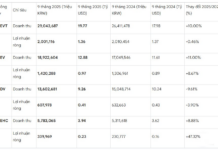

The total value of shrimp exports in January reached approximately $242 million, a 71% increase compared to the same period. Consumption demand is gradually warming up in the export market, especially in the Chinese market – Hong Kong, which has seen a strong increase after the country reopened trade after the Covid-19 pandemic.

In addition, the Japanese market is also a potential market due to consumers’ preference for high-quality products. This is in line with the production capacity of Vietnamese enterprises and also helps them compete more easily with cheap, unprocessed shrimp products from Ecuador and India.

Vietnamese shrimp exports to Japan reached over $37 million, a 30% increase compared to the same period in 2023 in January 2024. In the first month of the year, Japan was the third largest shrimp import market for Vietnam, accounting for 15.4% of the total.

According to Vasep, the Japanese market is expected to recover sooner than other major markets like the US and the EU in 2024. Japanese consumers demand delicious, nutritious, beautiful, elaborate processed products that are suitable for Vietnam’s processing capabilities. In addition, the Japanese market is geographically closer and payment methods are safer compared to the US and the EU.

Currently, value-added processed shrimp products account for 40-45% of the total value of annual shrimp exports. The overall processing level of Vietnamese shrimp enterprises is among the highest in the world, which is a competitive advantage of Vietnamese shrimp in the Japanese market. Vietnam is leading in the market share of high-end shrimp in Japan.

For the Australian market, as of February 15, 2024, Vietnamese shrimp exports to Australia reached over $23 million, a 48% increase compared to the same period in 2023. Australia is the fifth largest single market for shrimp imports from Vietnam, accounting for 7.5% of the total value of Vietnam’s shrimp exports to various markets.

Although it is the fifth largest shrimp consumption market in Vietnam, Australia is considered a potential market, especially as the demand for processed shrimp in this market is increasing. While the processing level of Vietnamese shrimp enterprises is constantly increasing, with an increasingly diverse range of products.

Despite having a relatively small population, only 25.7 million people, this is a potential market as people are willing to pay high prices for quality products and are open to imported goods.

On the occasion of the Special High-Level ASEAN-Australia Commemorative Summit and the visit to Australia by Prime Minister Pham Minh Chinh in early March, the two Prime Ministers of the two countries agreed to upgrade Vietnam-Australia relations to Comprehensive Strategic Partners, equivalent to relations between Vietnam and the US, Japan, Russia, India, and China. Both sides will promote market access measures and create favorable trade conditions for both countries in the agricultural and seafood sectors.

With the positive information in the cooperation between the two sides, the economic situation is gradually improving. It is expected that shrimp exports to the Australian market in 2024 will achieve promising results.

In the US market, consumer demand is expected to recover in 2024. US inflation has cooled down in 2023, with CPI in the US as of January 2024 at 3.1%, lower than the 3.4% in the previous month and close to the Fed’s target of 2%. In recent meetings, the Fed has also indicated that it will implement interest rate cuts in 2024 to stimulate business activities and trade. This will help stimulate consumer demand in the largest seafood import market for Vietnam.

Shrimp prices have also rebounded strongly amid optimistic export prospects. White-leg shrimp prices for 100 pieces/kg have increased. As of the end of January 2024, the price of this shrimp size was at about 84,000 VND/kg, a 15% recovery from the bottom. Meanwhile, prices for tiger shrimp have recovered more slowly, up about 3% to 97,500 VND/kg. This is a positive signal for shrimp farmers after a long period of keeping their shrimp quality due to low selling prices.

Meanwhile, shrimp production in India and Ecuador is declining, helping to reduce price competition for Vietnam. The production volume of these two major competitors decreased by 6.5% and 12.4% respectively in 2023 compared to the same period.

The reason is due to the surplus supply, resulting in lower prices in the markets, so shrimp farmers have reduced their farming areas to avoid losses. In addition, Ecuador is also facing a very unstable security situation with a significant increase in violence across the country. A business owner said that security incidents have made it difficult for staff to travel to shrimp farms, affecting the production process of businesses.

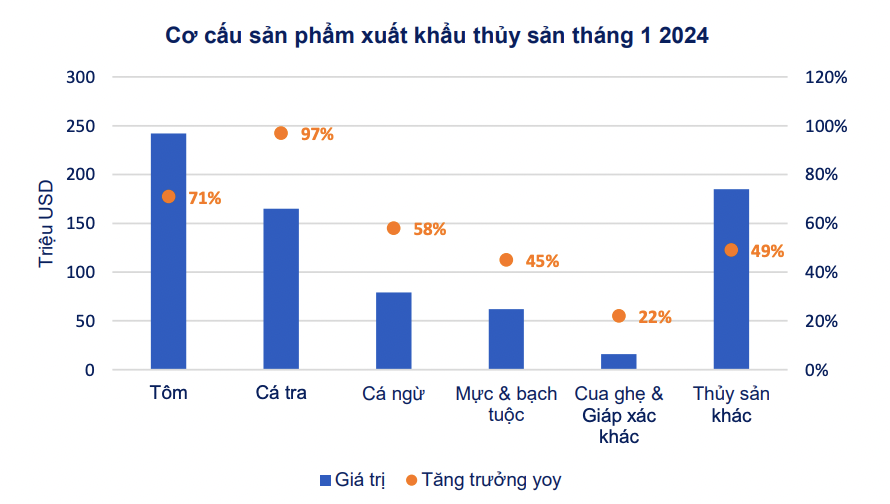

Ecuador’s exports in January 2024 reached 89,211 tons, a 6% decrease compared to January 2023. The export value decreased by 17% compared to the same period, reaching $432 million, in which Ecuador’s exports to China decreased by 14%.

In the face of these situations, the price competition pressure for shrimp exports from Vietnamese enterprises is expected to decrease due to the stagnant supply. The profitability of shrimp industry enterprises, after reaching a bottom in 2023, is forecasted to recover strongly in 2024. FMC and MPC are two large shrimp industry enterprises in the securities market. Their stocks are expected to rebound strongly along with the story of export value increase and price trends in 2024.