Mr. Đỗ Thanh Sơn, Deputy General Director of Vietnam Joint Stock Commercial Bank for Industry and Trade (Vietinbank), made a statement at the Conference – Photo VGP/Nhat Bac

|

According to Mr. Sơn, shortly after the Government issued Resolution 33 and the Social Housing Loan Program, as a leading bank in the economy, Vietinbank has actively implemented and closely followed the project portfolio of provincial and municipal People’s Committees, as well as the guidance of the State Bank of Vietnam.

From April 01, 2023 to February 29, 2024, Vietinbank has provided financial support to 8 projects, including 3 projects that have signed credit contracts and disbursed a total of 423 billion VND, and financing for 5 projects, with a total scale of nearly 3,000 billion VND.

During the implementation process, Vietinbank has received great support from Ministries and Departments to effectively carry out the program. However, Vietinbank has encountered some difficulties:

The first is the legal barrier. Many projects lack the approved decision of the provincial/municipal People’s Committee; the procedures for implementing social housing projects are complex and take longer than commercial housing projects. Many projects are delayed due to land clearance and handover issues. The approval process for annual land use planning and land use conversion for agricultural land takes a long time and affects the project schedule.

The second is the profit interest rate limitation of the projects. The current regulations for social housing loans and workers’ housing loans are limited in profit interest rates, at 10%, which is not attractive enough for investors. Some social housing projects have been approved but have not attracted investors, and there is no specific plan and timeline for implementation.

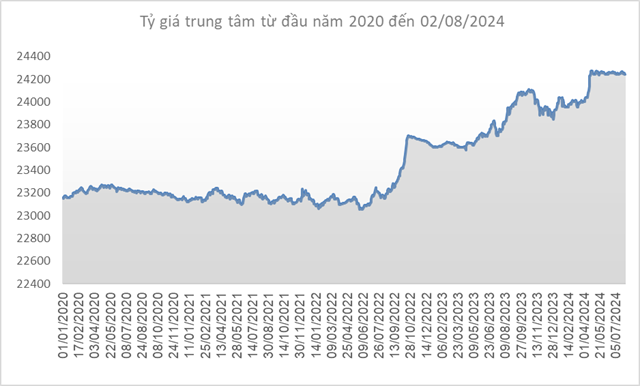

The third is the project funding source. The essence of the 120 trillion VND package is credit from the commercial capital of banks, without support from the State budget, including the confirmation of lending rates as well as the average commercial lending rates of 4 state-owned commercial banks. Although commercial banks prioritize resources for the program, the interest rate for investors and homebuyers is still not attractive compared to programs supported by the State budget.

Based on the above-mentioned difficulties, Vietinbank has some recommendations and proposals for ministries and departments:

First, to make the program more attractive and have a truly preferential interest rate that is more suitable for home buyers, social housing business enterprises, and renovation of old condominiums, it is proposed that the Government consider establishing a social housing development fund, with preferential funding for social housing development. Based on this preferential source, the lending interest rate can be lower than the normal commercial lending rate in the market. It is necessary to mobilize resources from various sources and the State budget plays a leading role.

Second, consider assigning the task of selecting homebuyers to project investors to increase initiative in the sales process, while expanding the target group and relaxing conditions for eligible social housing buyers.