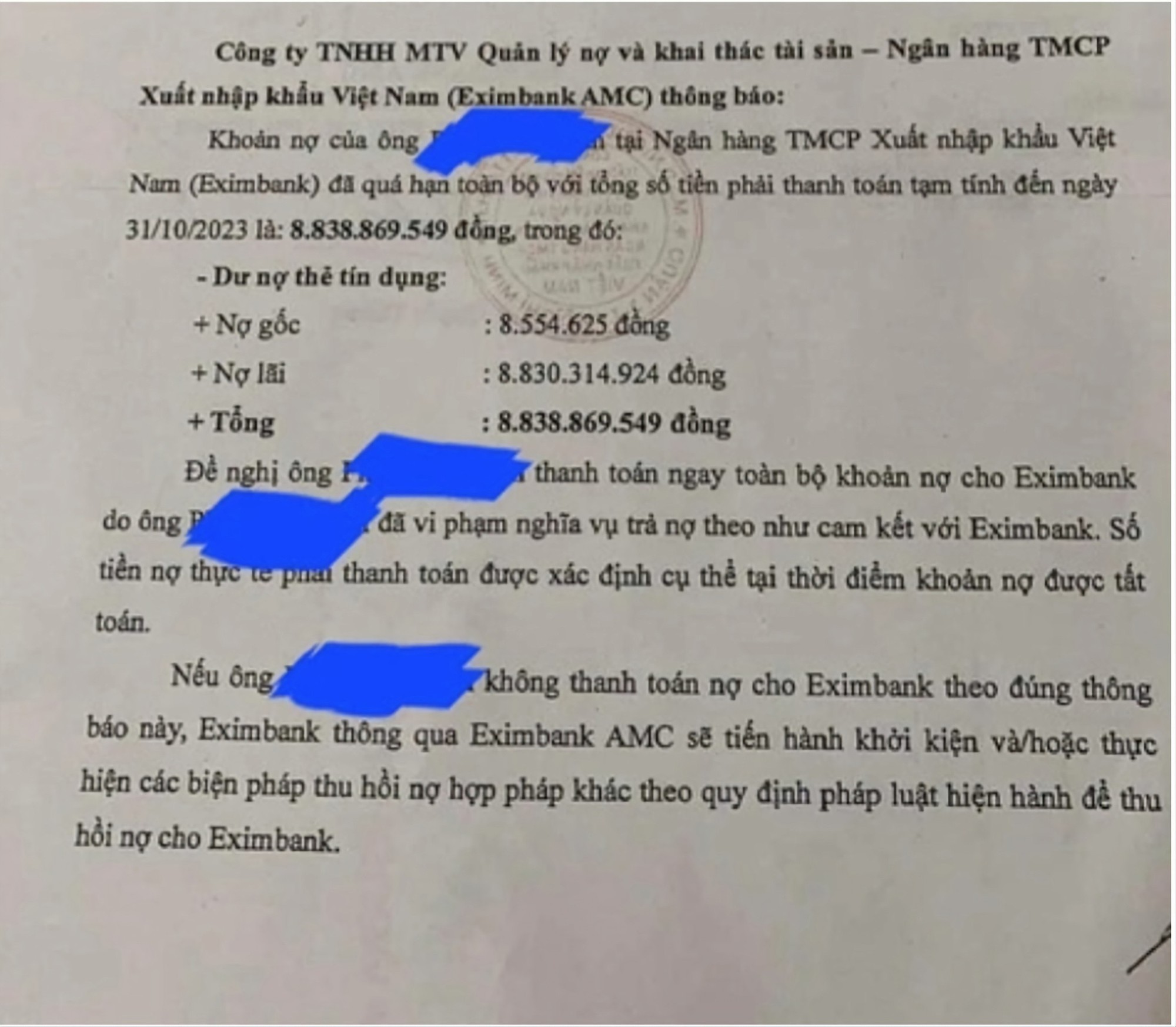

Eximbank AMC’s debt reminder notice sent to customers causing a stir in public opinion

According to Mr. Pham H.A., around March 2013, he asked a staff member named Giang at Eximbank’s branch in Quang Ninh to open a credit card for him, but in reality, he did not receive the credit card afterwards.

“In the past, when opening a card like this, customers often signed first. The staff member named Giang gave me the card opening documents to sign and about 1-2 weeks later, he asked me to go to the branch headquarters, but I was asked to wait outside while Giang went inside to bring me the card receiving documents for signing. After I finished signing, Giang gave me a regular bank card. At the same time, he mentioned that my salary of around 5 million VND was too low so he needed to consult his boss, and there is a possibility that it will be approved and he will contact me again. But afterwards, he never contacted me again, so I thought it didn’t work out and let it go” – Mr. A recounted.

Mr. A added that more than 4 years later (in 2017), when he needed to borrow money, he was shocked when the bank informed him that he had a bad debt at Eximbank. Immediately after that, Mr. A proactively went to Eximbank’s branch in Quang Ninh to verify the situation, and the branch manager informed him that the responsibility lies with Mr. Pham H.A. because he had signed for the card.

“I questioned why when interest and late payments occurred, they did not inform me immediately? Why in the card opening documents, there was an additional phone number that does not belong to me, which was written next to my phone number? Did the bank try to contact the other phone number, which is not mine, and could not reach anyone? I asked why they didn’t contact the other phone number that I’m currently using, but the bank couldn’t provide an answer” – Mr. A said.

Mr. A also mentioned that the bank did not send any notifications to his home address. Only 4 years later, when he had a need to borrow money, did he discover this bad debt. “The bank did not send any notifications, which is no different from covering up for the former employee (the staff member named Giang) and pushing the customer into a difficult situation, suffering losses” – Mr. H.A. expressed his indignation.

Mr. Pham H.A. provided further information that at that time, he proposed a solution to accept the consequences by returning the original amount of 10 million VND in the credit card and paying an additional 10 million VND as a penalty fee, even though he never spent that amount and did not know whether this credit card actually existed. However, the bank did not agree and forced him to pay the full amount of both the principal and interest, which amounted to over 110 million VND at that time.

In response to this incident, since 2017, Mr. A has filed a complaint about the bank not sending notifications regarding the credit debt to customers. The bank also responded in writing that they had sent notifications, but so far they have not been able to prove that they sent notifications in any form.

It’s worth noting that when Mr. Pham H.A. requested a statement of account, he noticed that there were interest payments in the first month, so he asked to investigate who made the interest payments and through what means, but the bank did not respond.

According to Mr. Pham H.A., in his last meeting around mid-2022 with a bank representative, he requested clarification on the signs of fraud committed by the staff member named Giang and was willing to pursue the matter to the end to clarify the situation.