As reported by Bao Nguoi Lao Dong, customer P.H.A opened a Master Card at Eximbank Quang Ninh branch on March 23, 2013 with a credit limit of 10 million dong. This credit card generated 2 transactions totaling 8.5 million dong, but the customer has not made the payment.

Since September 14, 2013, the above-mentioned card debt has become bad debt, with an overdue period of nearly 11 years as of the announcement date. The total amount that the cardholder has to pay, including principal and interest calculated until October 31, 2023, is over 8.8 billion dong.

According to Eximbank, the interest calculation method and fees are completely in accordance with the agreement between Eximbank and the customer based on the card opening application dated March 15, 2013, with the customer’s full signature (fee and interest regulations are clearly stated in the Issuance and Usage Fee Schedule, which has been publicly posted on Eximbank’s website).

The information about the credit card debt, which started at 8.5 million dong and has now reached 8.8 billion dong after 11 years, has attracted the attention of many people, especially credit card users.

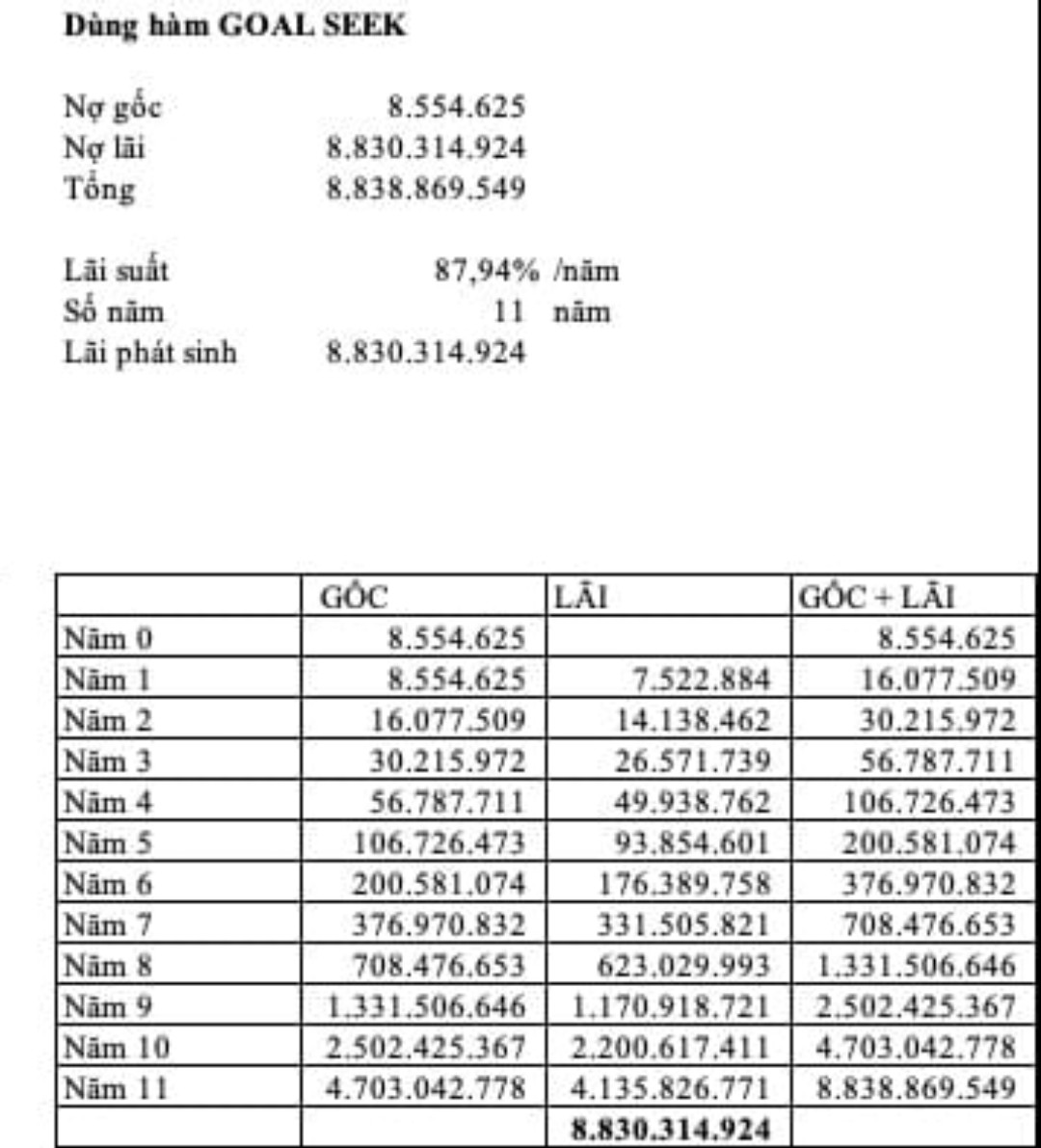

So what is the interest rate that Eximbank applies to customer P.H.A and how is it calculated to reach the amount of 8.8 billion dong?

According to research by Bao Nguoi Lao Dong, Eximbank’s stated credit card interest rate is 33% per year. Since credit card statements are usually issued monthly, the interest amount will be calculated monthly using the following formula: Monthly interest amount = Card debt x 33%/365 (days) x number of days the transaction occurred.

Additionally, each month, the customer will also incur late payment penalties, SMS banking fees, and other fees…

These interest and fees will become the end-of-period balance. In the following month, they will be calculated using the same formula. Every year, there will be an annual fee added to the debt, which will then continue to accrue interest…

Calculation of the initial 8.5 million dong debt interest rate

