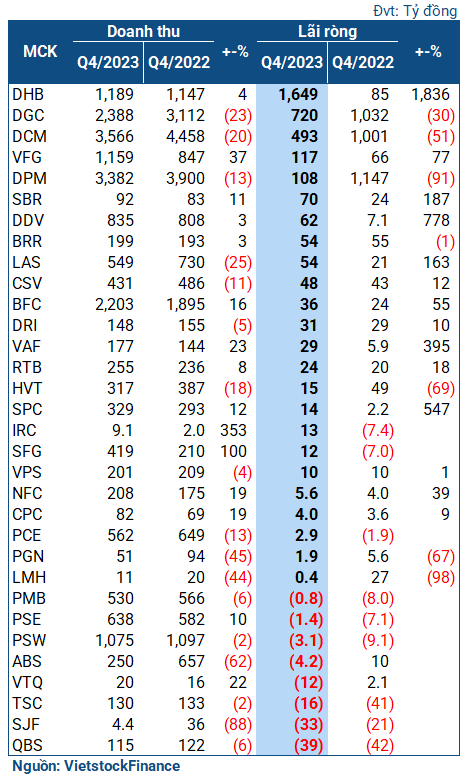

According to VietstockFinance, out of 32 companies that reported their Q4 results, 16 companies achieved profit growth, including 2 companies that turned losses into profits. The remaining 16 companies either witnessed a decrease in profit or had to report losses.

|

Q4 results of chemical companies

|

The contrasting story of the giants

Overall, most of the prominent names in the chemical and fertilizer industry acknowledged a decline in their Q4 results due to a high base of the previous year. However, the nature behind these ups and downs varies.

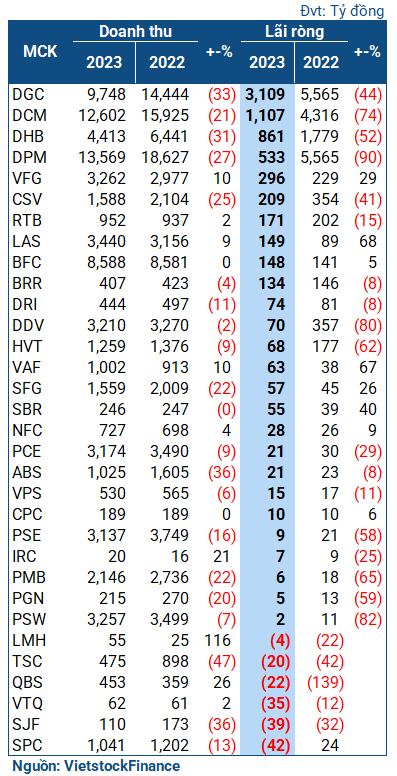

Ca Mau Fertilizer (HOSE: DCM) only achieved a Q4 profit of 493 billion VND, 51% lower than the same period last year. The reason is the sharp decrease in fertilizer prices, resulting in a decline in revenue together with increased business expenses for scientific and technological research. However, this result is not bad in reality, as the Q4 profit accounts for 45% of the accumulated net profit of the major ammonia producer (1.1 trillion VND, down 74%). The sales volume during the period also increased significantly, indicating a significant recovery of the company in the last quarter.

| The commodities boom in 2022 caused Ca Mau Fertilizer to end the year with a 74% profit decrease |

The decrease in fertilizer prices while fuel prices increased compared to the same period was the reason for the steep decline in profits of Phu My Fertilizer (PetroVietnam Fertilizer and Chemicals Corporation, HOSE: DPM). At the end of Q4, DPM only achieved a net profit of over 108 billion VND, a 91% decrease compared to the same period last year.

For the whole year of 2023, DPM recorded a net revenue of nearly 13.6 trillion VND and a net profit of over 530 billion VND, both of which saw a significant decrease compared to the previous year. However, the company has a very healthy financial situation with 6.8 trillion VND of cash and no short-term debts.

