Gold prices plunge

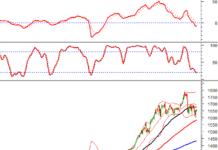

The gold price chart this morning has continuously decreased, making investors dizzy. In just a few hours in the morning, the price of SJC gold and gold rings dropped more than 1 million dong/tael and continuously broke previous historical milestones, surprising many people.

By 11am, Saigon Jewelry Co., Ltd listed SJC gold pieces at 79.3 – 81.3 million dong/tael for buying and selling, a decrease of 1.2 million dong/tael for selling compared to the early morning.

The rings of Bao Tin Minh Chau Co., Ltd listed at 68.28 – 69.68 million dong/tael, a decrease of 1.1 million dong/tael for selling compared to the early morning.

Gold prices drop sharply in the morning of March 3th.

In the international market, the price of gold has dropped 20 USD per ounce in the past 24 hours to 2.158 USD/ounce, converted according to the Vietcombank exchange rate equivalent to 64.55 million dong per tael. The price difference between pieces of gold and simple rings compared to the world is over 17 million dong and 4.5-5.5 million dong respectively.

The sharp drop in gold prices has prompted many people to buy. A representative of Bao Tin Minh Chau Co., Ltd said that at their business establishments, the amount of gold bought accounted for 55% while the amount sold accounted for the remaining 45%.

Mr. Dang Khoa (in Ba Dinh, Hanoi) said: “I took advantage of the decrease in gold prices to buy. I think the price of gold in the country has dropped because it has been hot in the past. But I expect that in the future, the price of gold will increase and break the previous records”.

Gold prices rise again?

In an interview with PV Tien Phong, Mr. Nguyen The Hung – Deputy Chairman of the Vietnam Gold Business Association – analyzed that this morning the domestic gold price dropped more than 1 million dong/tael, equivalent to the decrease in the world gold price.

According to Mr. Hung, if the world gold price does not break the 2,200 USD/ounce level, the world gold price will increase again; if it has already broken this level, the gold price will immediately decrease.

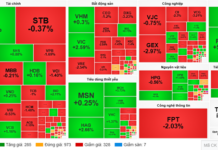

High demand shows that people still prioritize gold investment.

In the unpredictable gold price context, people still invest in gold. Mr. Hung believes that it is difficult to determine when the gold price will increase or decrease. However, at this time, people choose to invest in gold because other investment channels are not attractive: low interest rates, declining stocks, large capital requirement for real estate investment and no sign of recovery. These factors lead people to turn to buying gold.

“Meanwhile, the supply of gold is limited, and the large demand for gold will cause the gold price to rise again”, Mr. Hung said and added that currently the gold market has not had any macro impact, so the State Bank has not intervened.

Mr. Nguyen Nhat Minh – an expert from the Banking Research Institute, Banking Academy said that on the evening of 12/3, the world gold price unexpectedly dropped by more than 30 USD/ounce, from 2,181 USD/ounce at 7:30 pm (Vietnam time) to the lowest level of the day at 2,150 USD/ounce at 2 am on March 13, corresponding to a decrease of about 1.4%.

According to Mr. Minh, the cause of this sudden price drop comes from the Consumer Price Index (CPI) report for February of the United States announced yesterday. Accordingly, the core CPI index (excluding food and energy prices) increased for the second consecutive month, with an increase of 0.4%, after an increase of 0.3% in January. The US basic CPI increased by 3.8% in February, higher than the previous forecast of 3.7%. The February CPI index increased 3.2% compared to the same period last year, higher than the 3.1% recorded in January.

The higher-than-expected inflation rate in the US in February made investors worried that the US Federal Reserve (Fed) might postpone interest rate cuts and reverse its monetary policy from tightening to loosening, as mentioned by Fed Chairman Jerome Powell at a hearing before the Senate Banking Committee on March 7. Therefore, the gold price faced strong profit-taking pressure from investors.

“Similarly, in the country, in recent times, the gold price has continuously reached a historical peak, reaching the threshold of 82.4 million dong/tael at the end of March 12, 2024, causing the price difference between the domestic gold price and the world gold price to exceed 18 million dong/tael since the beginning of March until now, leading to profit-taking pressure from investors”, Mr. Minh said.