A finance expert shared with Bao Nguoi Lao Dong how to calculate the principal, interest, and monthly penalty interest for a credit card balance of 8.5 million dong, which, after about 11 years, has grown to over 8.8 billion dong.

Accordingly, the interest rate is fixed at 33% per year, but additional penalties, annual fees, etc., will be added to the principal and monthly interest (credit card statements are issued monthly), causing the debt to continue to increase each year.

“Credit card interest is calculated and compounded monthly. If the customer pays on time within the interest-free period of 45-55 days, there will be no interest or fees. But after this time, in addition to the credit card interest rate, there will be additional fees and penalty interest accumulated over the years, resulting in a very large amount. This is called compound interest.

Compound interest applies to savings deposits or securities investments and may generate significant profits if favorable. However, when applied to consumer loans such as credit card debt, it can be risky if not paid on time,” analyzed a financial expert.

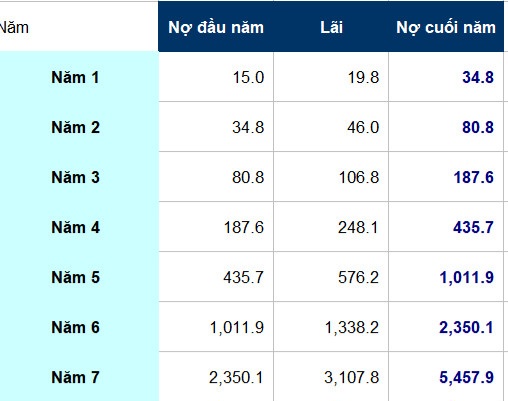

In a similar calculation as the above case, this is an illustration of another credit card debt with an initial balance of 15 million dong, a fixed interest rate of 33% per year, and a monthly penalty rate of about 5% per year. If the cardholder does not pay on time, in the first year, the principal and interest will be around 34.8 million dong, but with compound interest, the total principal, interest, and fees that need to be paid in the 7th year will reach… 5.45 billion dong.

Regarding the case between Eximbank and customer P.H.A, the latest information from the customer when responding to Bao Nguoi Lao Dong is that he affirmed he “was the one who suffered a loss by not spending the 8.5 million dong on the credit card”.

Eximbank said it is still working and cooperating with the customer to find a solution to handle the debt. Up to the present time, Eximbank has not received any payment from the customer.

Bao Nguoi Lao Dong will continue to provide updates on the case…