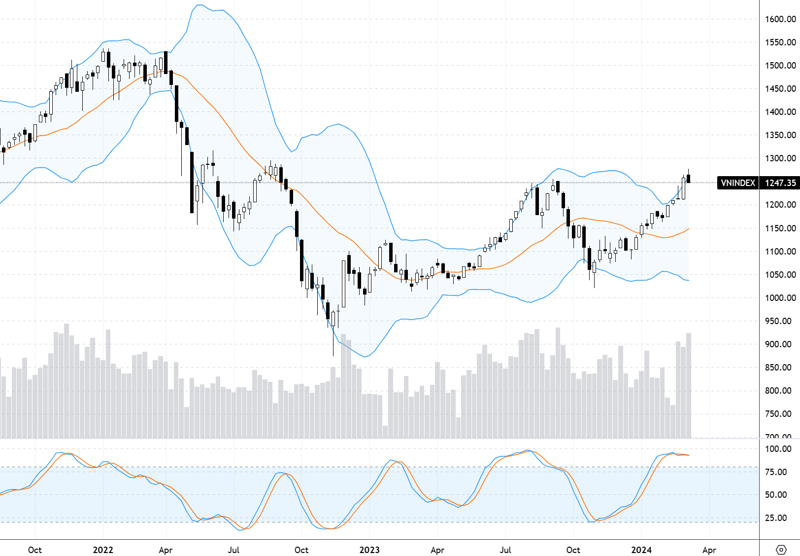

The market unexpectedly fluctuated last week, recovering quickly and even experiencing an explosive increase of more than 25 points on March 13 before stabilizing. Experts’ perspectives on the evaluation of the risk of VN-Index forming a double top pattern and the assessment of the bottom-fishing demand have started to differ significantly…

Experts have different opinions mainly in evaluating the bottom-fishing demand. The positive view believes that after the first decline, approaching the previous week’s peak, the market only had one more declining session in the beginning of the week, then quickly rebounded. The high buying pressure is considered well absorbed, and selling pressure has eased. The risk-averse view believes that the market continues to experience distribution sessions around the old peak and has signals of decreasing liquidity. These are technical signals to pay attention to.

In terms of money withdrawal activities related to the issuance of bonds through treasury transactions, experts do not believe that the impact will be as significant as in the period from September to November 2023 because there have been some changes. The most notable change is the Fed’s current interest rate hike/decline process, which is much clearer, and Vietnam is no longer going against the world, creating a sense of uncertainty like last year. However, experts still recommend closely monitoring the scale, frequency of bond issuances, as well as currency exchange rate developments to assess the effectiveness. The pure stock market has similar signs to the September 2023 peak area and is also affected by bond issuances. Therefore, risk management is crucial at this stage.

This rebound lacks certainty and is accompanied by more risks as it approaches the nearest peak. Money flow is now more focused on midcap and smallcap stocks. This could imply a lack of strong momentum for VN-Index to continue its upward trend and to break through important resistance levels.

Mr. Nghiem Sy Tien

Nguyen Hoang – VnEconomy

Last week, there were two very strong sessions of increase in the market, especially on March 13, but the last two sessions of the week reversed the trend. VN-Index could not surpass the previous week’s peak, and there are concerns that this week may be another bull-trap and form a double top. What is your view?

Mr. Nguyen Viet Quang – Director of 3 Yuanta Hanoi Business Center

I agree with the concern that the market is forming a double top at the current level. Looking at the market from a technical perspective, it has given some warning signals:

i) VN-index is creating divergence between price and RSI (usually seen when the market forms a 2-3 top pattern).

ii) VN-index has had around 3 distribution sessions and 1 strong distribution session on March 8. The index is also facing strong resistance areas combined by fibo 61.8 and the peak of September 2022.

Mr. Nguyen Van Son – Analyst at Phu Hung Securities Company

In my opinion, the risk of a double top in the market at the current level has diminished a lot.

Looking at it from a technical perspective, VN-Index had two sessions of decline when approaching the previous peak, so it cannot be affirmed that the risk of a double top has passed. However, looking at the trading volume still above the average of the past 10 sessions and the closing index candle of the last trading session being a Doji candle above MA5, after a previous red declining body, it is clear that the high buying demand is still well absorbed and the profit-taking pressure has cooled down, reducing the risk of market decline next week.

Moreover, the supporting factors for medium and long-term upward trends still exist, such as maintaining a low interest rate level to support economic recovery. Furthermore, in the short term, the upcoming general shareholders’ meetings, along with business plans and dividend payout information, will be the new motivations to make the stock market more active.

Therefore, after the past week of trading, I believe that the risk of a double top in the market has decreased.

Mr. Nghiem Sy Tien – Investment Strategist, KBSV Securities

In my view, the current upward trend lacks certainty and is accompanied by more risks as it approaches the nearest peak.

Regarding the specific recovery sessions of the past week, including a 25-point increase, the highest level since November 2023, I noticed that money flow is now more concentrated in mid and smallcap stocks to lead the market, instead of large-cap and value stocks that have the potential to support and maintain the market stability. This could imply a lack of strong momentum for VN-Index to continue its upward trend and to break through important resistance levels.

Therefore, unless the money flow has a supply absorption trend and helps the market surpass the resistance level, the upward trend will still continue. However, if the market continues to be cautious in the next 1-2 sessions and closes at a low price within the session, there is a greater risk of deeper adjustment in the market.

Mr. Nguyen Huy Phuong – Deputy Head of Analysis and Investment Consulting Department, Dragon Securities

Although the stock market faced significant profit-taking pressure when approaching the previous peak of 1,277 points, I think it is too early to say that the market has formed a double top. The distribution session on March 14 posed a risk to the market, but the upward trend prior to that has not been broken, and investors can act more calmly in response to this move. In addition, we should also pay attention to whether the market sends any warnings that increase the probability of a double top formation.

Mr. Nguyen Viet Quang – Director of 3 Yuanta Hanoi Business Center

I believe that whether VN-Index repeats the scenario of September 2023 depends largely on the timing of the State Bank of Vietnam’s bond issuance and the extent to which net bond issuance increases. The State Bank of Vietnam’s bond issuance at the current time has similarities to the September period when the market had a strong phase and approached resistance levels. Therefore, risk management and cautious trading are necessary at this stage.

Mr. Nghiem Sy Tien – Investment Strategist, KBSV Securities

From my perspective, the flow of money into the market is relatively weak. The two recovery sessions had lower liquidity than the 20-session average. In the short term, buying new stocks will have more risks than opportunities. In terms of those who are holding strong stocks to increase profits, they can observe whether the stocks have started to weaken or encounter strong resistance levels to take partial profits and buy back later.

Mr. Nguyen Van Son – Analyst at Phu Hung Securities Company

In my opinion, the money flow in the market is quite strong. This is an important factor that not only eases the concern of the market forming a double top but also reinforces the determination of investors to hold their positions.

A possible scenario for the market next week is Sideway or Sideway Up, so there are still opportunities for implementing short-term swing trades based on the flow cycle. In particular, stocks with good fundamentals, positive information during the upcoming general shareholders’ meetings, can be the focus of money in this period.

Mr. Nguyen Huy Phuong – Deputy Head of Analysis and Investment Consulting Department, Dragon Securities