Market liquidity increased from the previous trading session, with the VN-Index‘s matched trading volume reaching over 819 million shares, equivalent to a value of more than 19 trillion VND. The HNX-Index also saw an increase in liquidity, with a trading volume of over 100 million shares, equivalent to a value of over 2.2 trillion VND.

The VN-Index opened the afternoon session on a less optimistic note as selling pressure continued to dominate, causing the index to weaken. However, buying support quickly returned, helping the VN-Index recover and surpass the reference level by the end of the session. In terms of impact, HPG, GAS, PLX, and MSN were the most positive influences on the VN-Index, contributing over 1.4 points to the index. On the other hand, VPB, NVL, and HVN were the most negative influences, taking away more than 1.3 points from the index.

| Top 10 stocks impacting the VN-Index on May 8, 2024 |

The HNX-Index followed a similar trajectory, positively influenced by PVS (5.39%), MBS (2.52%), VIF (3.07%), SHS (1.06%), and others.

|

Source: VietstockFinance

|

The mining industry witnessed the strongest growth, with a 3.68% increase mainly driven by PVS (+5.39%), PVD (+3.44%), and PVT (+9.8%). This was followed by the construction materials industry and the plastics and chemicals manufacturing industry, with growth rates of 1.5% and 0.88%, respectively.

On the contrary, the other financial industry witnessed the sharpest decline in the market, falling by -1.13%, mainly due to losses in IPA (-2.08%) and OGC (-1.5%).

In terms of foreign trading, foreign investors net sold over 1,406 billion VND on the HOSE exchange, focusing on VHM (917 billion), TCB (119 billion), and PVD (72 billion). On the HNX exchange, foreign investors net bought over 70 billion VND, mainly investing in IDC (70 billion) and MBS (15 billion).

| Foreign trading activities on the HOSE exchange |

Morning Session: VN-Index‘s Recovery Effort Falls Short, Index Returns to Negative Territory

Despite a brief recovery and return to green territory, the index failed to maintain its gains and slipped back into the red by the end of the morning session. At the close of May 8, the VN-Index stood at 1,247.2 points, a decrease of 1.43 points from the previous session. There were 31 stocks that hit the ceiling price, 312 stocks that increased in price, 916 stocks that remained unchanged, 336 stocks that decreased in price, and 12 stocks that hit the floor price.

Market liquidity showed improvement compared to the previous session and was expected to surpass the 20-day average by the end of the afternoon session. As of the morning session, liquidity on the HOSE exceeded 10.5 trillion VND, accounting for more than 70% of the previous session’s liquidity of 15 trillion VND.

Many bank stocks remained in negative territory, including VCB, CTG, VPB, MBB, ACB, HDB, VIB, STB, and others. Conversely, SHB stood out with a positive gain of over 2%, while TCB‘s upward momentum narrowed to a gain of nearly 1.1%, EIB rose nearly 2%, and BID inched up 0.4%.

Several real estate stocks witnessed sharp declines in the morning session, including NVL, KDH, PDR, NLG, and DXG. On the other hand, stocks like TCH, HDG, and NTL managed to stay in positive territory.

In the retail group, HAX was the standout performer, with a notable gain of 3.45%. Other stocks in this sector, such as MWG, PNJ, and FRT, were all in the red.

Meanwhile, a few large-cap stocks like PLX, SHB, and SAB maintained their upward momentum.

10:45 am: Regaining the Reference Level

Buying and selling forces in the market were relatively balanced, resulting in a lack of significant breakthroughs for the main indices. As of 10:40 am, the VN-Index had gained 0.79 points, trading around the 1,249-point level. The HNX-Index, on the other hand, had climbed 1.61 points to trade around 234 points.

Within the VN30 basket, red dominated, with only a handful of stocks managing to stay in positive territory. Specifically, VPB, FPT, MBB, and ACB were the biggest detractors from the index, taking away 1.14 points, 1.04 points, 0.83 points, and 0.67 points, respectively. Conversely, MSN, SAB, SSI, and PLX were among the most bought stocks, contributing more than 1 point to the VN30-Index.

The retail and real estate groups faced strong selling pressure, with prominent names such as MWG falling by 0.84%, PNJ declining by 0.61%, FRT dropping by 1.16%, VHM slipping by 0.73%, VIC decreasing by 0.44%, VRE falling by 1.07%, and NVL plunging by 5.14%.

On the flip side, the mining sector emerged as a strong supporter of the market’s upward trend, driven by the three oil and gas giants: PVS, PVD, and PVT. PVS rose by 5.88%, PVD climbed by 5.26%, and PVT hit the ceiling price after news that the Vietnam Oil and Gas Group (PVN) had announced the discovery of two new oil and gas fields at the Rồng and Bunga Aster mines.

From a technical perspective, PVT‘s price surged and formed a Rising Window candlestick pattern, accompanied by a significant increase in volume that surpassed the 20-day average. This indicated heightened trading activity among investors. Currently, PVT‘s price has rebounded after successfully retesting a long-term trendline support and is now testing the October 2023 high (which also coincides with the 50% Fibonacci Projection level). The positive MACD crossover further reinforces the long-term upward trend.

Source: stockchart.vietstock.vn

|

Following the mining sector’s lead, the securities sector also posted impressive gains. Notable mentions include SSI, which rose by 0.98%, VCI climbing by 1.25%, HCM surging by 1.8%, SHS advancing by 1.6%, and FTS rallying by 2.37%.

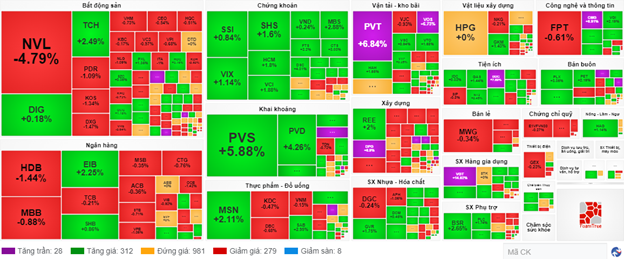

Compared to the opening, buyers and sellers engaged in a fierce tug-of-war, with over 980 stocks unchanged and buyers slightly gaining the upper hand. There were 312 stocks that decreased (including 28 that hit the ceiling price) and 279 stocks that increased (including 8 that hit the floor price).

Source: VietstockFinance

|

Opening: Market Plunges into the Red

The market opened on a negative note, with red dominating across all sectors. The VN30 index was the most negatively impacted, with almost all stocks in this group trading in negative territory.

As of 9:30 am, red dominated the VN30 basket, with 28 stocks declining, 1 stock increasing, and 1 stock unchanged. The biggest losers included MBB (-1.32%), MWG (-0.67%), VRE (-1.28%), VJC (-0.93%), and HPG (-0.33%). On the bright side, PLX (+2.07%) was the top gainer.

The real estate sector also witnessed a sharp decline of 1.67% in the early morning session, with prominent names such as VIC, VHM, BCM, NVL, KDH, KBC, DXG, and DIG all trading in negative territory.

The securities sector also started the trading day in the red, with stocks like VND falling by 1.19%, VIX slipping by 0.86%, SHS declining by 1.06%, VCI dropping by 0.28%, BSI decreasing by 0.36%, and VCI edging down by 0.1%.