Duc Giang Chemicals (HOSE: DGC) also experienced a sharp decline in Q4 with a profit of 720 billion VND, 30% lower than the same period last year, due to a decrease in the selling prices of their main products. For the whole year of 2023, the company achieved a revenue of over 9.7 trillion VND, down 33% compared to the previous year, and a net profit of 3.1 trillion VND, a decrease of about 45%. However, in reality, the profit of the chemical giant in 2023 is the second highest in history. The decline is simply due to the high base of 2022, a period when the company benefited greatly from the global commodities boom.

| If not considering the sharp increase in 2022, Duc Giang Chemicals had a successful business year |

In contrast to the “giants,” Ha Bac Fertilizer (HNX: DHB) achieved a whopping profit of over 1.6 trillion VND in Q4, tens of times higher than the same period last year. However, in reality, the core business of DHB is still quite…poor, with a gross profit of only 65 billion VND, an 83% drop, and an after-tax loss of over 154 billion VND (compared to a profit of 85 billion VND in the same period). The reason for the company’s escape from losses is thanks to the amount received from the debt restructuring project at the Development Bank (over 1.8 trillion VND), which includes reduced interest rates, debt write-offs, and an extended loan term.

Due to the unexpected income in Q4, DHB turned the situation around for the whole year of 2023, making a profit of 861 billion VND, 50% lower than the previous year (the company had a net loss of 788 billion VND in the first 9 months of 2023). At the same time, it has almost achieved the profit target approved by the 2023 General Meeting of Shareholders (92%).

| Thanks to the sudden profit increase in Q4, DHB has turned the situation around to report nearly 900 billion VND profit in 2023 |

Mixed fortune

Q4 witnessed many companies in the chemical group reporting a significant increase in profit. For example, DDV (DAP – Vinachem) made a profit of over 62 billion VND, nearly 9 times higher than the same period last year, thanks to the increased consumption of DAP fertilizer despite the lower selling price. However, the overall result appears less favorable when the Q4 profit accounts for almost the entire achievement of DDV in 2023. The company ended the year with a net profit of 70 billion VND, down 80% compared to the previous year.

| Although the Q4 profit increased, the 2023 result of DDV still declined significantly |

Van Dien Melamine Fertilizer (VAF) achieved a net profit of over 29 billion VND in Q4, nearly 3 times higher than the same period last year. Most of the reasons are due to the company selling some assets from its construction investment projects in Thai Binh and recovering some difficult-to-collect debts. The remaining part is thanks to the increased production volume, which helped increase revenue. For the whole year, VAF made a profit of over 63 billion VND, a 50% growth.

Vietnam Germfree Co., Ltd. (VFG) also had a successful business period. The improved core business helped the company achieve a net profit of 117 billion VND, a 77% increase compared to the same period last year; a total profit of 296 billion VND, up 29%. These are the highest figures ever for the company, breaking the record set in 2022.

Southern Fertilizer (SFG) turned losses into profits in Q4. The company made a net profit of 12 billion VND, compared to a loss of 6.7 billion VND in the same period last year. For the whole year, SFG achieved a net profit of nearly 57 billion VND, a 12% increase compared to the previous year, surpassing the pre-tax profit target approved by the 2023 General Meeting of Shareholders by 35%.

On the other hand, many companies had to report losses. One notable example is Quang Binh Import-Export Company (QBS), which had the worst business quarter of the year, with a net loss of over 39 billion VND (compared to a loss of 42 billion VND in the same period). The company ended the year 2023 with a net loss of over 22 billion VND. Although this is a significant decrease from the nearly 139 billion VND loss in the previous year, the accumulated losses up to the present for the company have reached over 242 billion VND. This result also continues to subject QBS shares to control on HOSE.

|

Cumulative results of the chemical-fertilizer group in 2023

|

Not so positive for 2024?

According to the 2024 Prospect Report from VCBS, tight supply sources this year may cause a slight increase in global fertilizer prices. Domestic fertilizer prices fluctuate in correlation with global prices, based on factors such as China continuing to restrict urea exports to ensure domestic supply; Russia maintaining the policy of limiting fertilizer export quotas until May 2024 to protect the domestic market; and urea production in the EU is expected to remain low due to higher costs compared to importing from Egypt.

In the Middle East region, the Egyptian government has indefinitely extended the 30% reduction in natural gas supply for all its urea producers, significantly affecting global supply.

Based on these reasons, VCBS believes that the growth in fertilizer consumption in 2024 will be slower. Domestic consumption is expected to increase in Q1/2024 when entering the Spring crop season.

Chau An