The exchange rate remains one of the factors putting pressure on the stock market. Photo: LE VU

|

The low interest rate environment always brings many opportunities for financial assets. Low interest rates make the opportunity cost of holding low-risk assets higher, and investment funds will seek attractive investment channels with higher returns.

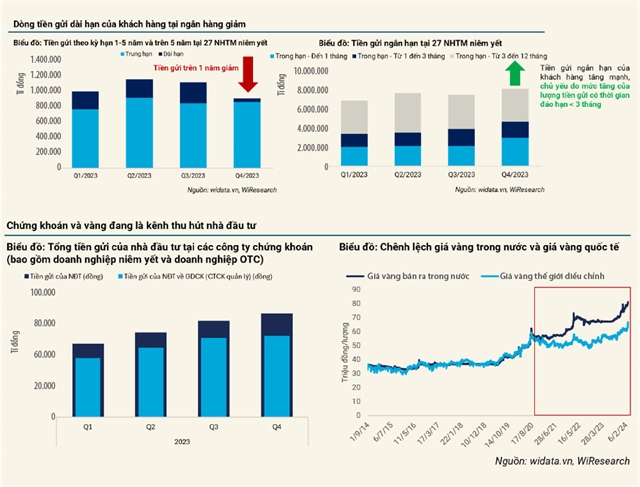

In the last quarter of last year, we read headlines about continuous strong deposit flows into the banking sector. However, we need to understand that the increase in deposits in the past period mainly came from new disbursed loans of commercial banks rather than idle money flowing into the banking system. According to statistics, a considerable amount of long and medium-term deposits from the public in the banking system have shifted to other investment channels. The chart shows a significant decrease in long and medium-term deposits in the entire banking system in Q4-2023 (a decrease of 18.64% compared to Q3). In particular, long-term deposits have declined sharply and an estimated 200,000 trillion VND of long-term deposits may have flowed into other investment channels. The increase in total deposits is mainly due to the increase in deposits with a term of less than one month, estimated at nearly one million trillion VND in Q4.

Stock investment channels are attracting investors

The stock market had a relatively good growth year in 2023, along with significantly improved liquidity in the final period compared to the beginning of the year. The deposit balance of investors at securities companies has continuously increased in four quarters of 2023. In Q4-2023, the deposit of investors at securities companies reached 83,340 trillion VND (an increase of over 8% compared to the previous quarter), in which the deposit of investors in securities trading (managed by securities companies) accounted for the majority, reaching 65,206 trillion VND. Therefore, the prospects of the stock market in the recent time will depend heavily on the trend of domestic individual investors.

|

In the first two months of 2024, VN-Index surged due to personal investors’ cash flow, with liquidity from this group accounting for over 92%. Market liquidity is much better than the average level of 2023 and is still mainly concentrated in large market capitalization groups and industries with cyclical and sensitive characteristics to economic recovery, such as banking, real estate, and finance.

According to the cyclical theory, in the economic recovery period, cyclical industries may experience a strong surge compared to other industry groups. The main question is whether Vietnam’s economic activities can sustainably recover before domestic demand, which is of great concern to investors. However, the cash flow is still a supportive factor for stock investors in this period as the loose monetary policy of banks is being maintained strongly.

Other financial assets are still hot

The gold price trend continues to be an important topic at present. Gold prices reached a historic peak in the first week of March at $2,141 per ounce. Gold continues to grow well and widen the gap between domestic gold prices and world gold prices. The Federal Reserve is gradually considering reducing interest rates, which provides more opportunities for gold prices to grow in recent times.

|

The group of highly speculative assets, such as gold, digital currency, is growing very hot, which will put pressure on bank deposits in the coming time, especially long-term deposits. |

The high gold price gap maintained for a long time shows that speculation in gold prices among individual investors is still very high, although the risk is also very high due to short-term volatility and high transaction costs between buying and selling prices. In the context that real estate investment channels are still difficult, a large amount of idle money may have flowed into the gold channel. To date, the price gap between domestic and international gold has continued to be maintained at a high level for over 18 months, and the price gap has shown signs of widening as domestic gold prices have increased sharply in recent days.

The group of highly speculative assets, such as gold and digital currency, is growing very hot, which will put pressure on bank deposits in the coming time, especially long-term deposits.

Real estate market liquidity is recovering

The liquidity of the real estate market has begun to soar in the first two months of the year as the number of transactions has increased sharply compared to the same period. The number of real estate transaction records in the first two months of the year was about 67,750 records, an increase of 18,801 records compared to the same period in 2023, equivalent to about 20%. This is a very positive recovery after four consecutive quarters of decline in 2023. Low interest rates and easy disbursed activities from banks have greatly improved real estate transactions.

The bond market is also showing signs of recovery, with issuance value in the first two months of the year increasing compared to the same period. However, the scale is still very small. Investors are still cautious with the bond market as asymmetric information is still high. Bonds are more suitable for professional investors with large investment value and the ability to understand the credit capacity of issuing enterprises rather than small retail investors.

Le Hoai An – Tran Thi Thu Uyen