In a conversation with PV Tien Phong, a leader of the State Bank of Vietnam (SBV) said that banks have the autonomy in their business operations, the State Bank of Vietnam does not manage this matter. The issue lies in the interest calculation, Eximbank is not the first bank to encounter this situation, there have been cases of other banks filing lawsuits against customers.

“In the credit card issuance contract, the interest rate is clearly stated, but the issue is how the principal and interest amount to 8.8 billion VND? So it needs to be clearly understood that, in the case of credit card spending, if the full payment is made, there is no problem, but if only the minimum payment is made, the interest rate is already 18-25% per year, very high. If payment is not made on time, the entire loan amount will be subject to overdue interest, 1.5 times the normal rate. Interest begets interest for 11 years,” the SBV leader said.

According to this representative, with the case of customer P.H.A sharing that they did not receive a credit card, did not use the card but still incurred a debt, it is necessary for the police to investigate whether there was fraudulent card issuance or not. The State Bank Inspectorate of Quang Ninh Branch has requested Eximbank’s Quang Ninh branch to report on the incident.

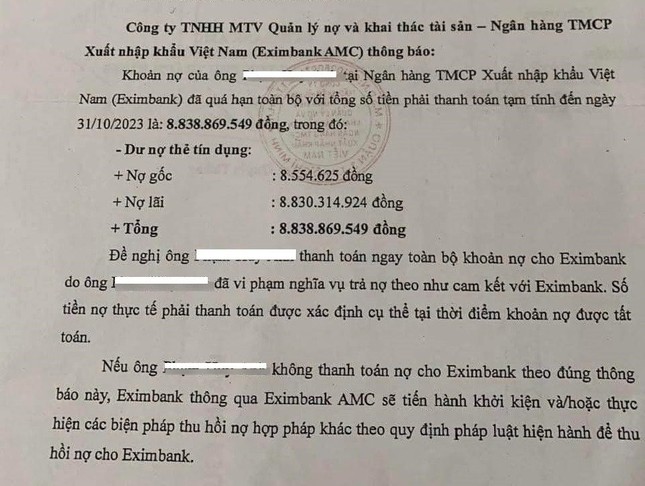

Debt reminder letter sent by Eximbank AMC to customer P.H.A.

In the role of the SBV, the representative said that if this civil dispute is brought to court and the court requests the SBV to confirm whether the bank’s interest calculation is correct or not, then this agency will respond. As for participating in civil disputes, it is not within the jurisdiction of the SBV.

Prior to the incident at Eximbank, SBV leaders also advised credit card users to carefully read the interest rates and calculation methods stated in the card issuance contract signed by the cardholder. “Not everyone is qualified to be issued a credit card, and the bank checks to ensure the cardholder’s ability to spend before paying later. Credit cards are not bad, they have many benefits, interest-free for 45 days, but customers need to understand thoroughly when using them to avoid bad debts,” the representative emphasized.

Earlier, as reported by Tien Phong, the incident caused a stir in Quang Ninh in recent times when social media platforms spread the announcement from Eximbank AMC to customer P.H.A (located in Cam Tay Ward, Cam Pha City, Quang Ninh) with an outstanding debt of nearly 9 billion VND.

According to the content provided by Eximbank, customer P.H.A opened a MasterCard at Eximbank’s Quang Ninh branch on March 23, 2013 with a credit limit of 10 million VND and made 2 payment transactions on April 23, 2013 and July 26, 2013 at an accepting point of sale. Since September 14, 2013, the card debt has become bad debt, and the overdue period has been nearly 11 years as of the notification date.

Eximbank emphasized that, despite taking many measures to notify and work directly with the customer, Mr. P.H.A has not yet proposed a debt settlement plan. Regarding the propagation of the debt reminder letter on social media, Eximbank affirmed that issuing debt obligation notifications to customers is a normal business activity in the process of debt processing and recovery. Up to the present time, Eximbank has not received any payments from the customer.

In an exchange with the media, Mr. P.H.A. (the person named in the “overdue debt reminder letter” sent by Eximbank) confirmed that in 2013, he asked an employee of Eximbank’s Quang Ninh branch to open a credit card with a limit of 10 million VND. After signing the contract, the employee said that my salary was low (more than 3 million VND/month) and not enough to open a credit card, but they said they would ask the boss later. For a while, I thought I couldn’t get the card, but later found out that the card was still activated, and the employee had withdrawn money from the card for spending. After that, I learned that this employee had quit and gone elsewhere.